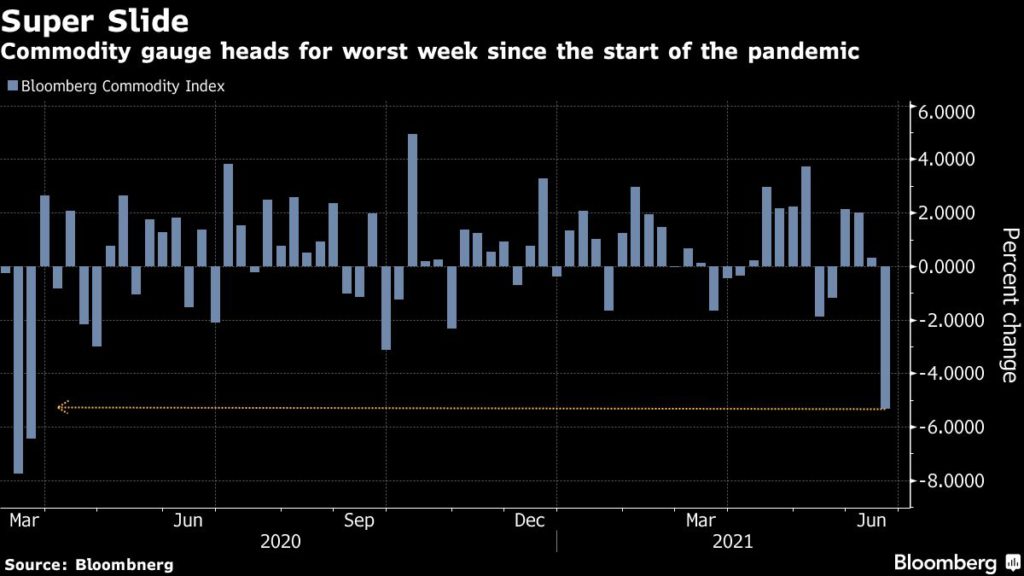

Commodities set for worst week since start of pandemic

Metals were further damaged by Chinese plans to release copper, aluminum, and zinc from its national reserves as it struggles to rein in factory gate inflation at more than a decade high, although iron ore prices continued to defy gravity jumping to $220 a tonne on Thursday.

The combination with even steeper declines in soft commodities, set up the Bloomberg Commodity Index for its worst week since the start of the pandemic.

With the exception of gold, metals remain well above where they started the year (tin is up more than 50% and aluminum has gained 20%), and some analysts say the rally is unlikely to fade significantly reports Bloomberg.

“We believe we are in the early innings of a decade long strong cycle in commodities, similar to the cycle that took place from the late 90’s through 2008,” said Jason Bloom, global market strategist for Invesco, which oversees $1.4 trillion assets for clients:

“The supply constraints are relatively insulated from the language of the Fed in a given meeting. China can push around prices in the short-term by releasing reserves, but they don’t control markets.”

With files from Bloomberg