As markets struggle at the start of 2021, two traders share the top trends that they’re banking on for the new year.

Todd Gordon, founder of TradingAnalysis.com, sees continued outperformance for one corner of the technology sector.

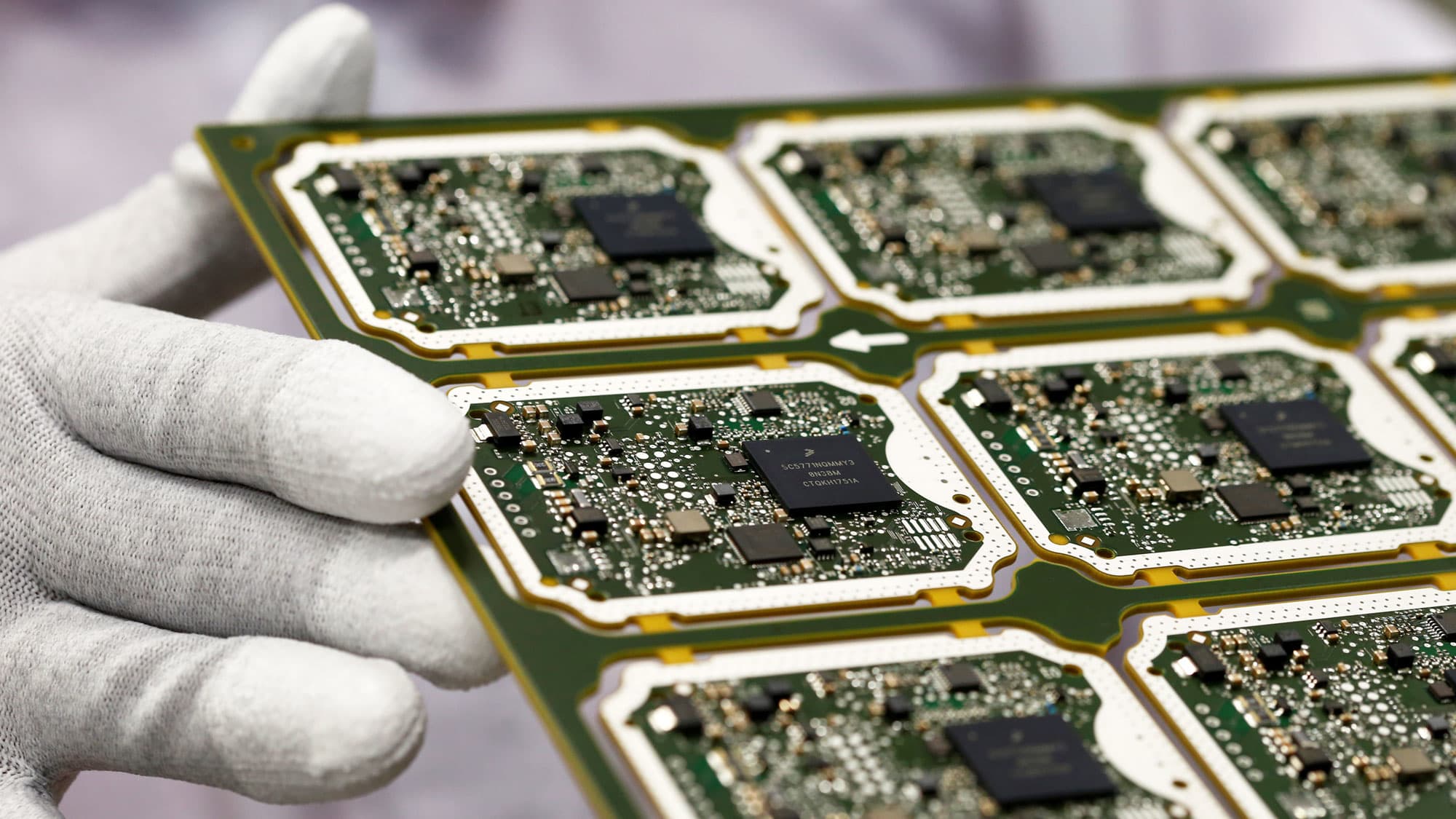

“If I was to select one group [or] industry within a sector, it is semiconductors,” Gordon told CNBC’s “Trading Nation” on Monday. “It’s fairly insulated from Covid’s impact on the economy as the semiconductor evolution was in play before Covid hit and I think whether the pandemic rages on next year or if it’s managed in 2021, they should do well.”

Gordon points to semiconductor use in gaming, mobile phones, PC, crypto mining and data centers as reasons to be bullish – those trends accelerated during the pandemic due to increased remote work and online entertainment.

He specifically points to Nvidia and AMD as two picks that could benefit from the digital acceleration. Gordon said AMD needs to break through consolidation at around $98 to continue to rally – should it do that, he sees upside to $140. It traded Tuesday just below $92.

Nvidia, too, needs to rally through its holding pattern, according to Gordon.

“It’s taken a bit of a backseat in the second half of last year, big old triangle consolidation. If we can break through $580, the party gets started there,” he said.

Nvidia traded Tuesday at $529. It has rallied 192% off its March low.

It’s not just the high-flying tech stocks that have caught traders’ attention. Boris Schlossberg, managing director of FX strategy at BK Asset Management, sees a return to value in the next 12 months.

“This may be the year where value finally becomes valuable,” Schlossberg said during the same segment. “For the last couple of years, the absolute easiest money has been to go long Nasdaq, short Russell 2000 and Nasdaq has outperformed by a mile because basically we’ve been in a winner-take-all economy where the largest high-tech companies have been able to essentially enjoy monopoly profits.”

Now, he predicts Big Tech undergoing harsher regulatory scrutiny under a Biden administration which could put a crimp on their outperformance.

“More importantly, it’s valuation. It’s really never different anytime. And I think when you look at valuation basically at any kind of historical precedent especially the ’99 run-up … anytime you are enjoying triple digit P/E, it always ends,” said Schlossberg.

Cost-cutting during the pandemic should also give the Russell 2000 companies that have survived greater operational leverage.

“They’re going to outperform on that basis. So when you look at it from every possible angle, I think this may be the year where value finally does come back,” Schlossberg said.

The small cap-focused IWM Russell 2000 ETF has rallied 25% in the past three months.

Disclosure: Gordon holds AMD and NVDA.