China’s new anti-monopoly rules will have limited market impact for now, says analyst

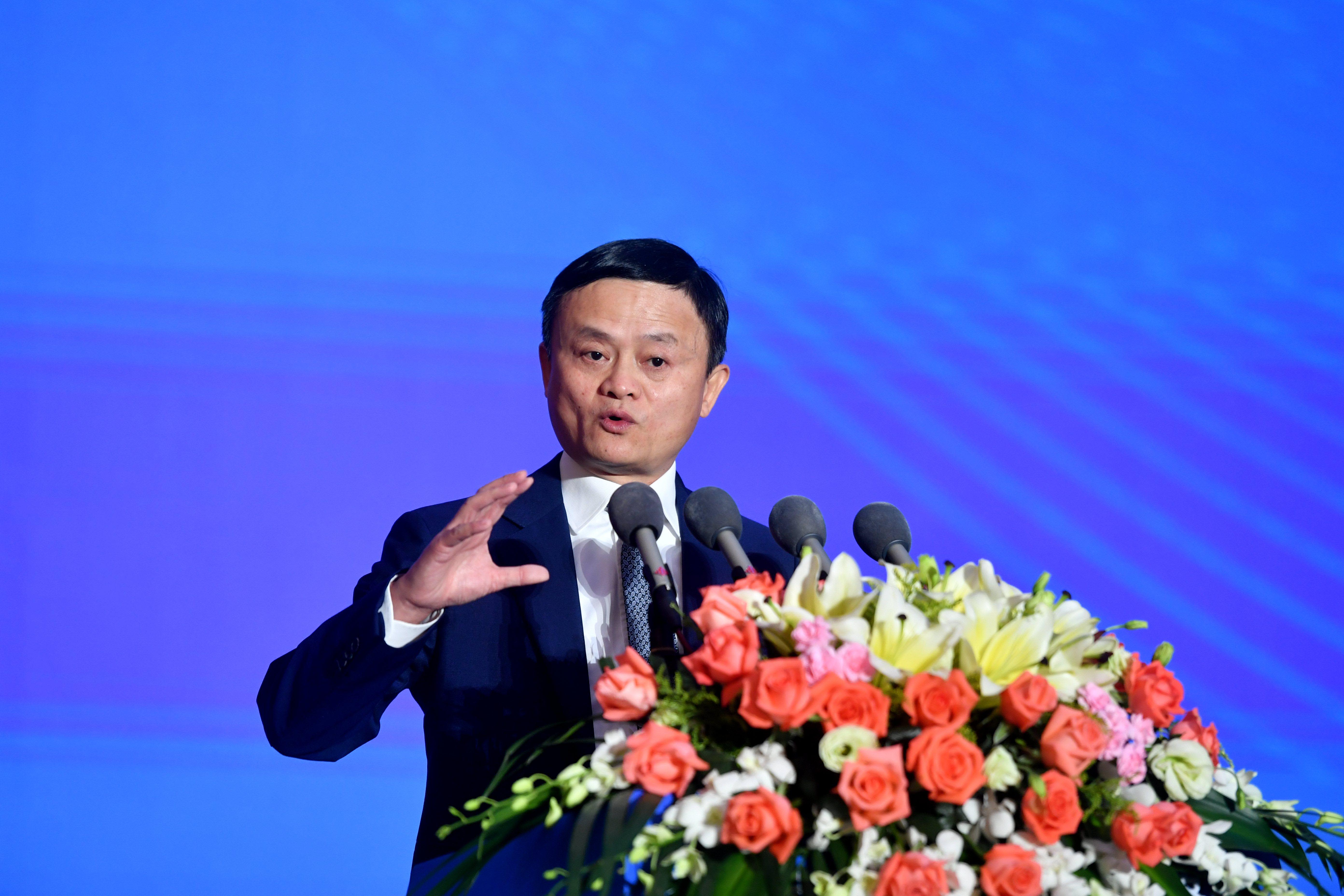

Jack Ma, founder of Alibaba Group, during the opening ceremony of the 3rd All-China Young Entrepreneurs Summit on Sept. 25, 2020 in Fuzhou, Fujian Province of China.

Lyu Ming | China News Service | Getty Images

China announced new anti-monopoly rules over the weekend — but that’s not likely to have much impact on the market for now, according to one market observer.

“The new regulation is still, you know, slightly sketchy in details,” Hao Hong, managing director and head of research at Bank of Communications International, told CNBC’s “Street Signs Asia” on Monday.

China’s State Administration for Market Regulation (SAMR) has tightened restrictions on China’s internet giants such as Alibaba and Meituan, and introduced new guidelines on Sunday to curb monopolistic behavior. The new rules formalize a draft that was released months earlier.

Still, the development appeared to have little impact on stocks of China’s internet giants, with most of them still in positive territory by Monday afternoon in Hong Kong: Tencent was up 0.82%, Meituan jumped 1.54% and JD.com gaining 1.14%. Only Alibaba bucked the trend, dipping by about 0.16%.

Monday’s market moves were in sharp contrast to the volatility seen in November, when Hong Kong-listed shares of China’s tech giants plummeted after the regulator’s initial announcement. Billions of dollars in market value were wiped out after the anti-trust guidelines were first proposed.

Hong said the market needs time to digest the details of the latest anti-monopoly guidelines, adding that China’s internet giants have been operating for years and already have “very solid” market positions.

“The regulation, you know, is starting with a very good intention,” Hong said. “The actual fact is that … the market position … of these big internet platforms are very difficult to encroach for now.”

While Hong acknowledged that the new rules will “make it easier for the smaller guys to grow,” he also added that a lot of the large internet players, like Alibaba and Tencent, have also “put their own money into many of the internet startups.”

Some noted examples of such investments include Alibaba’s stake in financial technology giant Ant Group and Tencent’s backing of short video firm Kuaishou, which saw strong investor interest on Friday during its $5 billion public listing in Hong Kong.

The increased scrutiny by Beijing comes at a time where the tech industry is coming under the regulatory spotlight worldwide, with similar movements in the U.S. as well as the European Union.

— CNBC’s Evelyn Cheng contributed to this report.