CHARTS: China’s overseas copper mining scramble

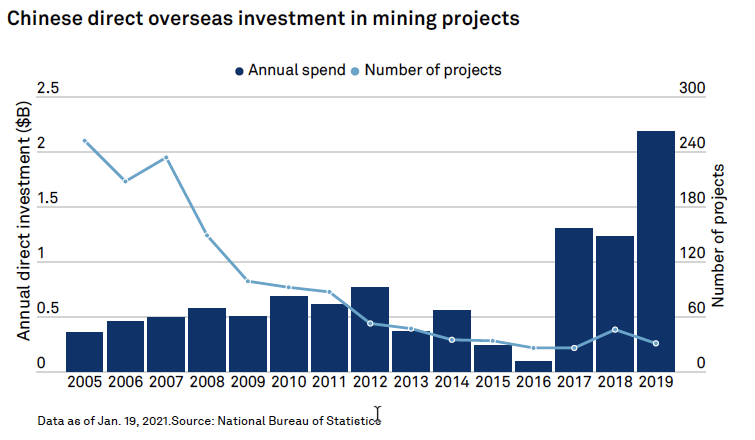

S&P Global says Chinese direct investment overseas in mines and projects topped $1 billion in 2017 for the first time and peaked in 2019 at nearly $2.2 billion with cobalt and lithium its favourite targets.

The billions spent on battery minerals is not surprising – China has a stranglehold on the electric vehicle supply chain with chemical processors and refiners responsible for 82% and 60% of midstream production of cobalt and lithium, respectively.

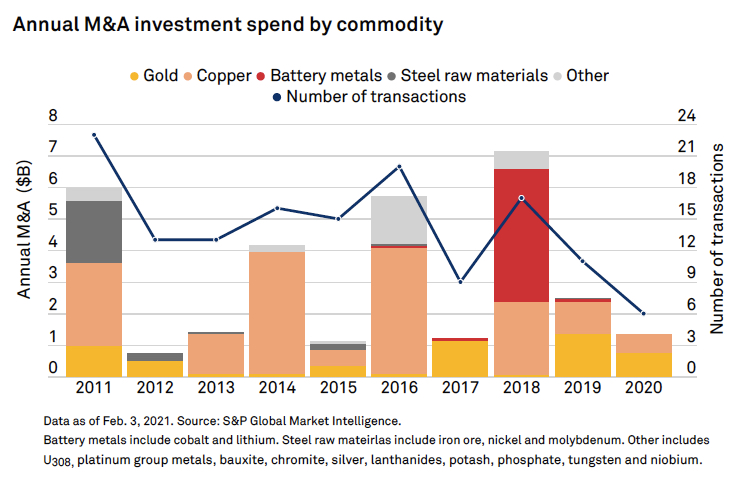

The preferred route to make up for stagnating domestic production over the last decade has been foreign acquisitions, with $16.1 billion from 2011 to 2021 spent, according to S&P data. Private and state-owned companies picked up assets at the bottom of the previous cycle, scaling back activity last year as commodity prices started to run-up.

The bulk of the money went into copper assets and more specifically copper (and cobalt) projects in Africa with China Moly’s 2016 acquisition of the Tenke Fungurume mine from Freeport for $2.65 billion and Zijin Mining’s joint venture with Ivanhoe Mines on the Kamoa-Kakula copper project two high-profile examples, both of which are located in the Democratic Republic of Congo (DRC).

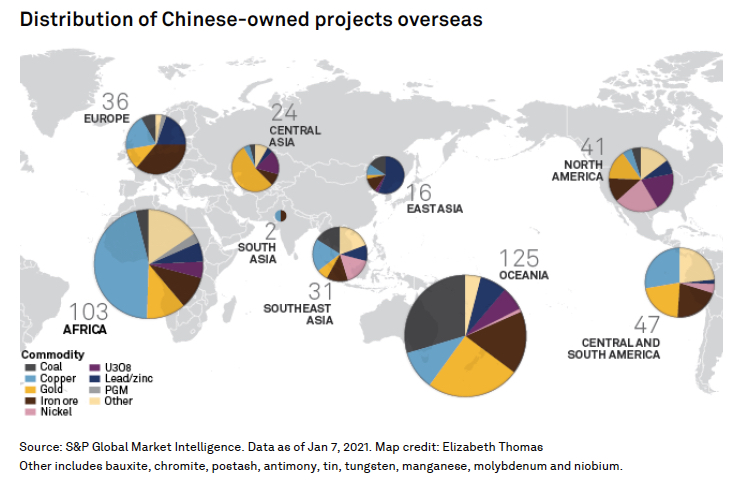

There are currently 30 operating copper projects owned by Chinese companies in foreign locations, with a further 38 in the exploration stage, says S&P.

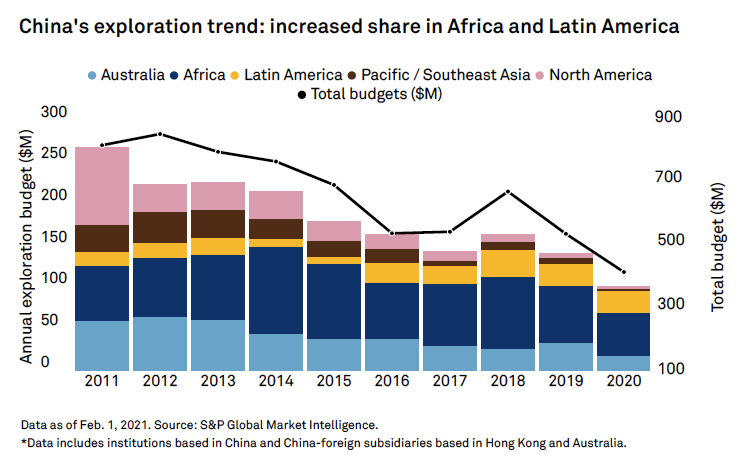

As M&A activity picked up, after peaking in 2012 at more than $800 million, exploration budgets were shrinking, particularly in Canada, South East Asia, and Australia with again the most money flowing into Africa and increasingly South America. The total share of these three regions dropped to 5.6% in 2020 from more than a fifth in 2011.

China is engaged in 52 primary copper projects in Africa and Europe, which account for 60% of its total foreign projects. Two thirds of China’s nearly 70 overseas gold mining assets are located in Central Asia, Europe and Australia.