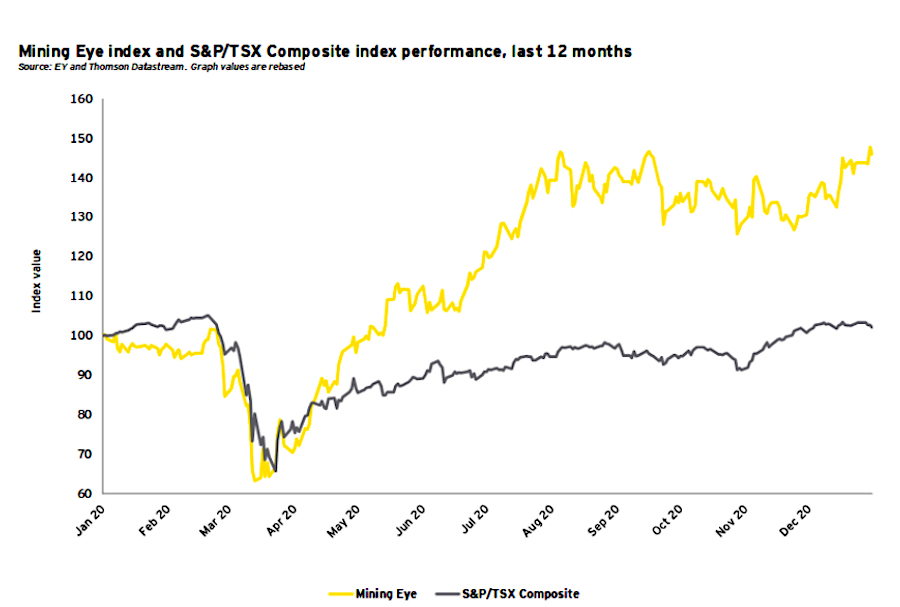

Strong gold prices, which remained at $1,900 levels in late 2020, as well as rising prices for copper, nickel and zinc were cited as the main factors that boosted Canadian companies’ performance.

Strong gold, copper, nickel and zinc prices helped boost Canadian mining companies’ performance in late 2020.

Copper prices increased 16% after an 11% increase in the previous quarter. Nickel prices and zinc prices each experienced an increase of 14%.

“We’re hearing from economists around the world that US inflation is expected to rise in the coming months on the back of global economic recovery, supported by various governments’ fiscal and monetary stimulus initiatives,” says Jay Patel, EY Canada mining & metals strategy and transactions leader. “With inflation pressures rising, we can anticipate continued demand for precious metals.”

Research houses such as Goldman Sachs and Citigroup foresee inflation to push above 2% in the first half of 2021 before settling down closer to the 2% level by end of the year.

EY analysts expect vaccine distribution, along with strong demand from China, to positively support base metals prices in the near term.

“As we enter a new year and see economic recovery on the horizon, we’re optimistic that the industry will continue with its growth momentum,” EY Canada mining & metals co-leader, Jeff Swinoga, notes.

Iron ore prices are also expected to remain high in the short term driven by tight supply conditions. The global market is expected to remain in deficit in the medium-term amid a slower ramp-up in Brazilian exports and strong Chinese stainless-steel demand.