The Toronto-based company signed an option agreement in June 2018 to acquire an initial 25% interest in the polymetallic project with the option to increase its stake to 80%.

Lagoa Salgada, which was discovered in 1992 by a team from the Portuguese Geological Survey, sits in the copper-rich Iberian pyrite belt, which is home to mines such as Aguas Tenidas (Trafigura/Mubudala); Neves Corvo (Lundin Mining) and Aljustrel (Almina).

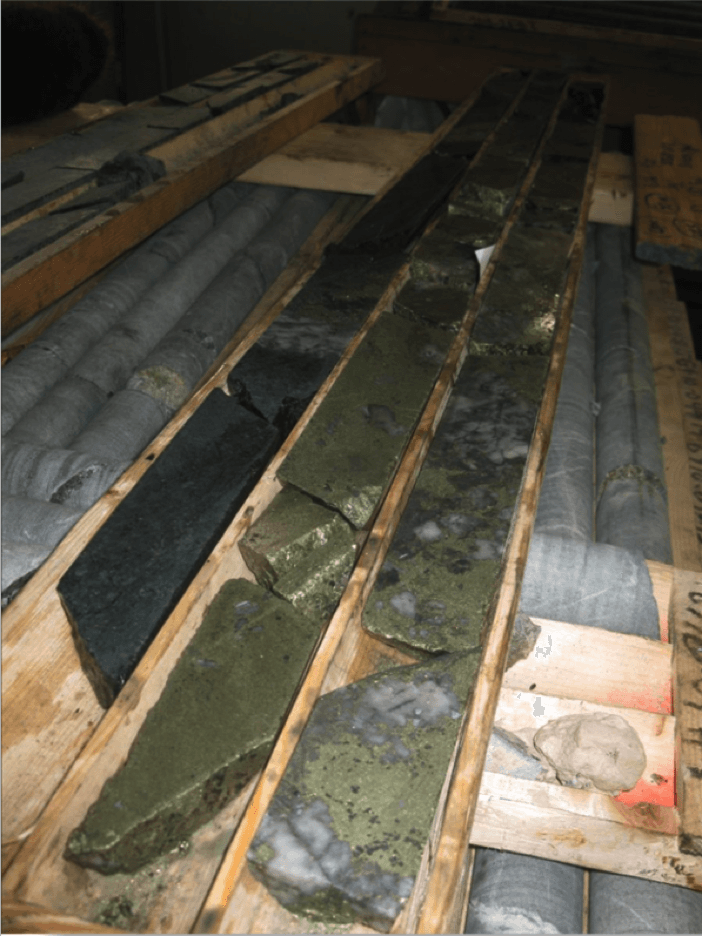

The deposit, which is completely covered by a thick sequence of Tertiary sedimentary rock averaging 135 metres thick, was discovered by diamond drill testing a geophysical gravity anomaly.

The company has defined North, Central and South zones of the deposit, which at last count contains total measured and indicated resources of 14.75 million tonnes grading 2.53% copper-equivalent and 7.56% zinc equivalent, and inferred resources of 11.88 million tonnes grading 1.55% copper-equivalent and 4.30% zinc-equivalent. The resources remain shallow, at less than 500 metres deep. Lagoa Salgada remains open in all directions.

Last year, a preliminary economic assessment that included just the North zone outlined a mine life of nine years at a mining rate of 2,700 tonnes per day and all-in sustaining costs were expected to come in at 66¢ per lb. zinc-equivalent. Initial capex is forecast at $163 million, including a $38 million contingency, with a payback period of four years. The early stage study estimated an after-tax net present value (NPV) at an 8% discount rate of $106 million with an after-tax internal rate of return of 31%.

In May, Ascendant raised $3.9 million and said the funds would be spent on completing more metallurgical test work and an updated PEA by mid-August that will incorporate both the North and South zones. In January, the company reported results from the first three drill holes on the South Zone with highlights of 25.2 metres grading 2.23% copper-equivalent (0.64% copper, 1.99% zinc, 1.42% lead and 26.47 grams silver per tonne); 8.4 metres of 2.24% copper-equivalent (1.18% copper, 0.46% zinc 0.77% lead and 27.83 grams per tonne silver); and 7.7 metres grading 2.13% copper-equivalent (0.33% copper, 3.09% zinc, 1.31% lead, and 14 grams silver per tonne).

As of June 1, management and directors owned 9% of the company. Other significant shareholders include Steve Laciak (12.5%); CQS LLP (11.7%); and MMCAP Asset Management (7.1%).

Ascendant has a market capitalization of C$28.3 million.

Camino Minerals

Vancouver-based Camino Minerals (TSXV: COR; US-OTC: CAMZF) has three copper projects in Peru – Los Chapitos, Maria Cecilia, and Plata Dorada.

Its flagship, Los Chapitos, is an iron oxide-copper-gold (IOCG) deposit that Camino says is part of the prolific belt of iron oxide and copper-gold mineralization that extends along the Peruvian coastal margin from Lima to just south of the Los Chapitos property. The project is 40 km from the Pan American highway, has existing power lines over the property and access to seawater processing 15 km away.

Highlights from last year’s drill program at Los Chapitos, included 55.5 metres of 0.72% copper from 99.5 metres depth, including 22.5 metres of 1.15% copper; 64.5 metres of 0.6% copper from 22 metres, including 12 metres at 1.05% copper; and 92.1 metres of 0.53% copper starting from 10 metres downhole, including 20.8 metres of 0.97% copper.

In March, the company announced the acquisition of the 7,11o-hectare Maria Cecilia project, a porphyry and skarn complex that the company believes has geological similarities with one of Peru’s largest copper mines, Antamina, about 100 km away. The company estimates about $28 million has been spent on the project since 2012, including 32,120 metres of drilling between 2013 and 2015.

The Maria Cecilia exploration target is believed to be at the heart of the porphyry complex that includes the Toropunto epithermal deposit and the Emmanuel porphyry deposit. A major magnetic anomaly, two porphyries, stockworks and a 2 km skarn structure are within the porphyry centre target at Maria Cecilia.

There are four main targets at Maria Cecilia: the Skarn Zone; Stockwork Zone; Porphyry Zone; and Tourmaline Breccia Zone. The skarn zone has a width of about 2 km by 250 metres. The zone has copper anomalies that range from 500 parts per million up to 6.7% copper including 110 grams silver per tonne. Chip sampling from three trenches returned grades of up to 1% copper, including 27.5 metres of 0.35% copper with chalcopyrite mineralization. The adjacent Stockwork Zone has a large magnetic geophysical anomaly that covers over 50% of its area and is characterized by the presence of a quartz stockwork that extends over an area of about 900 metres by 800 metres.

In the Porphyry Zone, targets are related to mineralized porphyry occurrences called Twin Porphyry 1 and Twin Porphyry 2, and channel samples in the zone have returned copper values of up to 0.9% copper. The Tourmaline Breccia target is at the edge of the concession and has molybdenum values of up to 120 parts per million. This area extends to the resource area to the north. (The Toropunto deposit has inferred resources of 32 tonnes grading 0.22% copper-equivalent. Emmanuel has 94 million inferred tonnes grading 0.29% copper-equivalent.)

The copper and silver Plata Dorada project is about 158 km east of the city of Cuzco. The company completed an exploration program in March, and identified six new polymetallic veins, bringing the total to 16. A rock chip sample taken along the Plata Dorada mesothermal trend identified a new copper and silver mineralized structure with a width of 0.5 metres grading 1.19% copper and 18.35 parts per million silver. The best results from geochemical sampling include 5.76% copper and 1,500 grams silver per tonne.

In May the company raised C$7.5 million in a non-brokered private placement and the funds will be spent on exploration. Camino Minerals has a market capitalization of C$18.5 million.

Dore Copper Mining

Dore Copper Mining (TSXV: DCMC; US-OTC DRCMF) is a copper-gold explorer in Quebec. The junior has consolidated a large land package in the Lac Dore/Chibougamau and Joe Mann mining camps in the province, which includes 13 former producing mines, deposits and resource target areas within a 60-km radius of the company’s 2,700 tonne per day Copper Rand mill.

Currently Dore Copper is working on a preliminary economic assessment of a hub-and-spoke operation with its Corner Bay asset as the main feed for the mill and other projects making up secondary feeds. It plans to complete the study before the end of this year.

Last year the company drilled 10,237 metres at Corner Bay, 20 km south of Chibougamau, and is now completing a 16,500 metre drill program. It plans to release an updated resource estimate before the end of the third quarter.

Drill results released in mid-May included 3.7 metres of 5.05% copper, 0.15 grams gold per tonne and 11.3 grams silver per tonne; 3.7 metres of 2.47% copper, 0.87 grams gold and 9.3 grams silver; and 5.5 metres of 3.46% copper, 0.25 grams gold and 8.4 grams silver.

Corner Bay has a 2019 resource of 1.35 million indicated tonnes grading 3.01% copper and 0.29 gram gold per tonne for 89.8 million lb. copper and 13,000 oz. of gold and inferred resources of 1.66 million tonnes grading 3.84% copper and 0.27 gram gold per tonne for 140.3 million lb. copper and 15,000 oz. gold.

The deposit was discovered in the early 1980s and accessed by a ramp to 115 metres in 2008. Corner Bay was never in production but a 40,000 tonne bulk sample in 2008 processed at the Copper Rand mill, generated recoveries of 94% for copper and 62% for gold.

Joe Mann would be the secondary feed to the mill. The company signed an option agreement in January 2020 to acquire a 100% interest in the Joe Mann gold mine, 60 km south of Chibougamau and 60 km from its Copper Rand mill. The mine operated between 1956 and 2007 and produced 28.7 million lb. of copper (at a grade of 0.25% copper); 1.2 million oz. gold (at a grade of 8.26 grams gold per tonne); and 607,000 oz. of silver (at a grade of 5 grams silver per tonne).

Last year the company completed 8,343 metres of drilling at Joe Mann and plans to release its first resource estimate by the end of June followed by a PEA in the second half of the year.

In addition, Dore Copper owns the Cedar Bay asset, 8 km southeast of Chibougamau. The past producing underground mine operated from 1958 until 1990, producing 3.86 million tonnes grading 1.63% copper and 3.3 grams gold per tonne. A 2019 resource outlined 130,000 indicated tonnes grading 9.44 grams gold per tonne and 1.55% copper for 39,000 oz. gold and 4.4 million lb. copper and inferred resources of 230,000 tonnes grading 8.32 grams gold and 2.13% copper for 61,000 oz. gold and 10.8 million lb. copper.

Last year the company drilled 9.025 metres at Cedar Bay.

The company’s other assets include the past-producing Copper Rand underground mine (1.5 million oz. gold and 0.5 billion lb. copper from 1959 to 2008 from 16.4 million tonnes grading an average of 1.8% copper and 2.8 grams gold), about 7 km east of Chibougamau, and Devlin, 18 km south of Chibougamau. Devlin has a measured and indicated resource of 0.41 million tonnes grading 2.48% copper and 0.27 grams gold and inferred resources of 0.34 million tonnes averaging 2.42% copper and 0.19 grams gold. A 1981 access decline to 55 metres below surface generated a 2,700 tonne bulk sample averaging 1.26% copper.

In May, Dore completed its 100% earn-in on the 2,100-hectare Cornerback property, which surrounds its Corner Bay asset.

Dore has a market capitalization of C$41.3 million.

Los Andes Copper

Los Andes Copper’s (TSXV: LA) is advancing its Vizcachitas project in central Chile, a copper-molybdenum porphyry deposit 150 km northeast of Santiago.

A preliminary economic assessment completed in June 2019 contemplated an open pit mine and concentrator plant that would produce copper and molybdenum concentrates over a mine life of 45 years. At a mill throughput rate of 110,000 tonnes per day, the early stage study forecast a post-tax net present value at an 8% discount rate of $1.8 billion and an internal rate of return of 20.8% based on a copper price of $3 per lb. Initial capex of $1.9 billion could be repaid in just under three and a half years. C1 cash costs with molybdenum and silver credits in the first eight years of operation are estimated at $1.36 per lb.

The company is now working on a prefeasibility study that it plans to complete in the first quarter of 2022. In April, the company reported the final results for copper recoveries and concentrate grades as part of the PFS, confirming recoveries of 91.4% and the production of a clean copper concentrate. Metallurgical testwork has also confirmed that the project’s tailings are amenable to being filtered and dry-stacked. The PFS is also looking at High Pressure Grinding Rolls (HPGR), which will help reduce water and energy consumption.

Vizcachitas has measured and indicated resources of 1.28 billion tonnes grading 0.40% copper and a copper-equivalent grade of 0.45% at a copper cut-off of 0.25%, for 11.2 billion lb. copper, 400 million lb. molybdenum, and 43.4 million oz. silver.

At the end of April the company received approval for a drill program of up to 350 holes on up to 124 platforms over the next four years, and this will enable the company to carry out the drilling needed to complete the PFS.

The work-plan includes infill drilling within the PFS open pit, drilling to extend the higher grade mineralization to the north of the pit outlined in the PEA, and to test geophysical targets identified in 2020.

The project is 65 km from a rail line in San Felipe, with connections to the Chagres smelter (90 km), the Ventanas smelter (140 km), and the port of Ventanas (140 km). It also has access to a 220 kilovolt power substation, 105 km away.

In June 2020 it sold a net smelter return (NSR) royalty on Vizcachitas to Resource Capital Fund VI L.P. for $14 million. Under the royalty, RCF will receive a 2% NSR for open-pit operations and a 1% NSR for underground operations.

Los Andes Copper has a market capitalization of C$204 million.

QC Copper and Gold

QC Copper and Gold (TSXV: QCCU; US-OTC: QCCUF) is focused on acquiring and developing copper projects in Quebec’s Chibougamau region and is advancing its 13,000-hectare Opemiska project, which hosts four historic underground mines that produced a total of over 1.1 billion lb. copper and 750,000 oz. gold. The four mines—Springer, Perry, Robitaille and Cooke—were operated by Falconbridge between 1953 and 1991.

The company envisions an open-pit, bulk tonnage operation, mining both the high-grade veins targeted by past operators, as well as lower grade disseminated copper mineralization outside these veins that was previously overlooked.

The project, near the town of Chapais and about 500 km north of Montreal in the Abitibi Greenstone belt, is exposed to 12 km of the Gwilliam Fault and also includes volcanogenic massive sulphide mineralization. The Springer, Perry and Robitaille deposits were the mainstay of production in the Chapais district. The past-producing Cooke mine is another potential satellite deposit. Unlike the three historic copper mines, Cooke is a high-grade gold project with copper by-products and previously generated about 320,000 oz. of gold from material grading 5.17 grams gold per tonne.

According to a 2019 technical report, the project has good data from previous operators, which includes more than 14,500 surface and underground drill holes totalling 854,000 linear metres of drill core, more than 300,000 assays along with thousands of maps of surface plans, level plans, and sections.

In 2019 the company focused its drill program around the historic Springer mine, which produced 12.47 million tonnes grading 2.56% copper and 1.23 grams gold. The 23-hole drill program (3,300 metres), confirmed QC Copper and Gold’s hypothesis of near-surface disseminated mineralization, and highlights of the drilling included 7.9 metres of 4.65% copper-equivalent from 81 metres and 25 metres of 4.15% copper-equivalent starting from 38 metres.

In December, the company received permits for a 20,000 metre (75 holes) drill program distributed between the Springer and Perry mines, with the objective of delineating a near surface, in-pit mineral resource. About 75% will be focused on resource delineation and 25% on brownfield exploration, with some holes focused on the adjacent Cooke-Robitaille property.

Drilling got underway in January, the company added a second rig in February, and results started flowing in April. Highlights have included 126 metres of 0.44% copper-equivalent starting from 51 metres, including 55.5 metres of 0.64% copper-equivalent, and a separate intersection of 7.5 metres at 1.28% copper-equivalent starting from 303 metres. Another hole cut 76.5 metres of 0.54% copper-equivalent from 155 metres and a separate intercept of 18 metres grading 0.80% copper-equivalent starting from 86 metres. A.t the end of May it reported 138 metres of 0.48% copper-equivalent from 49 metres.

The project lies within the boundaries of Quebec’s Plan Nord, which promotes and funds infrastructure and natural resource projects, and already has access to Highway 113 and the Canadian National Railway, and a power station.

Last month, the company acquired a new project called Roger, about 5 km from Chibougmau. It contains the Roger gold-copper deposit, which already has had about 58,000 metres of drilling. An updated resource in August 2018 outlined indicated resources of 10.9 million grading 0.85 gram gold for 297,000 oz. and inferred resources of 6.6 million tonnes grading 0.75 grams gold for 159,000 ounces.

QC Copper and Gold has a market capitalization of about C$25 million.

Solaris Resources

Solaris Resources (TSX: SLS; US-OTC: SLSSF) is part of the Augusta Group and is advancing a portfolio of copper and gold assets in the Americas. These include its flagship Warintza project in southeastern Ecuador; the Tamarugo and Ricardo projects in Chile and the Capricho and Paco Orco projects in Peru. It also owns 60% of the La Verde joint-venture project in Mexico with Teck Resources.

Warintza is 85 km east of Cuenca in a rural part of the Cordillera del Condor, an inland mountain range forming the border between Ecuador and Peru. It is situated 40 km north of the Mirador mine, operated by Ecuacorriente, a subsidiary of the Chinese consortium CRCC-Tongguan, which started production in 2019 and is expected to produce 94,000 tonnes of copper concentrate a year; and is also adjacent to Explorcobres’ (previously called Corriente Resources) San Carlos-Panantza copper and gold mine. The 268 sq km property has an access road to a nearby highway connecting it to ports on the Pacific ocean and has access to grid power.

The discovery was made in the early 2000s by mine finder David Lowell, who discovered 17 major mineral deposits over a 50-year career, including the world’s largest copper deposit, La Escondida, in Chile, in 1981, and Pierina, a gold deposit in Peru, in 1996.

There are five main targets within a 5 km by 5 km cluster of copper porphyries identified on the property so far. The key targets are Warintza Central, Warintza West and Warintza East. Warintza East is 1 km to the east of Warintza Central and will be drilled for the first time this year. The other targets are Warintza South, a separate, large high-conductivity anomaly about 4 km to the south of Warintza Central, and Yawi, about 850 metres to the east of the Warintza East anomaly.

In February Solaris announced a new discovery in first-ever drilling at Warintza West, and subsequently doubled its drill program at the project to 12 rigs. The first hole at Warintza West returned 798 metres of 0.31% copper-equivalent, including 260 metres of 0.42% copper-equivalent, from 32 metres depth.

Drill results released in March from Warintza Central included 922 metres of 0.94% copper-equivalent from surface; 1,002 metres of 0.60% copper-equivalent from surface, and 958 metres of 0.77% copper-equivalent from 20 metres downhole.

The company announced it was about to start drilling Warintza East for the first time. Warintza East is described as overlapping copper and molybdenum anomalies, measuring about 1,200 metre in diameter, with similar values to Warintza Central.

Warintza has an in-pit inferred resource of 124 million tonnes grading 0.70% copper-equivalent, which only includes historic drilling down to a depth of about 200 metres.

There are also undrilled regional targets.

Outside Ecuador, it can earn up to a 75% interest in Tamarugo in Chile from Freeport McMoRan, and 75% in the Capricho and Paco Orco projects in Peru. It owns 60% and Teck 40% of the La Verde project, in Michoacan and has optioned its Ricardo project to Freeport, which can earn 80% by spending $130 million over five years

In December it raised $81 million in a non-brokered private placement. The majority of the placement was taken up by Richard Warke, .the company’s executive chairman, Equinox Gold, and trusts established by the Lundin family.

Solaris has a market capitalization of C$1.2 billion.

US Copper

US Copper (TSXV: USCU) is focused on advancing its Moonlight-Superior copper project in Plumas county, northeastern California, about 160 km northwest of Reno, Nevada. The project includes copper sulphide and copper oxide resources with silver and gold credits in three deposits—Moonlight, Superior and Engels—that are hosted in Jurassic intrusive rocks within a 21 sq. km area.

The Superior deposit is 3 km southeast of Moonlight and 3 km southwest of Engels. Superior is open in multiple directions and at depth while Engels is open in all directions.

The company was formerly called Crown Mining and changed its name in April.

Copper was discovered in the Lights Creek district in 1883 and the Superior and Engels mines produced more than 161 million lb. copper between 1915 and 1930. The Moonlight deposit was discovered and drilled by Placer Amex during the 1960s.

A preliminary economic assessment completed in 2018 of the Moonlight deposit only, outlined an open pit mine life of 17 years producing 60,000 tons per day. Initial capex was forecast to be US$513 million. At $3.15 per copper, the early stage study outlined an after-tax net present value at an 8% discount rate of $179 million and a post-tax internal rate of return of 14.6%. Gold revenue was excluded from the financial analysis due to insufficient assay data density and the company believes gold credits have potential to improve Moonlight’s economics. The PEA also treated oxide copper as waste rock.

The Moonlight deposit hosts a 43-101 indicated resource of about 228 million tonnes averaging 0.25% copper, and an inferred resource of 98 million tonnes averaging 0.24% copper. Superior has inferred resources of 54 million tonnes grading 0.41% copper and Engels 2.5 million inferred tonnes grading 1.05% copper.

The company kicked off a drill program in the second quarter with the objective of defining a starter pit and establishing gold and silver credits at Superior; confirming the size of a starter pit at Engels’ and define an oxide resource at Moonlight and update portions of the resource from inferred to indicated. It also seeks to verify historic copper assays from Placer Amex’s drilling in the 1960s.

US Copper completed a C$2 million private placement in mid-May and kicked off its drill program on June 1. The company plans to drill between 2,134 and 3,048 metres over two or three months.

Nearby infrastructure includes a rail line and state highway 11 km to the southwest and power lines 3 km to the south.

The junior explorer has a market cap of C$25 million.

Western Copper and Gold

Western Copper and Gold (TSX: WRN; NYSE-AM: WRN) is focused on developing its Casino project in the Yukon, a porphyry copper-gold-molybdenum deposit in the northwest trending Dawson Range mountains, 300 km northwest of Whitehorse.

In May, Rio Tinto Canada invested $25.6 million for an 8% stake in the company. (Rio acquired 11.81 million common shares at a price of $2.17 per share.) The funds will be put towards economic studies and permitting. The strategic investment includes an investor rights agreement under which Rio Tinto has the right to appoint a member to the project’s technical committee and send an observer to Western Copper and Gold’s board meetings, as well as second as many as three people to the project. If Rio Tinto takes a bigger stake (12.5%), then it has the right to appoint a member to the board. In addition, it has the right to participate in any future equity issuances to maintain its stake in the company.

Last year Western Copper and Gold updated Casino’s resource estimate for the first time since 2010. The latest resource included results from the 2019 drill program and drilling from 2010 through 2012 that was unavailable when the company put together its 2010 model; it also incorporated an updated geologic model. The resource remains open at depth.

Casino now has measured and indicated resources of 2.17 billion tonnes grading 0.16% copper, 0.18 gram gold per tonne, 0.017% molybdenum and 1.4 grams silver per tonne (0.36% copper equivalent) for 7.4 billion lb. copper, 12.7 million oz. gold, 812 million lb. molybdenum and 100.2 million oz. silver. Inferred resources add 1.43 billion tonnes grading 0.10% copper, 0.14 gram gold, 0.01% molybdenum and 1.2 grams silver (0.24% copper equivalent) for 3.2 billion lb. copper, 6.4 million oz. gold, 323 million lb. molybdenum and 54 million oz. of silver.

While a heap leach operation won’t recover molybdenum — and isn’t included in the total resource numbers — it will be recovered in the milling operation at a grade of 0.017% moly in the measured and indicated category and 0.010% in the inferred.

Western Copper and Gold plans to complete a feasibility study on Casino before the end of the year, and in the interim, will put out a preliminary economic assessment. The studies will evaluate an open-pit operation, a concentrator to recover copper, gold silver and molybdenum and a solid waste facility to store mine waste rock and mill tailings. The company says the project will include a heap leach facility to recover gold, silver and copper from oxide ore.

Infrastructure will include a 130 km access road and a power generation facility to meet power demand. In addition, an airport will be relocated and some roads re-routed to lower the overall footprint.

Once in production, the pit could run more than 800 metres deep and 2 km by 1.8 km in diameter.

The company believes Casino will have a mine life of about 50 years based on measured and indicated resources and possibly another 25 years based on Casino’s inferred resources.

In February, the company released results from its 2020 exploration drill program (12,008 metres in 49 holes). Highlights included 44.4 metres of 0.74% copper and 0.83 gram gold starting from 178.7 metres downhole and 48.3 metres of0.52% copper and 0.77 gram gold from 170 metres downhole.

Work at Casino began in 2009 and 2010.

Western Copper and Gold has a market capitalization of about C$438 million.

(This article first appeared in The Northern Miner)