We were ‘dangerously close’ to collapse of ‘entire system,’ says Interactive Brokers founder ahead of GameStop hearing

“ ‘What I would like to point out here is that we have come dangerously close to the collapse of the entire system, and the public seems to be completely unaware of that, including Congress and the regulators.’ ”

That’s Thomas Peterffy, founder and chairman of Interactive Brokers Group Inc., detailing Wednesday on CNBC the dire situation in which the market stood in late January as individual investors on social-media platforms banded together to send a handful of heavily shorted stocks, including bricks-and-mortar videogame retailer GameStop Corp. GME,

As Peterffy explained to MarketWatch in an interview last month, the so-called short squeeze that played out was rocking clearinghouses and forcing a number of brokerages to attempt to protect themselves by raising margin requirements and capping trading in select stocks to prevent wider-reaching chaos in markets.

Peterffy’s comments come ahead of a highly anticipated noon hearing on Thursday where the House Financial Services Committee is set to grill executives from Robinhood Market, the hedge funds Citadel Securities and Melvin Capital, social-media firm Reddit, and Keith Gill, an independent investor who achieved sudden fame during the GameStop affair, about their roles in the frenzied trading that gripped the public and that briefly helped spark a mini-selloff in the Dow Jones Industrial Average DJIA,

Clearinghouses play a crucial role in markets from equities to derivatives. They stand between the parties to a trade to guarantee payment if either reneges.

Read: GameStop frenzy puts clearinghouses in spotlight as investors weigh systemic risk fears

That crucial piece of financial-market plumbing was at the center of the matter, Peterffy said.

Peterffy said existing protocols around shorting can lead to calamity in the stock market because, in a number of instances, the shares of the company targeted by short sellers exceed the total shares outstanding.

“So as the price goes higher, the shorts default on the brokers, the brokers now must cover themselves, [and] that puts the price further up, so the brokers default on the clearinghouse, and you end up with a complete mess that is practically impossible to sort out,” the Interactive Brokers chairman told CNBC. “So that’s what almost happened.”

In prepared testimony ahead of his hearing, Robinhood CEO Vlad Tenev gave his perspective on the January action: “What we experienced last month was extraordinary, and the trading limits we put in place on GameStop and other stocks were necessary to allow us to continue to meet the clearinghouse deposit requirements that we pay to support customer trading on our platform.”

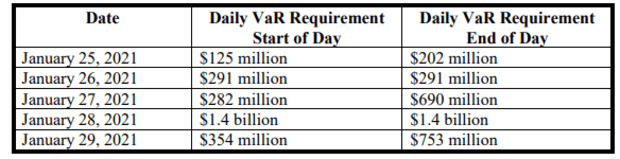

The Robinhood CEO says that the brokerage, which bills itself as catering to the average investor, said its daily value at risk, or VAR, surged by nearly 600% from $202 million on Jan. 25 to $1.4 billion by Jan. 28.

The surge in its depositary requirements forced Robinhood to raise $3.4 billion in additional capital to allow customers to resume normal trading across its platform, the CEO said.

Check out: Reddit millionaire investor set to tell Congress ‘I’m as bullish as ever’ on GameStop turnaround

Peterffy said that lawmakers and regulators can solve the current problems surrounding short selling by calling for more frequent data on short selling and increase margin requirements, or the leverage used, on shorted stocks.