According to Fastmarkets MB, Benchmark 62% Fe fines imported into Northern China (CFR Qingdao) were changing hands for $178.43 a tonne on Friday – the highest level since 2011.

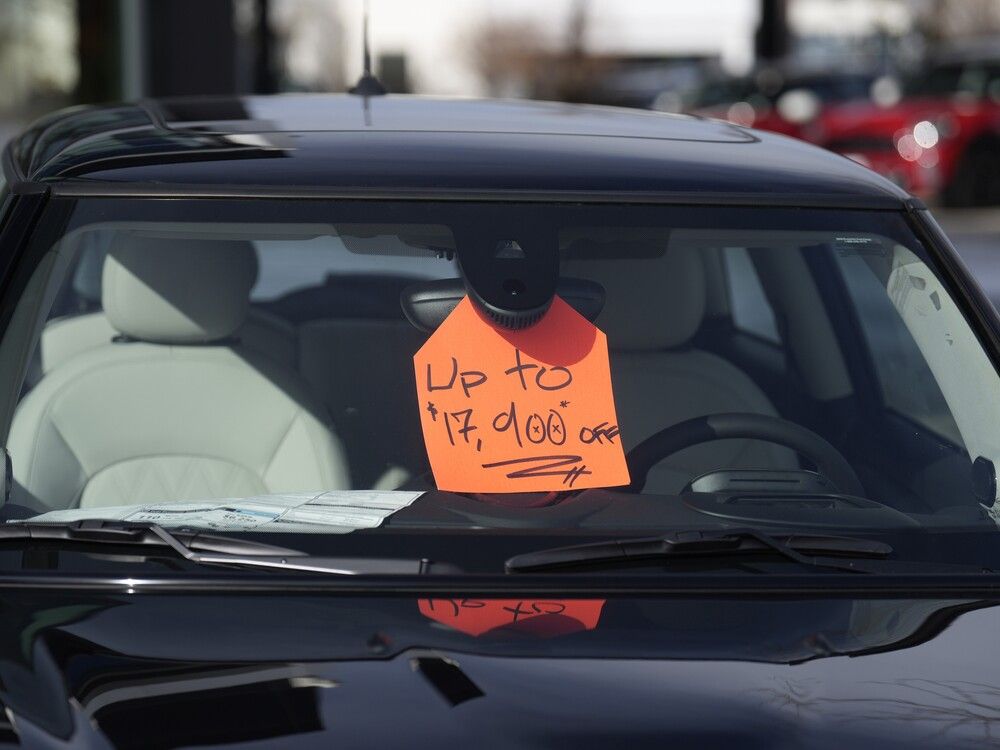

Goldman Sachs see prices falling back to $110 a tonne by the fourth quarter

The high-grade Brazilian index (65% Fe fines) also advanced to a record high of $211.10 a tonne.

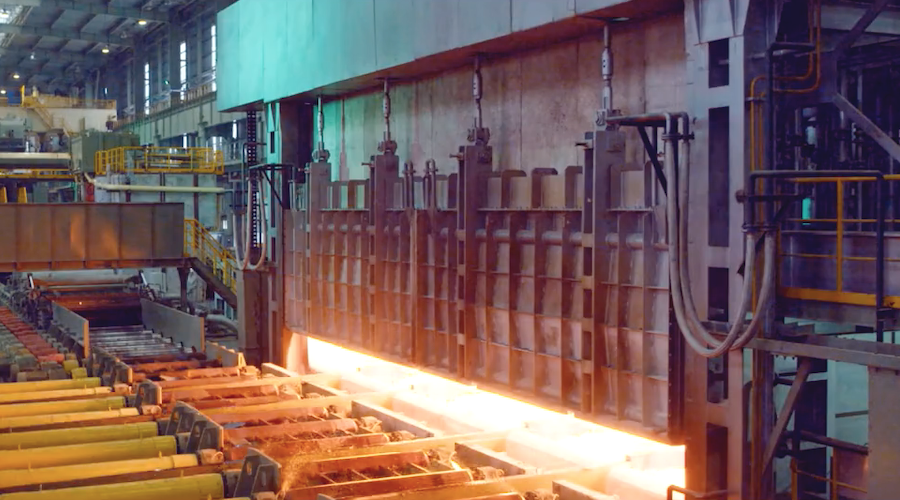

“Steel margins in China are very attractive at the moment, so even with the restrictions in Tangshan, other producers have every incentive to try to increase operating rates,” ING head of commodities strategy Warren Patterson told Financial Review.

“Stronger margins, along with more focus on reducing emissions, has also proved supportive for higher grade iron ore demand. This is reflected in the quality premium, which has widened recently.”

“Despite talk of nationwide inspections, we believe other regions will ramp up, particularly given the spike in steel margins,” JPMorgan analyst Lyndon Fagan said.

According to IndexBox, global steel consumption is forecast to increase in 2021 by 4.1% year-on-year.

Prices have also been fueled by falling supplies from major miners.

Shipments from Australia and Brazil — China’s two major iron ore suppliers — fell by 4.04 million tonnes to 24.04 million tonnes as of April 9 from the week earlier, data from Mysteel consultancy showed.

Goldman Sachs expects the market to enter a surplus in the second half of the year on higher Brazilian exports, bank analysts wrote in a note, adding they see prices falling back to $110 a tonne by the fourth quarter and below $100 in 2022.

(With files from Bloomberg and Reuters)