Here are 7 reasons to stay bullish on stocks and why the S&P is headed to 4,600, from Credit Suisse

Investors continued to sweep away those inflation worries at the start of the week, sending the S&P 500 SPX,

Markets simply believe it is too soon for a Federal Reserve taper, as the central bank’s two-day meeting kicks off Tuesday. According to Bank of America’s latest monthly fund manager survey, 72% are buying the Fed’s line that inflation is transitory.

That doesn’t mean some investors aren’t still worried about this, that and the other. Our call of the day comes from Credit Suisse’s chief U.S. equity strategist Jonathan Golub, who offers reasons to stay bullish.

“Surprisingly, we find investors more bearish as inflation readings and declining yields dominate conversations,” he said in a note to clients that published on Monday. “Despite these issues, we remain comfortable with our 4600 [S&P 500 SPX,

So here’s Golub debunking a few current investor concerns (in bold), with charts to back it up:

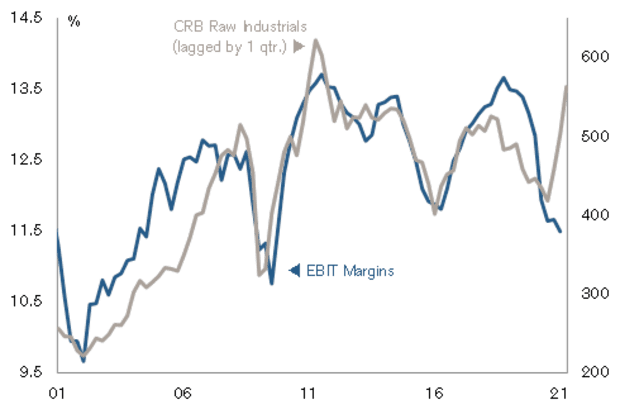

Inflation readings such as last week’s on consumer prices and higher commodity prices could begin putting profit margins under pressure. “Our work indicates that companies are experiencing substantial pricing power which should lead to greater profitability despite higher input costs,” countered Golub.

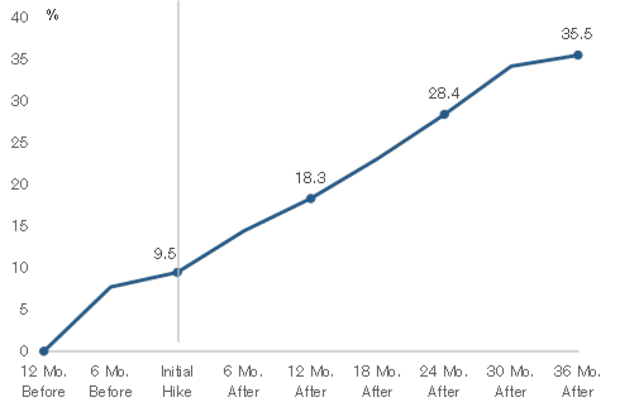

Some Fed officials have hinted of a readiness to start discussing tapering asset purchases, while rate-hike expectations have inched forward. In a review of rate increase cycles in 1994, 1999, 2004 and 2015, the bank found that returns were robust 12 months ahead of, and 36 months after the first rate increase, weakening only when the yield curve flattens.

Signs of declining bond yields in the face of higher prices could mean stagflation is looming. That is unlikely, with inflation largely seen as transitory and 10-year Treasury yield rate declines modest (5-year range 0.5% to 3.2%), said Golub.

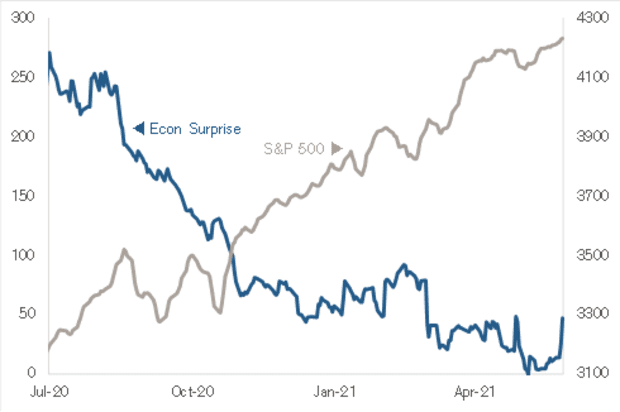

Economic surprises have steadily fallen since mid-July, but the market keeps going up. Economic activity has improved during this time, and that is the “true catalyst of the S&P 500’s advance,” the strategist argued.

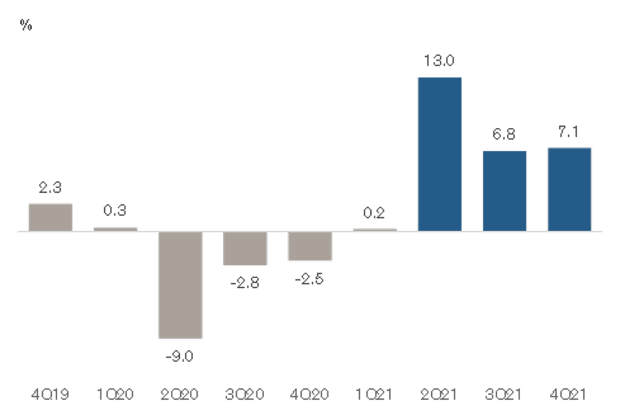

Growth and earnings per share, both running high, could be about to roll over. “While the pace of improvement is sure to moderate, growth is projected to remain well above trend through the end of 2022,” said the strategist.

While fiscal and monetary policy kept economies running throughout the COVID-19 pandemic, further help looks unlikely. “While further stimulus appears less likely (or will be reduced), we are less concerned given (1) an overheating economy; (2) less immediate impact of plan; and (3) higher accompanying taxes,” said Golub.

Retail sales and a 17-year tariff squabble may be over

Stock futures YM00,

Bitcoin BTCUSD,

Brace for a data dump, with retail sales, producer prices, the Empire State manufacturing index, industrial production, business inventories and a home builders index all ahead.

A 17-year trade spat between the U.S. and the European Union over aircraft subsidies for rival manufacturers Boeing BA,

Hong Kong officials are on the alert for a possible leak at Taishan Nuclear Power Plant in Guangdong province. Those reports knocked Hong Kong stocks.

Read: A dizzying week ahead for U.S. IPO market with 15 companies set to raise $2.5 billion

Chart of the day

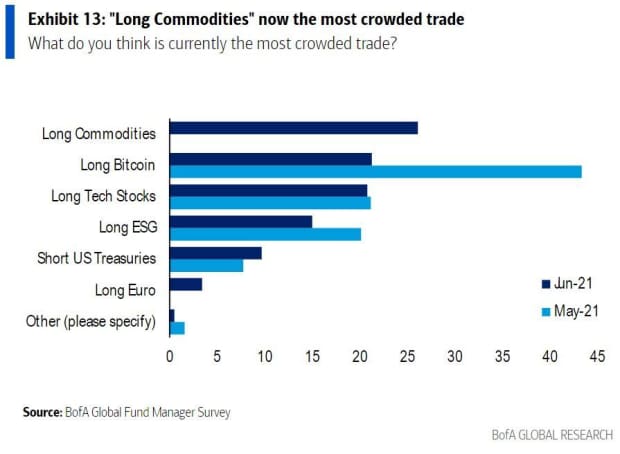

Bank of America’s June global fund manager survey finds a new “most crowded trade winner” — commodities.

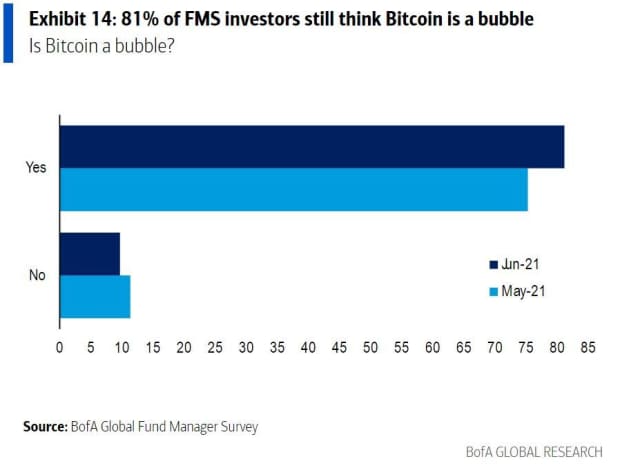

Last month’s crowded-trade king was bitcoin. Most fund managers still think the cryptocurrency is in a bubble, even after the pullback seen recently.

Random reads

No Girl Scouts knocking at your door the past year equals 15 million unsold boxes of cookies.

It was a heated battle between “foliage_patch” and “meridianlamb” for a $25,094 houseplant with nine leaves.

Coffee is good for you again.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.