Why the pullback in semiconductor stocks could offer investors a big opportunity

Are you a trader or a long-term investor? That may be the most important question to answer if you are involved in any way with semiconductor stocks. The group is volatile and we’re in the midst of a tech-stock pullback. But for investors who can commit for several years, the stage appears set for good performance.

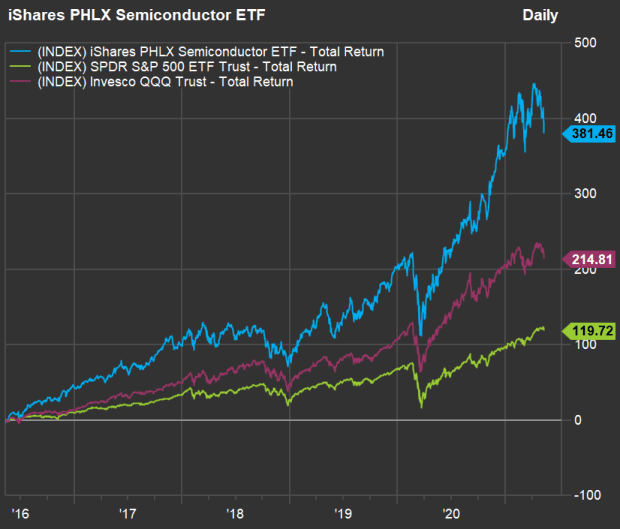

Semiconductors as a group have been excellent performers over the past five years for long-term investors who could tolerate considerable price volatility. You can see those results on the chart below.

The big news for chip makers now is the industry shortage brought about not only by the coronavirus pandemic’s supply and shipping disruptions but also by increasing demand for an array of products, including electric vehicles and their batteries, traditional combustion vehicles and 5G-enabled and other connected devices . The shortage has transformed the market for vehicles in the U.S.; the average price for a used car has climbed 10% over the past year and now exceeds $20,000.

Wallace Witkowski broke down the how the chip shortage is expected to affect different semiconductor manufacturers.

Valuation and performance

A concise way to invest in chip makers and related equipment suppliers is the iShares PHLX Semiconductor ETF SOXX,

| Company | % of SOXX |

| Texas Instrument Inc. TXN, |

8.4% |

| Nvidia Corp. NVDA, |

8.3% |

| Qualcomm Inc. QCOM, |

7.5% |

| Broadcom Inc. AVGO, |

7.4% |

| Intel Corp. INTC, |

7.3% |

| ASML Holding N.V. ADR ASML, |

4.2% |

| Applied Materials Inc. AMAT, |

4.2% |

| NXP Semiconductors N.V. NXPI, |

4.1% |

| LAM Research Corp. LRCX, |

4.1% |

| Analog Devices Inc. ADI, |

3.9% |

| (FactSet) | |

SOXX was down 4.5% on May 10, and was down another 2.5% in early trading on May 11. Through May 10, the ETF’s total return, including reinvested dividends, for 2021 was 7%, following a 53% return during 2020.

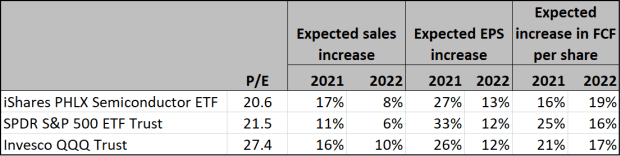

Here’s a comparison of forward price-to-earnings ratios and estimated increases in sales per share, earnings per share and free cash flow per share for SOXX, the SPDR S&P 500 ETF Trust SPY,

Among the three, the index of the 30 semiconductor stocks has the lowest forward P/E, based on consensus estimates for the next 12 months among analysts polled by FactSet.

SOXX also is expected to show the greatest increase in sales this year, even more than the tech-heavy QQQ, which has the highest forward P/E. The S&P 500 is expected to grow earnings per share the most in 2021.

The 30 semiconductor stocks as a group are expected to trail the other indexes for free cash flow growth this year before taking the lead in 2022.

Over the past five years, the total return for SOXX has been much higher than those for SPY and QQQ:

Individual semiconductor stocks

The following tables are large and you may have to scroll the to see all the data.

Quarterly sales growth and P/E ratios

First, here are the 30 stocks held by SOXX sorted by market capitalization with year-over-year changes in sales for their most recently reported fiscal quarters and forward P/E ratios.

The lofty P/E valuations for Nvidia, ASML and Advanced Micro Devices Inc. AMD,

Expected growth in 2021 and 2022

Here are expected growth rates for sales, earnings and free cash flow per share for calendar 2021 and 2022 (some companies have fiscal years that don’t match the calendar). Growth rates are based on consensus estimates among analysts polled by FactSet. The group is sorted by expected sales growth this year.

For Cree Inc. CREE,

One thing to keep in mind is that analysts tend to adjust their full-year estimates incrementally as companies report good or bad quarterly results. For example, Nvidia is expected to increase its sales to $21.9 billion in 2021 from $16.19 in 2020. But three months ago, the consensus 2021 sales estimate among analysts polled by FactSet was $19.45 billion. Another excellent quarter or two might push the 2021 and 2022 estimates higher across the board.

Wall Street’s favorite semiconductor stocks

Here’s the SOXX group again sorted by the percentage of analysts rating each stock a buy or the equivalent, along with price targets and implied 12-month upside potential:

Semiconductor companies have different specialties and sets of customers. As with any investment, you should do your own research to form your own opinion before committing money.

Don’t miss: 20 cybersecurity stocks Wall Street believes can rise up to 79% over the next year