The Fed is standing aside as house prices rip higher — but here’s what could get in the way

It seems appropriate on a day when the Federal Reserve is making an interest-rate decision to look at the most rate-sensitive sector, housing.

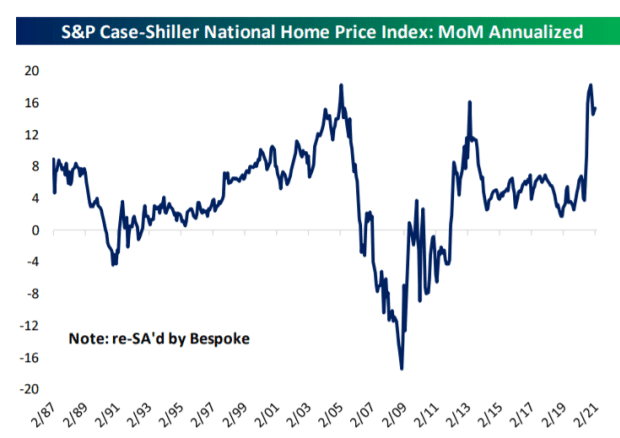

The Case-Shiller house price report released on Tuesday, showing an 11.9% surge for the 20-city composite in the three months ending February, was jaw dropping. Bespoke Investment Group calculates the annualized rise over the last eight months for the national index was 15.3% — a stronger period than even the subprime boom, or in fact any period in the series that dates back to the mid-1980s.

“This level of price appreciation isn’t sustainable long-term, but the combination of demographics, interest rates, and short-term demand shifts brought on by COVID have led to an absolutely terrifying rip higher in prices that even surpasses the subprime bubble’s peak,” said George Pearkes, a Bespoke analyst. Even in Cleveland, which missed out on the 2005 boom, prices climbed 12.5%. The housing website Zillow Z,

The hottest commodity around is lumber LB00,

Logically, the price rises are affecting sales. Bank of America BAC,

Low inventory seems to be the key — there is not adequate supply to satiate the interest by urban dwellers to move to spacier surroundings.

For the publicly traded home builders, who have been reticent since the 2008-09 financial crisis to put up more homes, it appears to still be a good backdrop. The SPDR S&P home builders ETF XHB,

The Fed certainly has shown no signs of wanting to get in the way, focusing instead on a jobs market that is still some 8 million positions short of pre-COVID levels. The central bank is months away from even flagging a reduction in bond purchases, and likely years away from an interest-rate hike.

Ironically, if there is one thing that could disrupt the trend it could be the reopening of the economy. “With remote work giving way to at least partial back-to-office this summer, the housing market is in flux, but we expect overall demand to remain strong, consistent with well-above-trend GDP [gross domestic product] growth for the remainder of this year,” said Robert Dye, chief economist at Comerica Bank.

That view was echoed by Lewis Alexander, U.S. chief economist at Nomura. “It will be interesting to see how housing demand evolves in coming months as more people are vaccinated. Vaccine rollout and economic reopening could prompt more people to move back into metropolitan areas and rent apartments. Alternatively, housing markets might be experiencing more secular changes, leading to a permanent shift in demand towards single-family homes in suburban areas,” he says.

Big tech earnings

Official confirmation the Fed will do nothing comes at 2 p.m. Eastern, followed by the press conference with Chair Jerome Powell at 2:30 p.m.

Google owner Alphabet GOOGL,

Besides the tech megacaps, payment processing giant Visa V,

Spotify Technology SPOT,

Weaker-than-expected results from China weighed on coffee chain Starbucks’ SBUX,

Psychedelic drug maker MindMed — which has no revenue — will go public on the Nasdaq on Wednesday.

President Joe Biden will lay out his American Family Plan to a joint session of Congress, which will feature an estimated $1.8 trillion of social spending, to be paid for by $1.5 trillion in taxes, including a hike in capital-gains tax and the imposition of capital-gains tax at death for high earners.

10-year yield on the move

The most interesting move in markets over the last two days has been in the bond market. Up 5 basis points on Tuesday, the yield on the 10-year Treasury BX:TMUBMUSD10Y edged up to 1.64%.

U.S. stock futures ES00,

Dogecoin DOGEUSD,

Random reads

Former U.K. Prime Minister Tony Blair draws comparisons to Doc Brown in “Back to the Future” with his new look.

It turns out the Spock character in “Star Trek” was bad at logic — describing events that happened as “impossible” 83% of the time.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.