Brazil

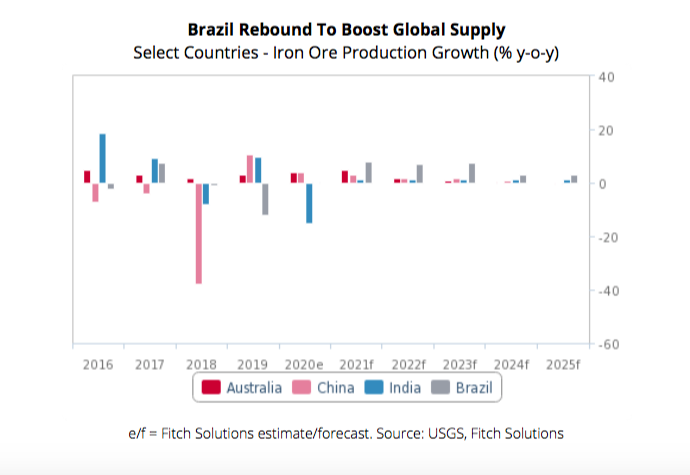

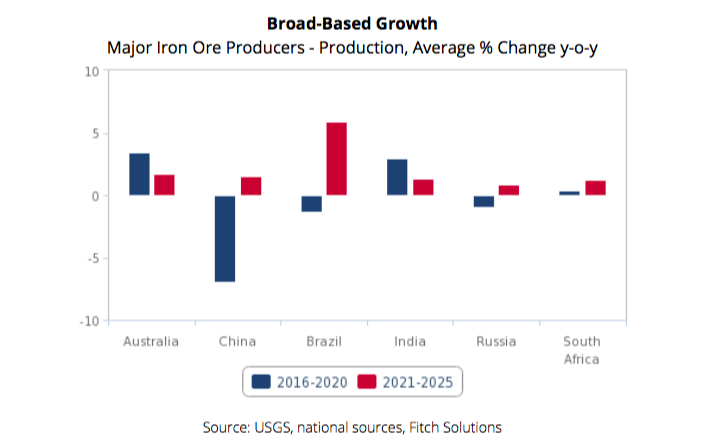

Brazil’s iron ore production growth will rebound in the coming years following contraction and stagnation over 2018-2020, Fitch predicts, pointing out that low operating costs, a solid project pipeline and Brazil’s high-quality iron ore increasingly favoured by Chinese steel producers will all contribute to higher output.

The analyst forecasts Brazil’s iron ore production to increase at an annual average rate of 5.9% over 2021 to increase from 391mnt in 2020 to 529mnt in 2025. Production growth will slow over the longer term and Fitch forecasts average annual growth of 1.7% over 2026-2030, which would take annual output to 575 million tonnes by 2030.

Australia

Fitch forecasts iron ore production in Australia to grow at an annual average of 1.7% over 2021-2025. While significantly slower than 3.4% over the previous five years, this would still lift annual output by 84 million tonnes compared to 2020 levels by 2025.

The analyst believes Australia’s seating at the lowest-end of the global iron ore cost curve will provide a healthy buffer against falling prices in the coming years. On average, the cost of producing iron ore in Australia is $30/tonne, compared with $40-50/tonne in West Africa and $90/tonne in China.

Production growth in Australia will stagnate over the longer term, and Fitch predicts production to actually peak around mid-decade at around 1.05 billion tonnes. This production slowdown will be due to mothballing of mines by junior miners and a pullback in capital expenditure by larger firms as iron ore prices decline, Fitch says.

China

China’s iron ore production will stabilise in the coming years, having declined significantly over recent years, and Fitch forecasts production to remain around 900 million tonnes over the coming decade, which would be around one-third lower than the 2015 level of 1.4 billion tonnes. Growth in output will be prevented by weak iron ore prices and tightening environmental regulations, Fitch notes.

China’s iron ore sector will become increasingly consolidated as historically low iron ore prices will price out high-cost domestic miners in the coming years, Fitch says.

According to Bloomberg, around 70% of Chinese iron ore output is uneconomical at prices below $96/tonne. In particular, Fitch notes, miners operating in provinces such as Hebei, Fujian, Guangdong and Xinjiang will take the strain of lower prices due to their sitting at the highest end of the iron ore cost curve.

Demand

Over 2021, a global economic recovery from the covid-19 pandemic will drive stronger consumption of iron ore. Fitch forecasts global steel production to grow by 4.9% in 2021 after contracting by 0.1% in 2020. This will be driven by 7.5% growth in steel production in China and 6.2% growth in India, the two largest steel producers.

Looking further ahead, Fitch expects global iron ore consumption to steadily slow over subsequent years. Fitch forecasts global steel production to grow at an annual average of 32% over 2021-2025 and then by just 1.4% over 2026-2030.

Read the full report here.