It would house processing facilities for both heavy rare and light rare earths, directly sourced from Lynas’ cracking and leaching plant under development in Kalgoorlie, Western Australia.

Deal takes the Australian miner a step closer to becoming a key supplier of rare earths to the US defence industry.

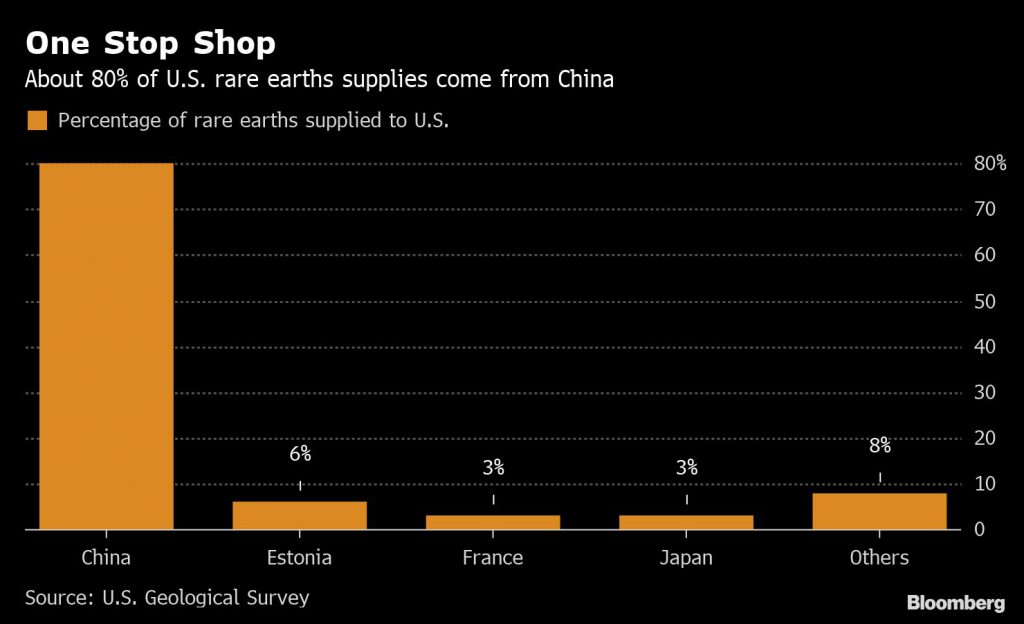

China currently accounts for 70% of global production of rare earths, controlling 90% of the $4-billion global market.

Lynas, the only major rare earths producer outside China, said both the company and the US Department of Defense could potentially contribute about $30 million each to the geopolitically generated venture.

Details of the funding for the project, which Lynas is developing with joint venture partner Blue Line were not disclosed. They are said to be in the works.

“This agreement is consistent with the US Government’s commitment to rebuild the domestic industrial base, while working effectively with partner nations,” chief executive and managing director, Amanda Lacaze, said in the statement.

The company did not provide a time frame on construction of the plant, but told investors the construction of the plant was part of its Lynas 2025 plan.

Lynas shares soared on the news, closing 13.7% higher at A$5.56. It lift the company’s value to A$5 billion (about $3.9bn). The stock is now up more than 400% on its lows last year when covid-triggered panic selling rocked global markets.

Not so rare

Despite their name, the 17 minerals grouped under the rare earths label are not rare. According to the US Geological Survey (USGS), they are roughly as common as copper. But, because rare earth ores oxidize quickly, extracting them is both difficult and extremely polluting.

Critical minerals were a focus of the Trump administration. The White House signed agreements with Canada and Australia, among other nations, to secure supply of such elements.

Late last year, Washington inked and aid and spending package, which included more than $800 million to fund rare earth and strategic minerals research.

The $2.3 trillion, 5,593-page bill essentially codified Trump’s previous executive orders to boost production of critical elements.

President Joe Biden is expected to boost domestic production of specialized minerals even further.

The US is not alone in its quest to reduce reliance on foreign producers. The European Union has stepped up its efforts to become less dependent on imported raw materials, a list that now includes lithium.