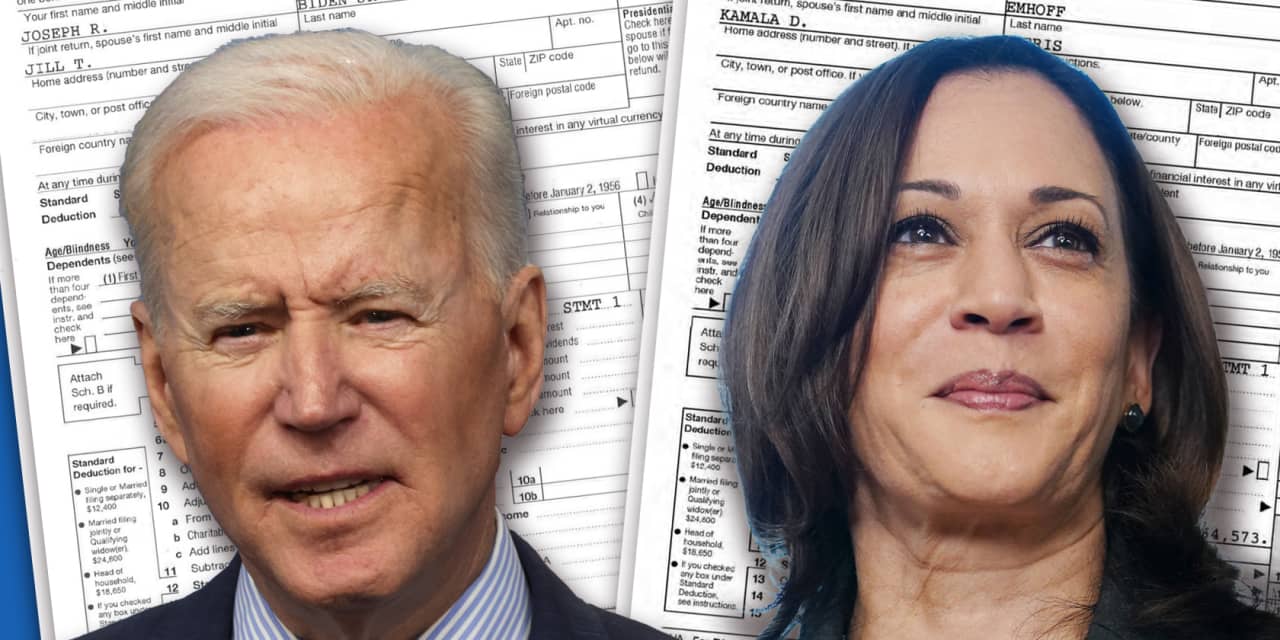

How much income tax will Biden and Harris pay under their proposed hikes? These accountants say they’ve found an answer

President Joe Biden has been touting his proposed tax hikes on the rich by saying they need to start “paying their fair share.”

If his proposals become law, the Commander-in-Chief will have to put his money where his policies are by paying more on his own taxes, according to a MarketWatch analysis.

The president wants to fund his $1.8 trillion American Families Plan by increasing taxes for wealthy households several ways, such as raising the top income tax bracket to 39.6% from the current 37% rate, a return to the top rate before Trump-era tax cuts.

“ Biden wants to fund his $1.8 trillion American Families Plan by increasing taxes for wealthy households several ways, such as raising the top income tax bracket to 39.6% from 37%. ”

That one step would only cost Biden $1,000 to $2,000 extra on his federal income tax bill, according to calculations from three accountants who crunched the numbers using the president’s 2020 tax returns and the Treasury Department’s details on tax increase proposals for their analysis.

If the American Families Plan became law, the tax bite would be even harder on Vice President Kamala Harris and her husband, Second Gentleman Doug Emhoff. The couple would pay roughly $30,000 extra in federal income taxes if the top rate climbed to 39.6%, the three estimates said.

The White House did not comment by Monday afternoon on the estimates. The White House released Biden and Vice President Kamala Harris’ 2020 tax returns last month.

Their 2020 earnings

Those documents show the Bidens paid $157,414 in federal taxes last year. The sum includes a $142,538 income-tax obligation and other taxes, including self-employment tax. The Bidens also received a $4,649 refund.

Harris and her husband’s 2020 returns showed they paid $621,893 in federal tax, with $540,095 in income taxes in addition to more than $82,000 for other federal taxes. The couple owed $34,489 to the IRS.

The American Families Plan would also tax capital gains at 39.6% for households making more than $1 million. But that measure wouldn’t affect Biden and Harris personally, at least if their 2020 returns are any indication.

For starters, the Bidens’ income falls below the $1 million dollar mark, with their 2020 adjusted gross income coming at $607,336. Besides, they didn’t sell, or “realize” any long-term capital gains during the 2020 tax year.

Harris and Emhoff’s adjusted gross income is $1.695 million, but they reported a $218 capital loss. If losses exceed gains, the amount, up to $3,000, can be used to lower income, according to IRS rules.

Running the numbers

When MarketWatch asked the accountants to run the numbers on how much more Biden and Harris would pay under the plan they are pressing for as public officials, the results varied slightly due to different calculation methods.

Andrew Schmidt, associate professor of accounting at North Carolina State University’s Poole College of Management, said the Bidens would pay an extra $1,931 while Harris and Emhoff would pay $31,382 more.

He focused on the income tax obligation (Line 16) and used the 2020 tax brackets. Schmidt swapped out the current top rate and applied the proposed 39.6% rate on taxable income over $509,300 for married couples filing jointly.

“ The three estimates hover near the same vicinity, giving a tangible example of the potential costs for some rich households under the Biden administration’s income-tax plan. ”

Similarly, Ed Zollars, of Thomas, Zollars & Lynch in Phoenix, Ariz. determined the Bidens would also pay an extra $1,931, while Harris and Emhoff would pay $31,507 more.

Zollars also started on Line 16, but he used the 2021 tax tables, which account for inflation and will be used to determine tax bills next year. Zollars then inserted the 39.6% rate for taxable income over $509,300.

Robert Seltzer of Seltzer Business Management in Los Angeles, Calif. said the Bidens would be paying an extra $1,091 in income taxes, while Harris and Emhoff would pay $29,127.

Seltzer started with the amount of taxable income on Line 15, and subtracted $509,300. He multiplied the result by 2.6%, which is rate increase from 37% to 39.6%.

Still, the three estimates hover near the same vicinity, giving a tangible example of the potential costs for some rich households under the Biden plan.

Even that $30,000 extra for Harris and her husband only makes up 3% of their after-tax income, Schmidt and Zollars said. For the Bidens, the extra tax only accounts for 0.3% to 0.5% of their after-tax income, Seltzer and Zollars added.

Impact on wealthy Americans

A household making between $500,000 and $1 million could see an average $3,700 increase in their federal income-tax bill or $219,880 for those earning $1 million-plus, according to recently-released estimates from the Tax Policy Center.

Seltzer has clients in the Harris-Emhoff income range and, based on his conversations with them, he said they “are not making a big fuss” over income-tax hikes. Their concern is the tax treatment for capital gains, he said.

But it all depends on the political leanings of his clients. Democrats may swallow higher rates easier than Republicans. As for the former, Seltzer said, “They look at the alternative of having Trump over paying an extra 2.6%, and they’ll gladly pay it.”

“ Political leanings play a role: 65% of Democratic-leaning poll participants said they paid the right amount versus 46% of Republican-leaning poll participants. ”

The president and vice president might be easily able to stomach a tax hike, but research suggests that Republican-leaning Americans who voted for Donald Trump in the last election may not take their own higher tax bill as well.

More than half of Americans (55%) said their tax bill is fair, a Gallup poll found last month: 65% of Democratic-leaning poll participants said they paid the right amount versus 46% of Republican-leaning poll participants.

More than two-thirds (69%) of people back the idea of more taxes for wealthy households and corporations, according to a recent poll commissioned by Americans for Tax Fairness, an advocacy group seeking more taxes on the rich.

What’s more, 43% of people said it was “extremely important” for wealthy households and corporation to “pay their fair share,” the poll said. The ultra-high net worth Americans are more prone to pay less, or no income tax at all.

ProPublica obtained years of tax returns from some of the super elite — including Tesla TSLA,