Given a 30% year to date rise in the copper price, the nickel price chugging along nicely following the March correction, and the cobalt price averaging more than $44,000 per tonne ($19 per lb.) in the year up to mid-May, all active cobalt production capacity is cash positive on an AISC basis, says Roskill.

All active cobalt production capacity is cash positive on an AISC basis, says Roskill

Fastmarkets’ benchmark assessment for standard grade cobalt metal in warehouses in Rotterdam soared to a nearly 10-year high of $43.70 to $44.45 per lb. in April 2018 before slumping to $12.10-12.75 per lb. in July 2019. The assessment was $19.80 to $20.15 per lb. on May 19, up 28.08% from the start of the year, but down 21.80% from a recent high of $25.30 to $25.80 per lb. on March 10.

Even in 2020, at an average cobalt price of $31,226 ($14.16), only 2% of production capacity was cash negative, most notably the Goro operation in New Caledonia, which is now under new ownership following Vale’s exit.

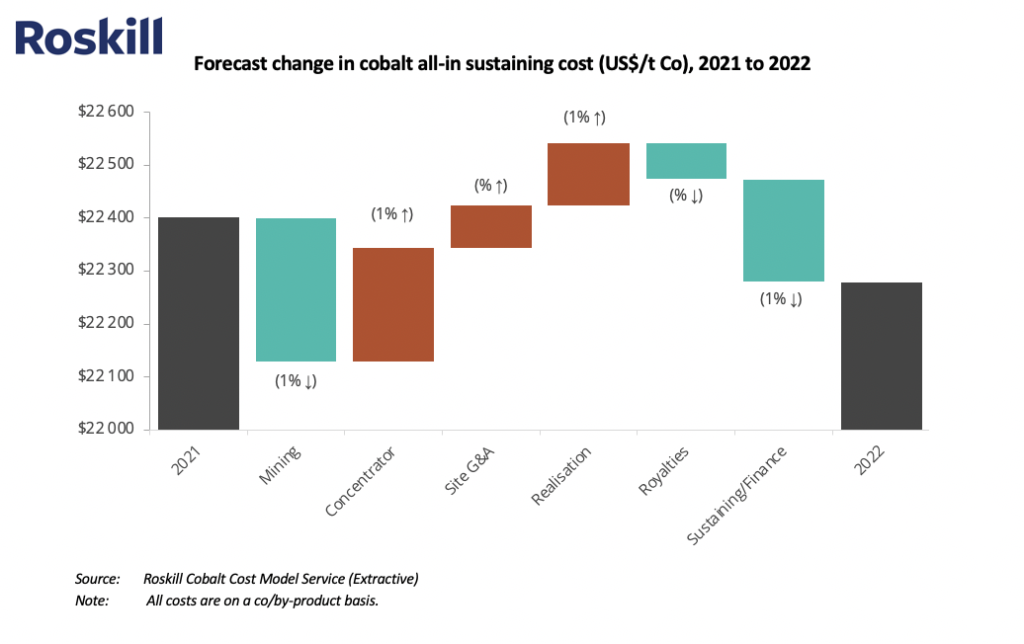

According to Roskill, mining costs are expected to fall through 2022 on lower stripping ratios and operating efficiencies implemented at major cobalt-producing mines such as Kamoto, Tenke Fungurume and Moa.

Roskill also flagged rising processing costs as offsetting much of the drop, mainly owing to falling overall mined grades.

Transportation by land and sea also make up a substantial component to the AISC calculation. While recent contract renegotiations in the Democratic Republic of Congo (DRC) were offset by a steep increase in shipping costs with the Baltic Dry Shipping Index, lower sustaining and finance costs also contribute to a lower-cost outlook for the metal.

In the medium to long term, Roskill expects that the cobalt cost curve will trend upwards and become left-skewed as higher metal prices incentivise higher-cost production to come online.

Dovetailing into the general lower-cost outlook is Glencore’s announcement this week it plans to restart operations at Mutanda, the world’s biggest cobalt mine next year. When it last operated, Mutanda produced 103,200 tonnes of copper and 25,100 tonnes of cobalt hydroxide in 2019, compared with 199,000 tonnes and 27,300 tonnes respectively in 2018.