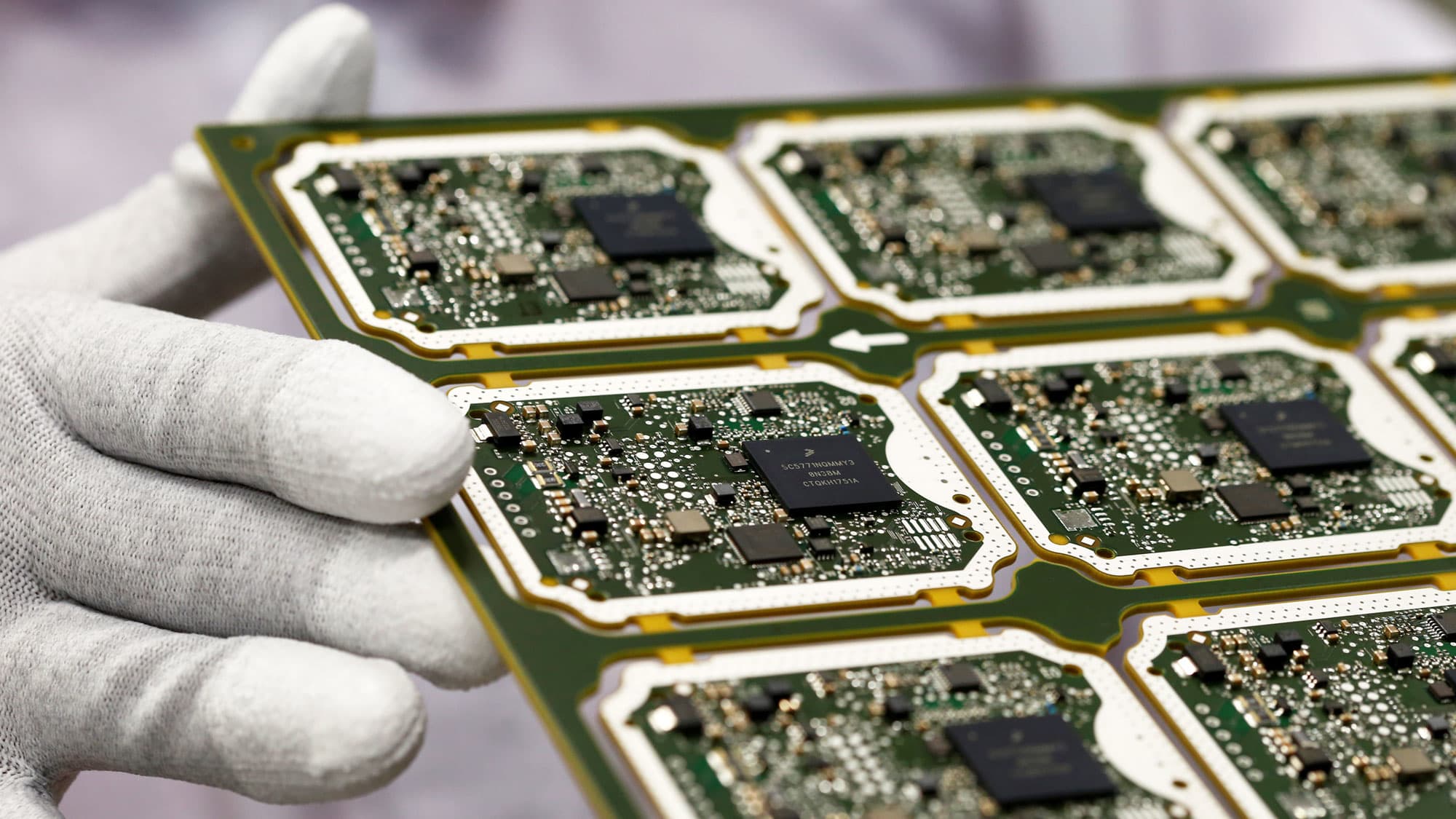

General Motors announced a halt in production at several North American plants and Ford announced additional downtime at two plants, the latest disruptions to the auto supply chain because of a chip shortage.

Shares for GM were down 1% on Thursday, the day of its announcement. Ford closed down nearly 2%.

Both stocks have risen more than 40% for the year, despite the continuing production issues.

JC O’Hara, chief market technician of MKM Partners, identified one way to get exposure to the auto stocks without the headwind risk.

“Used car sales are through the roof so one play that I’m very interested in here is CarMax. They are a huge used car sales company, and the positivity from used car sales is being reflected in the chart,” O’Hara told CNBC’s “Trading Nation” on Thursday.

CarMax has rallied more than 100% over the past 12 months. Shares are up 36% just this year.

Gina Sanchez, chief market strategist at Lido Advisors and CEO of Chantico Global, warned that the chip shortage is “something that’s probably not going away.”

With Ford and GM moving into electric vehicles, Sanchez noted, “the outlook for Ford is significantly better than GM, based on the idea that they’re really moving into the electric car space, but what’s interesting about that is that electric cars are going to require more chips, not less.”

“Suppliers just did not stockpile enough chips because auto demand plummeted during Covid, and so now they’re just caught on the wrong foot, and it’s not so easy to just order up more chips,” she said in the same interview. “This is going to take probably several months to work through, and it’s going to dampen the recovery for the auto sector.”

Still, for long-term investors, O’Hara said GM and Ford could present a more stable opportunity over more volatile electric vehicle makers such as Tesla.

“We have a chance to move into lower volatility names. GM and Ford, who are now looked at as EV plays. I think you will get a pullback and I think that pullback is buyable,” said O’Hara.