Biden’s capital-gains tax hike is his fourth hit on the rich

President Biden’s proposed 43.4% capital gains rate for taxpayers reporting more than $1 million income – the highest rate in American history – completes his quadruple whammy of higher taxes for rich Americans.

The first bite is a top marginal rate on household income of 39.6%, up from 37%. The second bite is a cut in the estate-tax exemption from $11.7 million to $3.5 million, and repeal of the step-up basis provision that eliminates capital gains on death. The third bite is a rise in the corporate tax rate from 21% to 28%, coupled with base-broadening measures, especially on foreign income.

The fourth bite, the capital gains proposal would, raise the federal rate from 23.8% to 43.4% for those with $1 million or more in income (the 39.6% marginal rate plus the investment income surcharge of 3.8% on high earners).

Not surprising, Republicans loathe all four measures, while they are warmly embraced by left-leaning Democrats. Key to enactment will be views of a handful of moderate Senate Democrats, such as Joe Manchin (D-WV) and Kyrsten Sinema (D-AZ).

The debate will center on alleged rising inequality in America, and the claim that rich households are best able to pay, directly and indirectly, for Biden’s American Jobs Plan ($2.7 trillion, centered on infrastructure broadly defined) and the American Family Plan ($1 trillion, centered on childcare, education, and health).

Read: Here’s what’s in Biden’s $1.8 trillion ‘American Families Plan’

Former Bureau of Labor Statistics Assistant Commissioner John Early and former U.S. Senate Banking Committee Chair Phil Gramm show that, when transfer payments and tax burdens are taken into the calculation, inequality has actually decreased since 1970. This fact will make little difference in a debate where the progressive view is set in concrete.

Other advanced countries have programs that bear a resemblance to the American Jobs Plan and the American Family Plan, but they are largely financed by broad-based value-added taxes (VAT) rather than sky-high rates on capital gains or corporations. Consider, for example, that “socialist” Sweden has a capital-gains tax rate of 30% and a corporate tax rate of 22%. The standard VAT rate there is 25%, but the rate is reduced for many items.

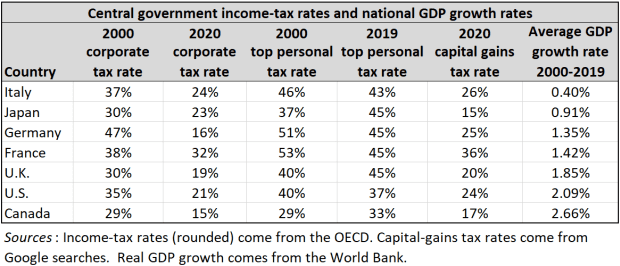

If Biden’s tax suite is fully enacted (which seems unlikely), the United States will embark on a great natural experiment: how do extreme tax rates, compared to other advanced countries, affect innovation and productivity?

Consider that federal tax rates in our Anglo-Saxon neighbor, Canada, are roughly as follows: top marginal household income rate, 20%; top capital gains rate (half of capital gains are excluded), 10%; top estate tax rates, the same as individual income and capital-gains rates; top corporate rate, 15%. (Canada has a 5% national VAT.)

Of course, Canadian provinces add their own taxes to the federal rates, but tax competition between the provinces keeps these in check. The province of Alberta, like the state of Florida, has very low tax rates on income, capital gains, estates and corporations.

Tax competition between provinces, like tax competition between states, will endure that some sub-federal jurisdictions continue to have favorable rates in the future.

It is no stretch to imagine that creators of the American technology companies — the Facebook, Amazon, Apple, Netflix and Google parent Alphabet (FAANGs) of tomorrow — might decide to move a few miles north and launch their ventures in Canada rather than the United States. Or they might be even more adventurous and set up shop in Switzerland or Singapore, historically noted for very favorable tax regimes.

President Biden and his supporters will tell us that other American attributes – enormous markets, great universities, rule of law – will more than compensate for elevated tax burdens on rich Americans when it comes to creating jobs and wealth through innovation. Maybe, as they are wont to claim, taxes don’t matter. Those arguments may be right, but they cannot be confirmed by the experience of any advanced country.

Gary Clyde Hufbauer is a nonresident senior fellow at the Peterson Institute for International Economics, a Washington, D.C., think tank. The views expressed are his own.

Also: Biden’s plan to raise capital-gains taxes on the rich is good politics but bad economics