Jack Bogle’s ghost warns about 401(k)s

Retirement investors have never had it so good. For a decade now individual retirement accounts and company 401(k) plans have been booming thanks to the stock market’s giddy rise.

But before we start to get complacent, or think this is normal, here comes a timely new warning. And it comes from beyond the grave, from the late, great Vanguard founder Jack Bogle—one of the champions of the Mom and Pop investor and buy-and-hold index investing. Bogle died in 2019.

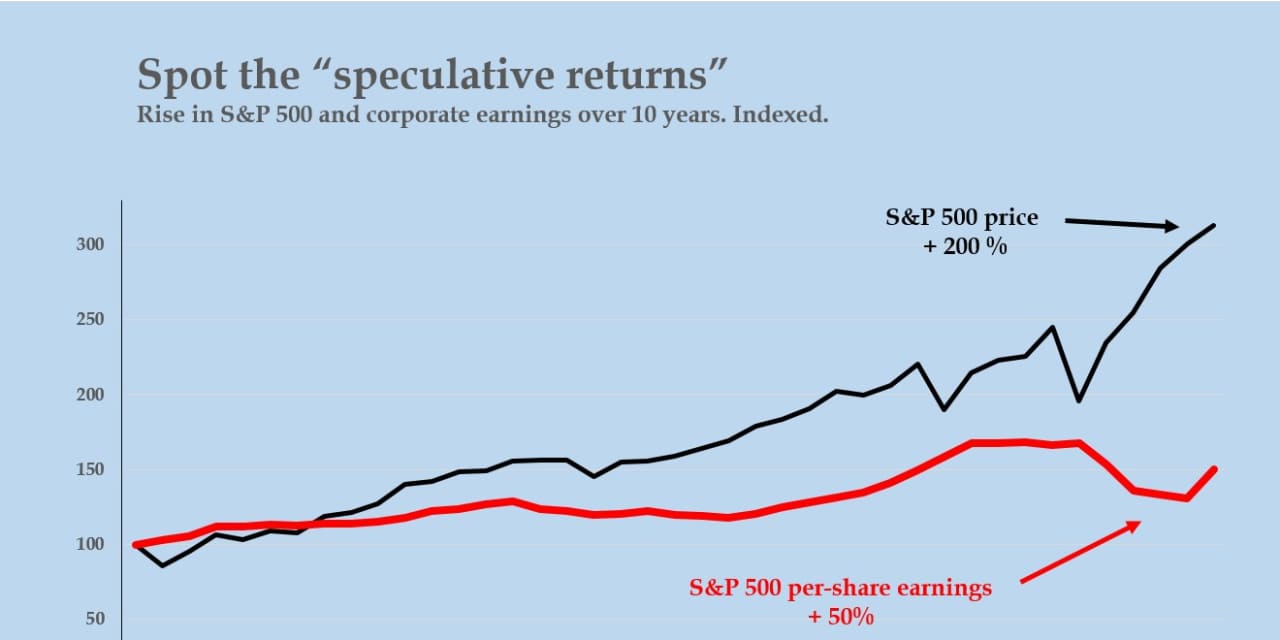

We’ve seen this movie before, Bogle will remind us in “In Pursuit of The Perfect Portfolio”, a forthcoming book on investing from Princeton University Press. Over the past century, the “speculative return” on U.S. stocks “goes up and goes down and goes up and down” and always ends up back where it starts, warns Bogle. “If you go back and look at the history of American business over the last century, you will find the [price/earnings] effect of stocks is zero,” he says.

It doesn’t mean simply that “what goes up must come down,” but that stock returns, Bogle points out, can only come from three things: Dividends, earnings growth, and these “speculative returns.” And the speculative returns, such as we’ve all enjoyed for years, have always, always reversed themselves.

Perfect Portfolio is written by Andrew Lo at the Massachusetts Institute of Technology’s Sloan School of Management and Stephen Foerster at Western University’s Ivey Business School.

By Bogle’s argument the current stock boom in retirement accounts will wash out in years to come, wiping out some or much of investors’ recent returns.

It’s worth taking a moment to reflect on just how good things have been for investors for a decade.

Among the top U.S. stock funds in retirement accounts, the Vanguard 500 Index Fund VFIAX,

The Vanguard Total US Stock Market Index Fund VTSAX,

And this year has already been pretty good. The S&P 500 is already up 11%, although for once growth- and technology-oriented funds are trailing behind.

How normal is this?

It’s not.

The gains on the S&P 500 over the past decade equal about 12% a year above the level of inflation.

But historically U.S. stocks have only produced about half that. Data from New York University says the average annual return on the S&P 500 has been about 6.6% above inflation.

As our chart above shows, stock prices over the past decade have risen about four times faster than the actual per-share earnings that are supposed to underpin them.

So what would Jack say?

As Lo and Foerster remind us, Bogle made stock market predictions. He referred to his “Bogle Sources of Return Model for Stocks,” which he abbreviated BSRM/S. In 2007, for example, he used it successfully to predict that the Dow Jones Industrial Average would hit 20,000 within a decade.

Today, the dividend yield on the S&P 500 is about 1.5%, according to FactSet data. That’s comparing today’s share prices with expected dividends for 2022, when companies are back on a sounder footing after the Covid crisis.

Earnings growth? The International Monetary Fund expects the U.S. economy to grow by 3.5% a year, on average, from 2022 onwards.

Add those two together, and Bogle’s model would predict 5% annual growth—which would still be OK, but for two things. Inflation over the next five years is now forecast to be 2.7% a year, so the actual real, post-inflation return comes to around 2.3%. That’s a far cry from the 12% from the past decade.

Oh, and then there are those “speculative returns.” If Bogle is right, we’ll have to give those back—cutting annual gains even further. The S&P 500 is currently trading on 20 times forecast per-share earnings for next year, 2022. The historical average is 16 times forecast per-share earnings for the current year. That difference is big enough potentially to wipe out all of dividends and earnings growth over the next five or ten years.

‘Yes but…” goes the optimist’s cry. There are multiple responses, including “This time is different,” “But…Amazon!”, “We’re number one!”, “USA! USA! USA!” and the like.

Let’s say, for example, that U.S. stocks are able to grow their earnings in line, not just with U.S. GDP, but global GDP. That would add about 2 full percentage points a year with earnings growth. Net return would be inflation plus 4.3% a year. That’s one third of the past decade’s return — and still doesn’t account for recent, speculative gains being reversed.

All of this also assumes that U.S. workers, retirees or the government don’t take a bigger share of annual GDP than they have in the past. By one measure, for example, after tax corporate profits account for about 10% of GDP—about twice what they did during the Reagan administration.

Bottom line? Enjoy making 12% a year, but don’t get used to it.