Capital-gains tax hike? Why the stock market bounced back so fast

Blink and you might have missed the stock-market selloff blamed on the White House’s purported plans to hike the capital-gains tax rate on America’s wealthiest investors.

After falling more than 300 points, or 0.9%, for its biggest one-day drop since early March, the Dow Jones Industrial Average DJIA,

The drop, which came Thursday afternoon, was widely blamed on news reports that President Joe Biden would propose hiking the capital-gains tax rate on people earning more than $1 million a year from 20% to 39.6%. Combined with an existing surcharge, high income individuals would face a capital-gains rate of as high as 43.4%, Bloomberg noted.

Cue the number crunchers, who were quick to point out an important fact about changes in the capital-gains tax rate: history shows they don’t have much, if any, effect on stock-market returns.

In the most recent example, capital-gains tax rates jumped by nearly 9 percentage points in 2013 but stocks rose 30% that year, noted Mark Haefele, chief investment officer for global wealth management at UBS, in a note.

“In addition, we find no correlation between capital-gains tax rates and equity market valuations,” Haefele wrote. “Price-to-earnings multiples have been as low as 10x when the capital-gains tax rate was 20%, and as high as 18x when it was 35%. Ultimately, other factors such as the outlook for economic growth, monetary policy, and interest rates are much more powerful drivers of equity market returns and

valuations.”

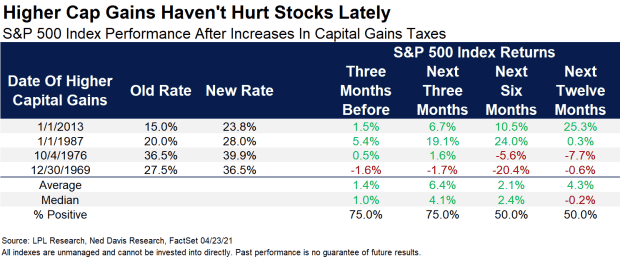

In the chart below, LPL Financial’s Ryan Detrick broke down the S&P 500’s performance following four past hikes in the capital-gains rate going back to 1969:

“Well, on the surface you’d think higher taxes wouldn’t be a good thing, but that’s actually not reality,” Detrick said, in a note. “In fact, the past two times we had an increase in the capital-gains tax stocks did really well for the next six months in 1987 and 2013.”

TaxWatch: Biden has pledged to tax the rich — but precisely how will he do that? Experts consider his options

Stocks did poorly after the hikes of 1969 and 1976, which seems to make for a mixed bag. But Detrick noted that the economy was already performing poorly in 1969 and 1976, while it was healthy in 1987 and 2013.

Detrick said for now he would side with a strong economy and accommodative Federal Reserve allowing the market to take tax hikes in stride.

There’s also uncertainty over what will ultimately pass Congress. Some congressional Democrats, not to mention most Republicans, are likely to oppose the proposed increase. Economists at Goldman Sachs predicted the rate would likely rise to 28% rather than the proposed 39.6%.

That doesn’t mean it won’t have any effect on the market. There’s uncertainty over when the tax would be likely to take effect. If not retroactive, the hike would likely trigger a bout of selling before it takes effect. Goldman analysts noted that the wealthiest households sold 1% of their equities when the rate rose in 2013.

Need to Know: Get ready for $178 billion of selling ahead of the capital-gains tax hike. These are the stocks most at risk

“If it’s passed for this tax year, we could see some selling towards the end of 2021 as investors get ahead of the change,” said Callie Cox, senior investment strategist for Ally Invest, in a note.

“But in this period of high growth, we’d expect the market to digest a capital-gains rate change easier than more material risks like an inflation scare or a Fed policy change,” she said.

Analysts also noted that the proposal, as reported, was largely in line with Biden’s 2020 election campaign pledges and shouldn’t have come as a surprise. The initial market reaction may say more about investor psychology.

“With a lot of good news already priced into markets, stocks could be vulnerable to negative surprises, whether from growth disappointments, higher inflation, or policy missteps,” Haefele said. “As a result, the plan could contribute to pockets of volatility ahead.”

But Cox said the market’s reaction seemed like a “healthy development.”

“It’s a sign that investors aren’t too exuberant and they’re thinking about what could be lurking around the corner,” she wrote. “That may be an obstacle for gains in the short-term, but a healthy level of fear could ultimately keep this bull rally intact.”