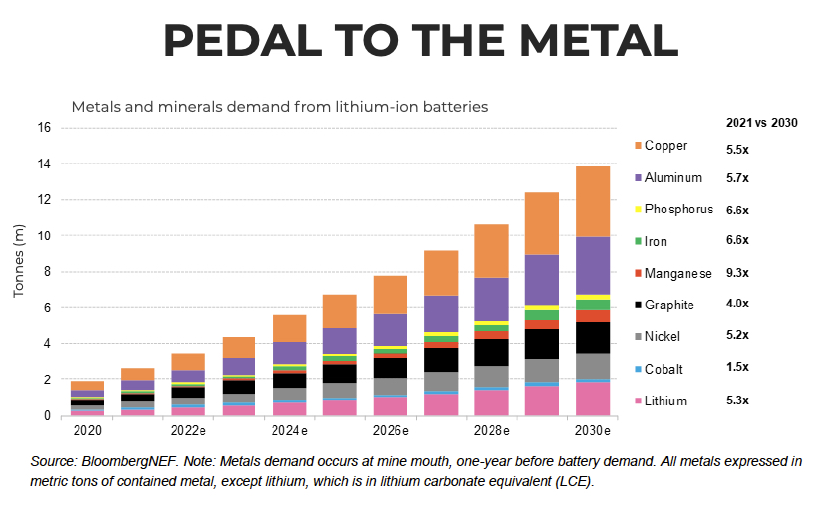

CHART: Study predicts over 400% increase in copper, lithium, nickel battery demand

Chemistries

BNEF says automakers wary of rising raw materials costs could switch to lithium iron phosphate (LFP) batteries, which are significantly cheaper to manufacture but come at the expense of lower range. This would would enable the electrification of transport to continue unabated says the firm:

“LFP’s share of stationary storage deployments in 2030 jumps to 53% in this outlook from 23%, at the cost of the highest nickel chemistries.”

Lithium

BNEF believes lithium carbonate and hydroxide should be sufficiently supplied until at least 2025, but hydroxide could face a shortage by 2027, as demand for high nickel chemistries surges:

“One key risk is that some 35% of the projected supply growth from now until 2025, will come from integrated spodumene-to-hydroxide converters in Australia.

“These projects are expensive and have a history of delays. Should the commissioning of these Australian converters be delayed there may be a shortage of hydroxide by 2025.”

Lithium prices have been on a tear this years with carbonate climbing 71%, hydroxide 91% and spodumene feedstock 58% and BNEF expects all prices to continue their rally but gradually plateau as more supply comes online through 2022.

Nickel

The nickel sulfate market is expected to remain balanced in the medium term and in the near term prices should hover around $18,000 a tonne mark:

“Domestic demand in China was relatively low as some automakers are shifting to LFP chemistries. This will have limited impact in the adoption of nickel-rich battery cathode chemistries, and as such, the nickel sulfate market may slip into a 128,000 metric ton deficit as early as 2024.

“At the start of the year, BNEF predicted that the nickel market will move into a two-tier system for nickel pricing to further incentivize investment into additional Class 1, battery-grade nickel supply. At the end of the first half of 2021, there have been no concrete developments toward this much needed change in the dynamics of pricing in the nickel market. “

Cobalt

BNEF expects the cobalt market to move into a small surplus of around 3,300 tonnes this year on the back of increasing large-scale and artisanal mining production. The DRC is responsible for some two-thirds of global output which is predicted to rise to about 166,434 tonnes in 2021.

From above $50,000 a tonne in March, a two year high, cobalt metal prices could average $45,000 per tonne by the end of the year:

“With the market projected to be relatively in surplus this decade, BNEF expects prices will hold at an average of $44,000 per ton up to 2025.”

Manganese

Manganese production in top producer South Africa in April more than tripled as covid disruptions eased, but BNEF says mining operations in the country are plagued by challenges associated with haulage, electricity reliability and port operations.

The manganese battery supply chain will experience the strongest growth through 2030, with the market increasing in size by a factor of more than 9. Manganese sulfate prices have risen 30%, from $867 per tonne in January to $1,128 in June and is expected to continue to strengthen over the course of the year:

“With the manganese sulfate market currently projected to be in a deficit, prices are likely to rise to support new refinery projects in order to meet demand by 2024.”

Graphite

Graphite demand from lithium-ion batteries, according to BNEF is set to grow by 37% year on year to just under 447,000 tonnes in 2021 increase fourfold by the end of the decade. Commercial vehicles will represent the fastest growth, with year-on-year demand doubling in 2021.