A worry for retirees: Inflation forecasts hit 8-year high

Nobody suffers more from high inflation than retirees. Back in the 1970s, it was those in retirement living on fixed income that got hit the hardest as prices rose year after year. The investment returns from their bonds and cash fell way behind. Bonds were ruefully described as “certificates of confiscation.” Every year retirees got poorer.

Could this happen again? Many strategists on Wall Street say no. There is so much slack in the economy, they argue, that there’s little to worry about. And things like fast technology advances, which make businesses more efficient and generally cap prices and wages, will keep prices tame, they say.

Admittedly, when they sound like this they make me think of Leslie Nielsen in “Naked Gun”, standing in front of an exploding fireworks store shouting “nothing to see here! Please disperse!”

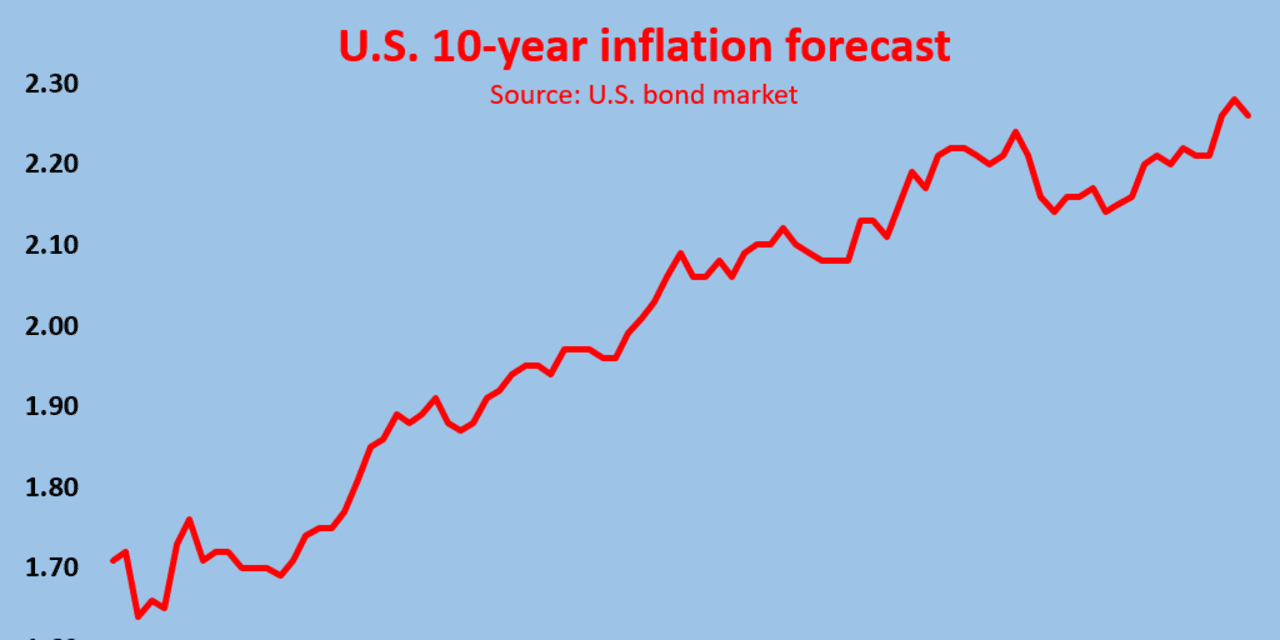

And not everyone is convinced. The bond market, for one. Five months ago, just before the elections, the bond market was predicting inflation over the next 10 years of 1.6%.

Today: 2.3%.

It may not sound like much in real terms. It’s still lower than the historic average. But it’s a 40% rise in a short time and it’s the highest since 2013.

It means someone holding their money in a five-year CD, or even a 10-year Treasury note, will actually lose purchasing power year after year.

So far, there is no reason to panic. At least yet. But there is a lot of ground to worry.

The problem with inflation isn’t that it’s certain, or even probable.

It’s that it’s so dangerous. Especially to people in retirement.

The Wall Street scribblers dismissing the risks—and for that matter the Federal Reserve governors and politicians doing the same—aren’t retired and trying to live on a safe and stable portfolio with lots of bonds and cash.

What can you do?

The honest answer—which no one on the Street will admit—is that nobody really knows. There is a lively academic debate about what investments, if any, will really protect against runaway inflation. Over the years I’ve asked some of the smartest investment managers I know, and they have said there is no clear answer. The problem with all historic data is that it’s situational.

For example, take gold. This is often described as an “inflation hedge.” But there’s no solid evidence for that. Gold happened to boom during the 1970s, when inflation also rocketed. But that may be coincidence instead of cause and effect. The 1970s was also when the federal government first freed up the gold market, after controlling and capping the price for decades. The gold price hadn’t been allowed to rise since 1933. So it may have just had a lot of catching up to do.

Inflation is calculated using the official Consumer Price Index, as measured by the federal government. It’s based on a basket of goods. As you’d expect, nowhere in the CPI calculations does the government measure gold or precious metal prices as part of that basket.

Yes, there are researchers who argue gold has kept its value in purchasing power terms for thousands of years. Maybe they’re right. But maybe that’s not relevant any more. The economy is totally different from what it used to be. Oh, and it may also be overpriced.

In the modern age, gold rose much faster than consumer prices in the 1970s. But it lost you purchasing power, big time, in the 1980s and 1990s. It boomed in the 2000s and collapsed in the 2010s. Inflation protection? Could’ve fooled me. I ran a simple regression analysis. Since 1973, annual changes in the gold price have had a 52% correlation with annual changes in consumer prices. It’s like buying fire insurance that makes you flip a coin, after your house burns down, to see if it will pay out.

This has nothing to do with whether or not gold is a good speculation, merely whether it proves reliable inflation insurance for people who need it.

With some disbelief, I am now reading people online who are seriously arguing that bitcoin is offering inflation protection. Well, of course it might. Technically anything might. Past returns are no guarantee of the future, and so on. (“Economics,” as the late Vassar economics chair Stephen Rousseas used to tell me, “is very good at predicting the past.”)

But there is no evidence, none, that bitcoin does or will provide inflation protection. It’s only been around for about 12 years — during which there has been very little inflation.

And even if gold and bitcoin can hedge inflation in theory, their usefulness in practice will depend on the price you pay.

One obvious inflation hedge is, or should be, the product designed to do exactly that: Treasury inflation-protected securities, or TIPS. These are U.S. Treasury bonds whose returns automatically adjust to reflect changes in the consumer-price index.

The downside of TIPS is that their prices are already at record highs and their real, inflation-adjusted yields at record lows. Those who bought into TIPS bonds during their last boom, in 2011-12, quickly saw their price collapse by about 10%, on average, when inflation worries faded.

TIPS offered a pretty good deal when their real, inflation-adjusted yield was about 2%. But today it’s either zero or negative. At this point it’s expensive insurance. The lowest price risk comes from shorter-term bonds (as usual). But someone buying five-year TIPS bonds is actually locking in a loss of purchasing power of about 1.7% a year between now and 2026. That sounds to me like a pretty lousy deal, at least unless I really am convinced inflation is about to hit.

Read about the best places to retire

Says Joachim Klement, investment strategist at Liberum Capital: “The only true inflation hedge are TIPS. Unfortunately, the real yield on these investments is extremely unattractive with the 10-year TIPS currently paying a negative 0.66%. This means that investors have to either accept defeat and invest in an asset that reduces real wealth over time, or look for alternatives that can provide indirect protection against inflation but no guaranteed protection.”

He suggests infrastructure investments, including utility stocks, renewable energy supplies and railroad stocks, are attractive right now and could offer good inflation protection.

And here’s something else worth considering. Based not on history or faith but logic and math.

The Consumer Price Index, as mentioned, is calculated by the federal government by looking at all the input costs that go into the things that you and I buy or pay for in the course of our daily lives.

None of it is based on the price of precious metals (or bitcoin).

But 31% of the CPI is based on just one thing: Our housing costs. And another 40% is based on the price of commodities (including the agricultural products that go into food and drink). That is a massive weighting toward just two economic sectors.

If I’m looking for inflation protection, I’m also going to look at stocks related to housing, such as residential real-estate investment trusts and home builders, and the stocks of natural resource companies that produce the commodities we consume. It is effectively impossible for the Consumer Price Index to rocket without these doing the same.

And, critically for retirees, stocks in these sectors currently pay out higher income than TIPS, Treasury bonds or Certificates of Deposit. Financial research company FactSet says its global index of energy stocks currently sports a dividend yield of 4%, its global index of non-energy mineral stocks — ie mining stocks — 3.6%, and its index of U.S. real-estate investment trusts 3.5%. The yields on many residential REITs are also around 3.5% to 4%. Meanwhile BAA-rated corporate bonds, the highest-yielding “investment grade” bonds you can buy, yield 3.4%.

So these are a type of insurance, if you will, which also pay at least some income.