Shares of major miners also fell in London trading, with BHP down 2.4%, Rio Tinto down 3.6%, Glencore down 2.44%, and Antofagasta down 1.25%.

The US Senate passed the covid relief plan on Saturday, a major milestone for the bill expected to boost the recovery in the country, but demand growth in China is still modest.

“A warning shot has been fired across the bow of proponents of the view that commodities are entering a new super-cycle: China’s imports of crude oil, iron ore, copper and coal in the first two month of the year look far from bullish,” said Reuters columnist Clyde Russell.

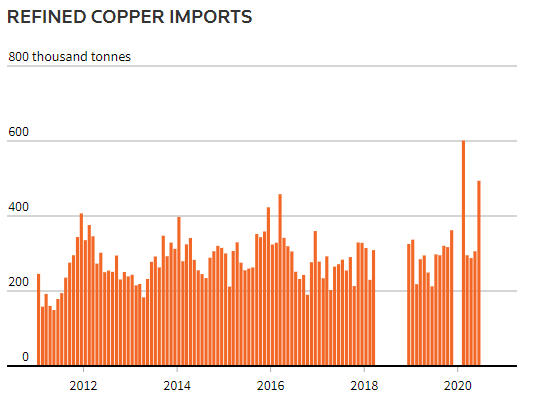

The first two months of 2021 saw imports unwrought copper of 884,009 tonnes, up 4.65% from the same period in 2020.

But on a tonnes per day basis, the January-February imports are 14,980 tonnes, down from 16,530 tonnes in December and 18,710 tonnes in November.

“Demand growth is modest, and certainly nowhere near levels that would lend support to the narrative of a new China-led super-cycle,” said Russell.

Output

Peru’s Energy and Mines Minister Jaime Galvez said on Tuesday he expected the Andean nation to hit a record copper output of 2.5 million tonnes in 2021, well over the 2.15 million tonnes produced in 2020.

Chile, the world’s top copper exporter, saw revenue from the export of the red metal surge in February. Copper exports jumped 65% over the same period the previous year to $3.879 billion, the country’s central bank said.

(With files from Reuters)