States must refund unemployment benefits they clawed back in error, Labor Department says. It may take a year

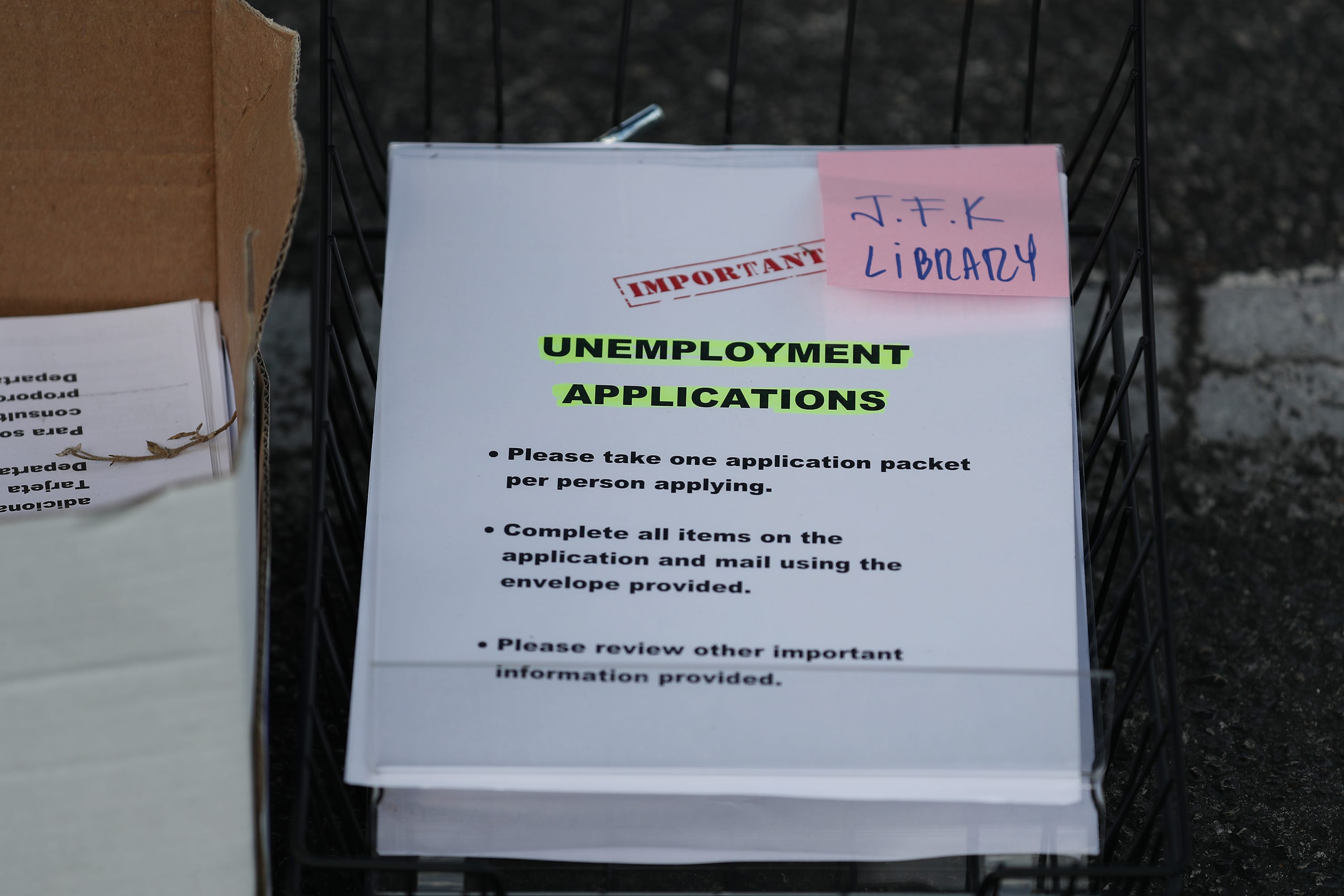

Unemployment applications are seen as City of Hialeah employees hand them out to people in front of the John F. Kennedy Library on April 08, 2020 in Hialeah, Florida.

Joe Raedle/Getty Images

However, the CARES Act didn’t offer a safety valve for states to forgive overpayments. That essentially meant states had to try to collect the funds.

Texas, for example, sent notices to about 260,000 PUA recipients between March 1 and Oct. 1 and tried to claw back $214 million.

Refunds and waivers

A $900 billion relief law passed in December let states opt to waive overpayments of benefits.

Now, states who opt into that forgiveness must issue refunds to workers who’d repaid all or some of their benefits prior to getting a waiver, according to the U.S. Labor Department.

“It may take some time (e.g., up to a year) for states to process such refunds and states are encouraged to contact the Department for technical assistance,” the agency said in guidance issued Wednesday.

States may forgive overpayments if a worker wasn’t at fault and recovering funds would cause financial hardship, for example.

States have many avenues to collect benefits deemed to be overpaid. They can reduce current benefits, garnish tax refunds, intercept lottery winnings and sue individuals to recoup aid, for example. Some charge interest on outstanding balances.

“In many cases, individuals received payments for which they may not have been eligible through no fault of their own,” according to Principal Deputy Assistant Secretary for Employment and Training Suzi LeVine.

“The guidance issued today by the U.S. Department of Labor will help states address this important issue, providing them with greater flexibility to forgo recovery of improper payments from honest workers who continue to struggle and direction in handling cases where real fraud exists,” she added.