The housing market already is on fire, and inflation will soon follow, this former Morgan Stanley economist argues

The bond market has stabilized after a huge selloff, and that has given comfort to stocks. The technology-dominated Nasdaq Composite COMP,

Will the tranquility continue? Manoj Pradhan, formerly a Morgan Stanley managing director in charge of global economics and the founder of Talking Heads Macroeconomics, said at a presentation held by fund manager Tabula Investment Management that inflation is going to heat up just when the Federal Reserve expects it to cool down, next year.

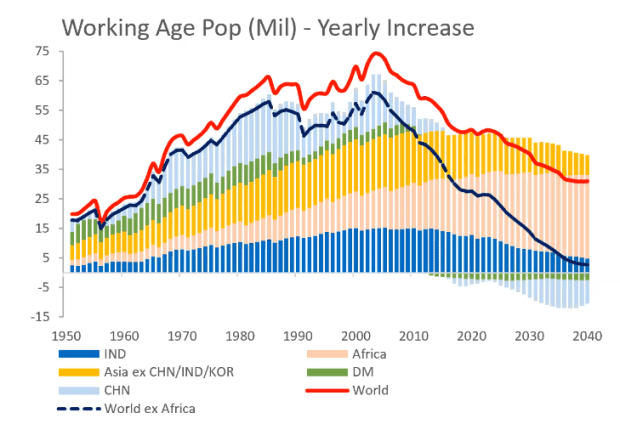

Pradhan argued that the breakdown of the Phillips curve — the traditional relationship that shows inflation rising as unemployment falls — occurred because of China’s entrance into the global labor force. But he said demography and the COVID-19 pandemic will fix it.

First, to demography. The aging of the U.S. and developed world population will mean a loss of workers, and the aging of the population also is creating a surge in government spending. Pradhan also noted caring for the elderly will be labor intensive. “We need tech to destroy jobs in other parts of the economy so that the labor it releases can be reallocated into looking after the elderly, at a similar level of skill,” he said.

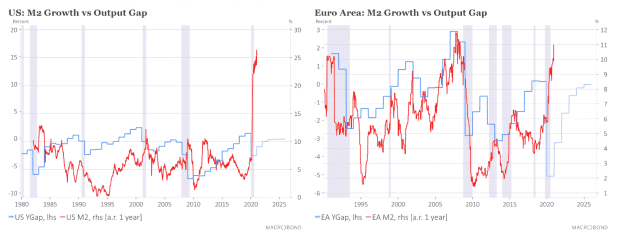

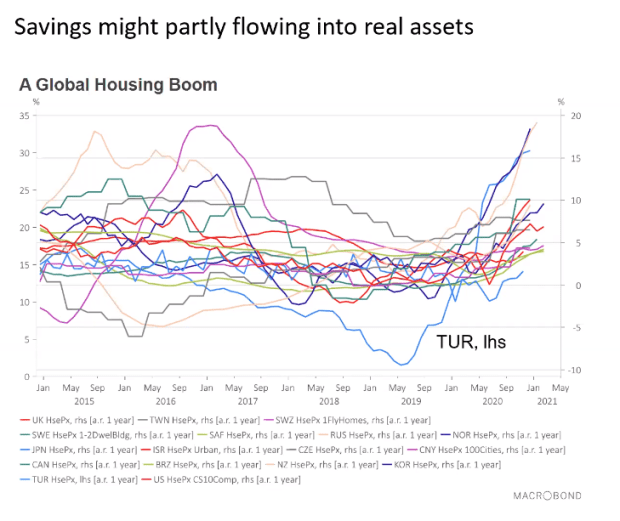

Onto the pandemic. Right now, he said, money supply signals are giving the “most extreme signals you’ve ever seen.” It hasn’t translated into inflation now, because the velocity of money has collapsed, and the savings rate has surged, both functions of consumers being shut at home. Citing European Central Bank research, Pradhan said the savings surge is “forced” rather than “precautionary.”

As the economy normalizes, forced savings will act like delayed stimulus. Even now, the housing market is on fire, with prices surging across the world. “This is a way of spending that can also drag in some of that surplus labor,” he said. But the rise in house prices doesn’t show up in official measures of inflation.

The Fed already is trying to address the challenge of coming inflation readings that, into May and June, may show 3.5% to 4% year-over-year gains. “I will tell you that anything above 3.5%-4% will create a significant breakdown in correlations [between stocks and bonds], because people have not seen inflation really in a big way in the advanced economies for the last 30 years,” he said.

“The real challenge will come in 2022, when a lot of spending will have been deployed into goods or into housing, monetary aggregates will still be high with velocity rising,” he said. He expects the yield curve to steepen further, and that if the Fed implements another Operation Twist or yield curve control, it will push inflation even higher.

Asset returns will be harder to extract, inequality will fall but against a backdrop of weak growth, and central bank independence will come under increasing threat, he forecasts.

WeWork deal

Shared-office provider WeWork has agreed to merge with a special-purpose acquisition company BowX Acquisition Corp. BOWX,

The Ever Given container ship is still stuck in the Suez Canal, disrupting roughly $10 billion of trade a day.

L Brands LB,

Friday’s data calendar includes personal income, consumer spending, and the PCE price index for February, as well as preliminary looks at trade and inventories.

The Fed said temporary limits on dividend payments and share buybacks will end for most banks after June 30.

Another up day?

U.S. stock futures ES00,

Crude-oil futures CL.1,

Random reads

NASA is getting ready to fly a helicopter over Mars.

Nothing quite like the pandemic to inspire the competition for the all-important Shed of the Year.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.