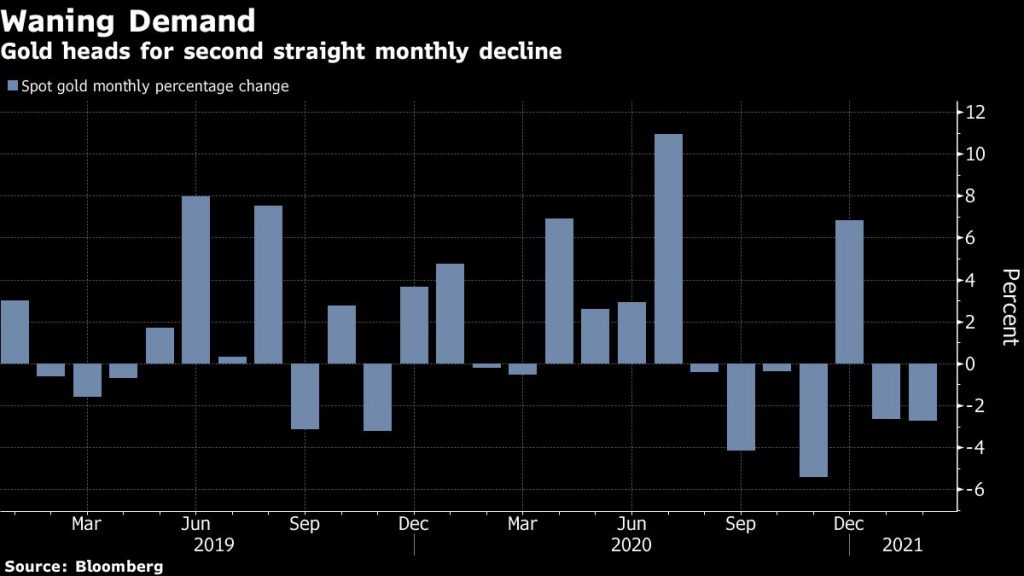

Gold price extends decline on surging bond yields

Meanwhile, 10-year US Treasury yields climbed to the highest in a year on Thursday, making gold less competitive as it does not bear interest. Evidently, holdings in exchange-traded funds backed by the metal registered an 8th consecutive daily outflow, a sign investment demand is flagging.

Bullion slump

Bullion is slumping this year as rates rise on bets that a brighter outlook for the global economy and higher inflation is just around the corner.

Federal Reserve Chairman Jerome Powell assured investors this week that the central bank is in no rush to pull back stimulus, boosting demand for many raw materials while further reducing the appeal of bullion as a safe haven asset.

“The broad-based rally on the commodities markets is continuing to bypass gold completely,” Commerzbank AG analyst Carsten Fritsch told Bloomberg.

With a further rise in US bond yields, even Powell’s renewed assurance of the current pace of bond purchases did nothing to help gold, he added.

“Liquidity is being spent on other investments at present, such as stocks, while capital is still being withdrawn from the gold ETFs.”

Carsten Fritsch, Commerzbank AG analyst

“The gold price is clearly not benefiting from the Fed narrative, which is that loose monetary policy is here to stay for some time,” wrote Naeem Aslam, chief market analyst at AvaTrade, in a daily note to MarketWatch.

“Investors believe that this is risk-on time, and they really do not see any reason why they need to hedge their risk if the Fed is holding their back, which has weakened the gold price’s strength,” Aslam said.

Contributing further pressure to gold is investor interest in bitcoin, Chintan Karnani, chief market analyst at Insignia Consultants, told MarketWatch. “A lot of short term gold investors have invested in … and continue to invest in cryptocurrencies.”

Goldman Sachs recently cut its gold price forecast, pointing to a rotation into riskier assets as a reason for the metal’s underperformance.

(With files from Bloomberg)