Turkey’s currency and stocks collapsed after the abrupt termination of its central bank head, a move that led investors to take a cautious stance toward risky assets on Monday.

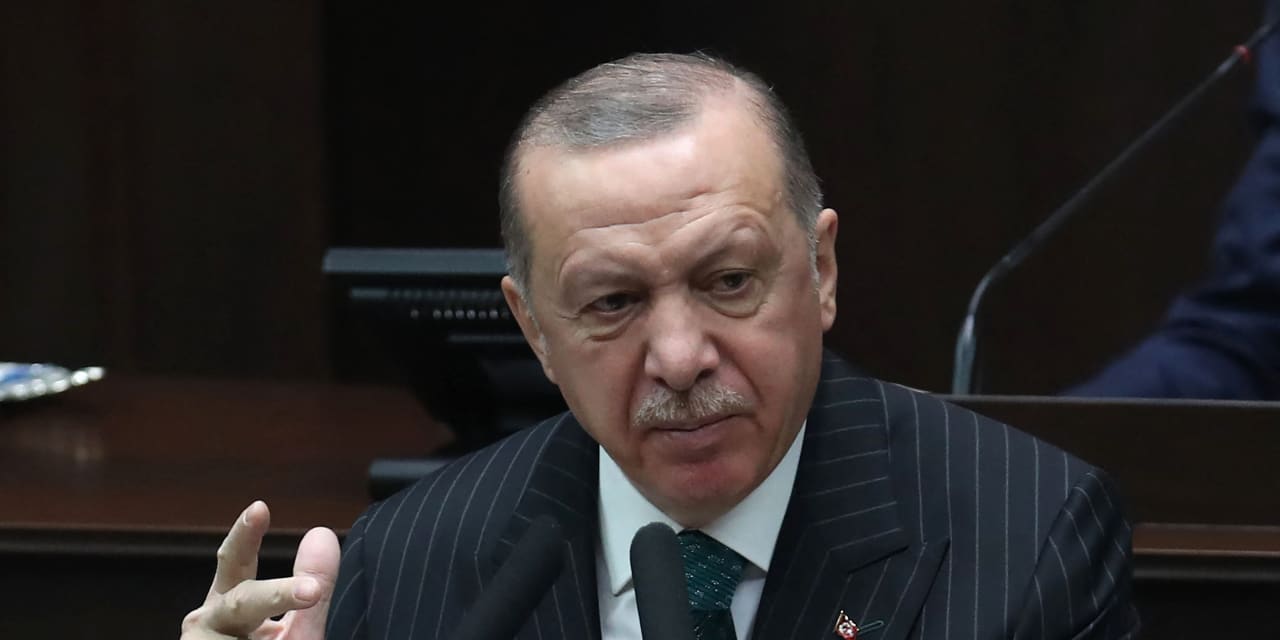

The dollar USDTRY, +8.32% rose by as much as 15% vs the Turkish lira, and the BIST-100 stock-market index XU100, -9.79% traded 10% lower after President Recep Tayyip Erdogan’s decision to replace Governor Naci Agbal with Sahap Kavcioglu — the third change at the Central Bank of the Republic of Turkey (CBRT) in two years. Turkey’s central bank last week hiked interest rates by 2 percentage points to 19%, a full percentage point more than expected.

“With Naci Agbal’s removal from the CBRT, Turkey loses one of its last remaining anchors of institutional credibility,” said Phoenix Kalen, a strategist at French bank Societe Generale. “During his short tenure, Agbal had succeeded where various predecessors had not – in cultivating trust in the central bank’s inflation-targeting framework, in restoring monetary policy independence, in encouraging international investors to re-engage with the crisis-prone Turkish narrative, in driving an 18.0% rally in the lira against the dollar, and most crucially – in arresting and even reversing the damaging trend of dollarization in the economy.”

BBVA BBVA, -7.50%, which owns just under half of Turkey’s Garanti BBVA, tumbled 7% in Madrid.

That caution spread to stocks, where the Stoxx Europe 600 SXXP, +0.15% was fractionally lower, though U.S. stocks SPX, +0.80% rose in early action.

Airline stocks including International Airlines Group IAG, -4.89%, easyJet EZJ, -5.85% and Ryanair RYA, -2.82% skidded after scientific advisors were reportedly urging U.K. Prime Minister Boris Johnson not to lift a ban on foreign holidays. That comes as the European Union has struggled in its vaccination campaign and is now considering blocking exports of AstraZeneca-made vaccines to the U.K.

Shares of AstraZeneca AZN, +3.16%, which separately reported that its vaccine, made with Oxford University, was 79% effective in preventing COVID-19 and 100% effective in preventing severe disease in a U.S. trial, rose 3%.

Volkswagen VOW3, +6.82% and its majority owner Porsche Automobil Holding PAH3, +8.22% both advanced, continuing their stellar run since VW laid out its electric vehicle and battery plans. Analysts at Deutsche Bank hiked its price target on VW by 46% and on Porsche by 38%.

“With the global roll-out of the ID.4 we see a good chance that VW could surpass Tesla’s TSLA, +6.46% [battery electric vehicle] sales as soon as next year, which should increase the credit given to its EV strategy,” said the analysts.

View Article Origin Here