Bitcoin skids to two-week low, but technical analyst says the slump is not a ‘decisive breakdown’ — she’s watching the next two closes

Bitcoin was under fresh selling pressure Tuesday, dragging the world’s No. 1 cryptocurrency to lows not seen since late May. At least one technical analyst, though, says the slump doesn’t represent a decisive breakdown of the bitcoin uptrend unless and until the asset registers weaker closes today and tomorrow.

“Short-term momentum has deteriorated, but not to the degree with which we have a ‘sell’ signal (in the daily MACD),” Katie Stockton, technical analyst and founder Fairlead Strategies, told MarketWatch, referring to the moving average convergence divergence, a measure of momentum in an asset.

“A close above the 20-day [moving average] would be a bullish short-term development,” the analyst said.

At last check, bitcoin BTCUSD,

CoinDesk analyst and author Damanick Dantes said that resistance for bitcoin stands around $40,000, with support around $30,000.

Bitcoin has been under pressure for weeks, but its slide has deepened in recent action, after U.S. authorities said that they recovered millions in bitcoin paid to the hackers who launched a cyberattack last month on Colonial Pipeline, a major East Coast fuel pipeline.

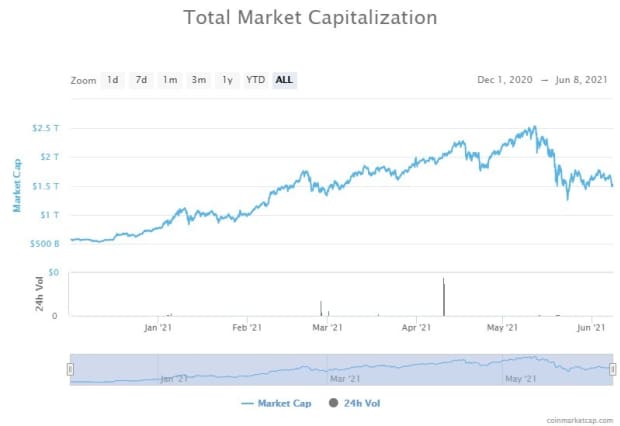

Overall bitcoin’s price slump has been weighing on the broader crypto complex.

Dogecoin DOGEUSD,

The world’s No. 2 most valued crypto, Ether ETHUSD,

By comparison, the Dow Jones Industrial Average DJIA,

Still, the total market value of crypto at $1.495 trillion is off by about 40% from a peak near the middle of May, according to CoinMarketCap.com.