AMD stock gains after announcing first major share repurchase in its history

Advanced Micro Devices Inc. shares rose Wednesday after the chip maker’s board approved an unprecedented share-repurchase program.

AMD AMD,

That AMD is considering any type of share buyback is itself a milestone — the company has not repurchased any shares since 2001, according to FactSet data, and at that time it only repurchased about $77 million worth of stock. In records dating back to 1980, AMD has spent a total of roughly $100 million on repurchasing stock. That’s unlike other companies in the semiconductor space like Intel Corp. INTC,

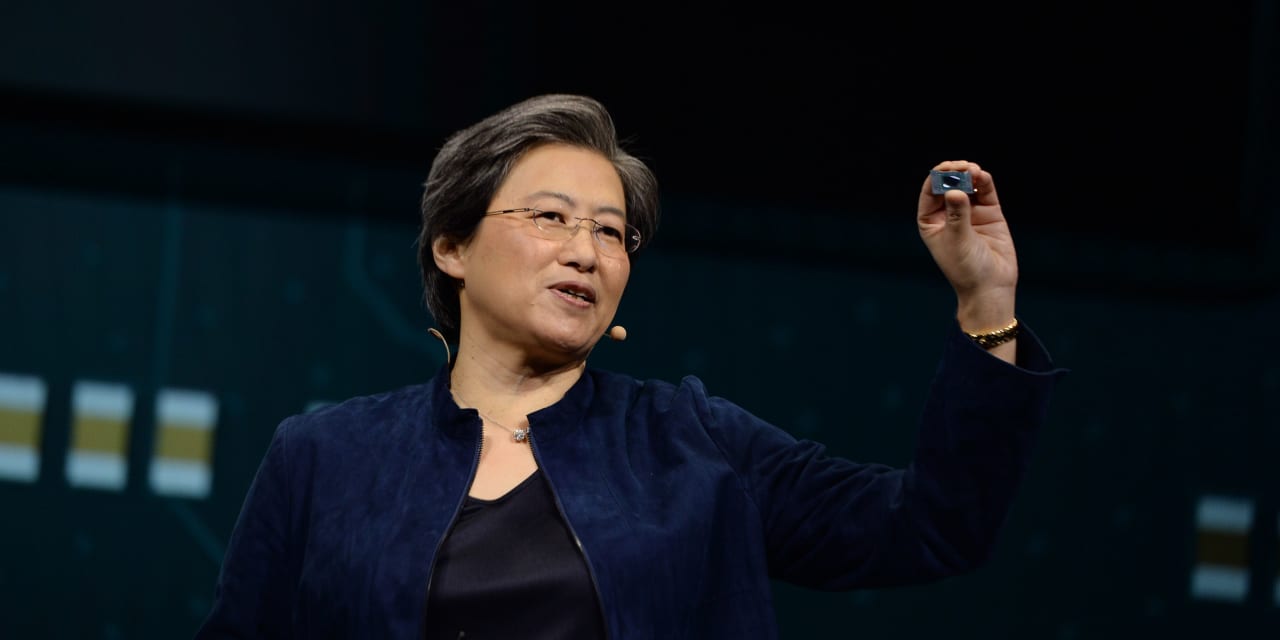

“Today’s announcement reflects our confidence in AMD’s business and the successful execution of our multiyear growth strategy,” said Lisa Su, AMD’s chief executive, in a statement. “Our strong financial results and growing cash generation enable us to invest in the business and begin returning capital to our shareholders.”

In 2020, AMD reported free cash flow of $777 million, up from $276 million in 2019, according to FactSet data. Before that, AMD hadn’t reported positive cash flow for a fiscal year since 2011. Additionally, AMD finished 2020 sitting on $2.29 billion in cash and short-term investments, its highest level since 2009, when it reported $2.68 billion.

That’s all built upon a renaissance at AMD under the tutelage of Su. Most recently, AMD has shown strong data-center adoption while Intel has lagged, while aggressively building out its portfolio of products and acquiring chip maker Xilinx Inc. for $35 billion, which shareholders recently approved.

AMD shares closed at an all-time high of $97.25 on Jan. 11, and are down nearly 17% for the year. Over the past 12 months, AMD shares have grown 39%, compared with a 68% rally in the SOX index, a 41% gain on the S&P 500 index SPX,