Gold price loses momentum with US runoffs in focus

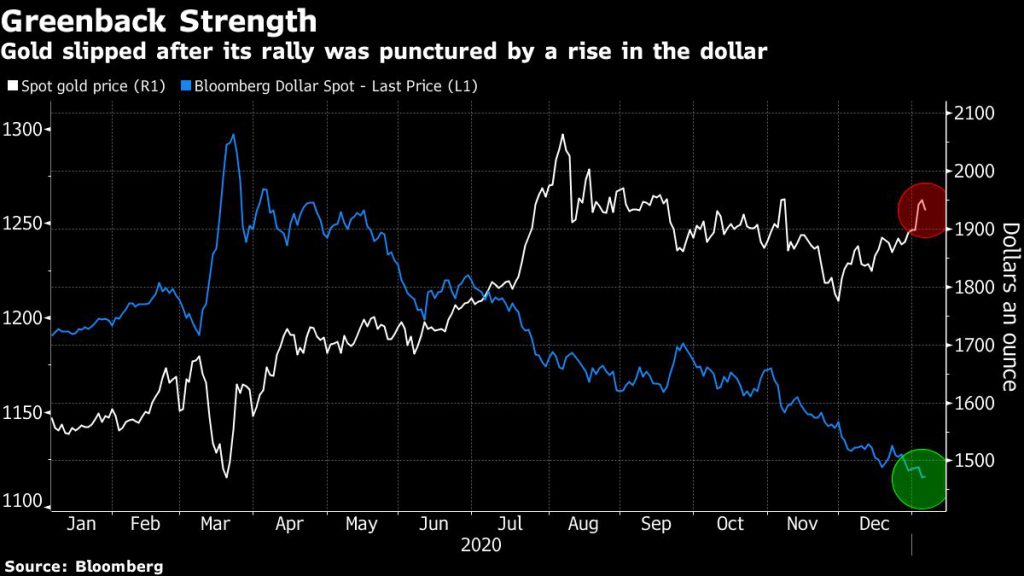

Meanwhile, the US dollar recovered from earlier losses, causing bullion’s new year rally to lose momentum. “We have seen a small bounce off the lows in the dollar, hence a very small pullback in gold off the highs,” David Meger, director of metals trading at High Ridge Futures, told Reuters.

Meger believes that the pullback is a short-term move as a potential ‘Blue Wave’ in the US Senate would be dollar negative and “supportive to gold and silver from a longer term perspective.”

Investors may have decided to take profits in the thin market after the dollar briefly strengthened, according to Georgette Boele, an analyst at ABN Amro Bank NV.

Also weighing on gold was the 10-year US Treasury yield, which rose above 1% for the first time since March, increasing the opportunity cost of holding non-interest bearing gold.

However, bullion remains underpinned as an inflationary hedge, with investors expecting more fiscal stimulus as the Democrats lead in runoff votes that will determine control of the US Senate.

The precious metal started the year by building on the biggest annual advance in a decade, and could gain further support should Democrats win control of the Senate.

“Democratic wins should be good for gold, with Republican wins likely less bullion friendly,” James Steel, chief precious metals analyst at HSBC Holdings Plc, wrote in a note.

(With files from Bloomberg and Reuters)