Will China’s new digital yuan threaten King Dollar’s reign?

China is the first major economy to issue a blockchain-enabled, digital version of its currency, the yuan, and this development has some in Washington worried that the U.S. dollar’s status as the global reserve currency is under threat.

“Anything that threatens the dollar is a national security issue. This threatens the dollar over the long term,” Josh Lipsky of the Atlantic Council told the Wall Street Journal, in a feature that described the digital yuan as “a re-imagination of money that could shake a pillar of American power.”

China certainly has reason to chafe at a global economic order wherein nearly 90% of foreign-exchange transactions involve dollars and where more than 60% of all global central-bank reserves are held in dollar-denominated assets, when the U.S. government has increasingly leveraged this reality in order to sanction countries and companies it sees as acting contrary to its national interest.

Read more: Why the coming recession could force the Federal Reserve to swap greenbacks for digital dollars

Diana Choyleva, chief economist at the China-focused Enodo Economics, argued in a Monday note to clients that recent events, including leaks by National Security Agency contractor Edward Snowden that the U.S. government monitors transactions on the Society for Worldwide Interbank Financial Telecommunication network, has served as a “wake-up call” for Chinese policy makers.

“The Chinese Communist Party, obsessed with control and highly averse to any foreign interference in its domestic affairs, realized that it was reliant on a global payments system that could be tapped by U.S. intelligence agencies and that Washington could use to deny Chinese banks access to dollar funding,” she wrote.

However, while China has geopolitical incentive to unseat the dollar as the world’s reserve currency, it’s not clear that a digital yuan will support that goal, according to Eswar Prasad, a former head of the International Monetary Fund’s China division and economics professor at Cornell University.

“Most cross-border payments either for trade or finance are already digital, so it’s hard to imagine a digital yuan having a huge impact on international payments,” he said. A more important development, he argued, was the introduction in 2015 of China’s Cross-Border Interbank Payment System, a rival to SWIFT. That system, in combination with a digital yuan, would make it easier for countries facing U.S. sanctions, including Russia, Iran and Venezuela, to be paid in yuan for oil or other exports.

See also: Bitcoin enthusiasts, liberal lawmakers cheer a Fed-backed digital dollar

But Prasad said there’s little chance that a digital yuan will threaten the U.S. dollar’s role as the global reserve currency, which is dependent on the unrivaled size and liquidity of U.S. debt markets, the flexibility of the dollar’s exchange rate, laws that enable capital to freely enter and exit the country, and an institutional framework of checks and balances, an independent judiciary and central bank.

While China has made strides in developing its financial markets, allowing the value of its currency to be set by market forces and allowing capital to flow more freely, there’s little reason to expect it to quickly adopt the sort of Western institutions that global investors seek out as an environment for protecting their savings, he said.

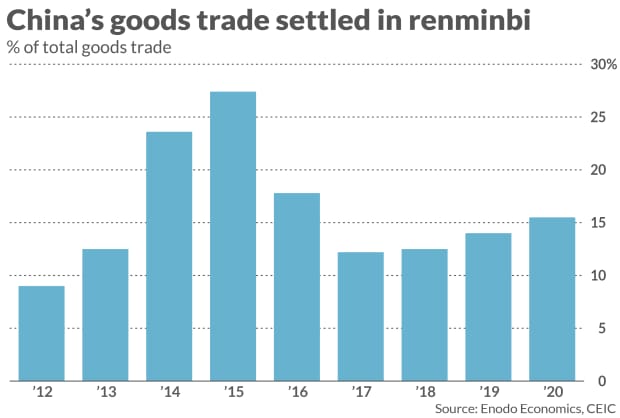

Indeed, even the share of China’s own trade in goods settled in renminbi, as the yuan is also known, remains well below its peak in 2015, before the government there cracked down on capital flight abroad, tipping its hand to international investors that for China, financial liberalization is not a one-way street.

Domestic policy, rather than geopolitics is the actual motivation for the rollout of the digital yuan, according to Stephanie Segal, a senior fellow at the Center for Strategic and International Studies.

“A lot of financial activity in China is happening over platforms like AliPay and WeChat Pay, and the central bank and other regulators didn’t have a lot of visibility into that activity and that’s something the Chinese authorities don’t like,” she said.

Meanwhile, China’s economy relies heavily on the forbearance of state-owned banks, which roll over nonperforming loans to avoid the disruptions of economically important institutions defaulting. “That can be sustained as long as you have a constant funding source,” in the form of consumer deposits, but a growing system of private money could undermine that, Segal said.

Indeed, the primary reason many governments, including the U.S., are experimenting with central-bank digital currency is for the convenience of their citizens and to improve the efficacy of macroeconomic policy.

During negotiations over coronavirus stimulus measures, liberal lawmakers pushed for legislation to include the creation of a Federal Reserve-backed digital dollar that could be held by Americans at individual accounts with the central bank. The move would have made it easier for the federal government to issue stimulus money to individuals, especially to the millions of Americans with no relationship with private banks.

The Federal Reserve is currently studying the idea of a digital dollar, but Chairman Jerome Powell has said it won’t move without first winning the support of a large majority of the American public and Congress. In March, Powell said that “Because we’re the world’s principle reserve currency, we don’t need to rush this project — we don’t need to be first to market.”