What could rattle markets in 2021, even as vaccines are rolling out

After a brutal year, it’s hard not to get excited about seeing a light at the end of the tunnel of the COVID-19 pandemic.

It’s also difficult to shake off concerns about what pitfalls might be lurking in the distance, particularly as Wall Street gets bullish about stocks zooming higher in 2021 and the U.S. economy staging a dramatic recovery.

As recent Deutsche Bank survey showed, investors rank potential complications with the mass vaccination effort as a top concern for global financial markets in the coming year, particularly if the virus mutates and “dodges” the vaccines.

Investors also pointed to the risks of serious side effects of a vaccine as a worry for markets and whether too many people will refuse to take it.

“It’s right to be optimistic. It’s really incredible news,” said James McCann, senior global economist at Aberdeen Standard Investments, of the COVID-19 vaccine rollout. “But we’ve got a lot to prove in terms of a mass vaccination program.”

McCann thinks markets likely aren’t expecting a flawless vaccination process, but worries that even basic hiccups, like syringe shortages, supply-chain challenges, and the need to administer follow-up booster shots “could shake confidence a bit.”

On Friday, the Dow Jones Industrial Average DJIA,

In more good news Friday evening, Moderna Inc.‘s MRNA,

But even if a herculean vaccination campaign can be pulled off without major hitches, that doesn’t mean all market risks will melt away automatically.

Time for trumpets?

“I think we’re early in a recovery and early in a bull market,” Jim Paulsen, chief investment strategist at The Leuthold Group, told MarketWatch. “But when I look into 2021, there are always things I’m worried about.”

For one thing, with major stock indexes already trading near record territory, its difficult to tell how much euphoria about the historic COVID-19 vaccine rollout already has been priced into markets.

Paulsen said jubilation around the initial round of COVID-19 inoculations reminded him about the old wartime adage “buy to the sound of cannons, sell to the sound of trumpets,” about investing in stocks.

“There’s no doubt that, at some point, in 2021 we are going to blow the trumpets,” he said. “Maybe we already are.” But as the saying goes, once victory finally has been declared, this time against the pandemic, Paulsen thinks stocks will see a double-digit correction.

“I don’t think it’s going to be massive or long-lasting, but rather a good buying opportunity,” he said, mainly because Paulsen also sees U.S. economic growth smashing expectations in the year ahead as people move beyond the “emotional destruction” of 2020, including worrying about losing their savings, jobs, businesses or lives to “suddenly being thrust into the best growth year,” potentially in more than 35 years.

Related: Move over, black swans; the Fed’s new worry is green swans

Vulnerable period

Remember in 2019 when markets were consumed almost entirely by the risks of an escalating U.S.-China trade war?

Since this summer, financial markets have been transfixed by the race among drugmakers to develop an effective vaccine and by wrangling in Washington by lawmakers over the size and scope of additional pandemic funding, which now looks poised for a vote a last-minute vote Sunday on a near $900 billion aid package to help families, business and cities hard hit by the pandemic.

See: Washington avoids government shutdown, but no stimulus vote until Sunday at earliest

“Certainly the vaccine,” said Jim Besaw, chief investment officer of GenTrust, “is what’s most on people’s minds.”

But Besaw also sees cyberattacks by other nation-states as an ever present threat that’s suddenly back on the radar, after Microsoft Corp. MSFT,

“Clearly, we are in a vulnerable period between now and January with the transition of power,” he told MarketWatch on Friday, speaking of the gap before the Biden administration takes the White House over from outgoing President Donald Trump. “It’s one of the few times that our guard is down.”

Wartime balance sheets

Bulls on Wall Street in the past week received more reassurances from the Federal Reserve, which vowed once again to use all its tools to supportive the economy until it heals, including though its commitment to keep rates near 0% and to maintain its massive bond-buying program.

That helped stocks rally despite surging coronavirus case counts, hospitalizations, and deaths in the colder months, which have prompted renewed stay-at-home orders across California and pointed leading indicators to a U.S. economic growth slump.

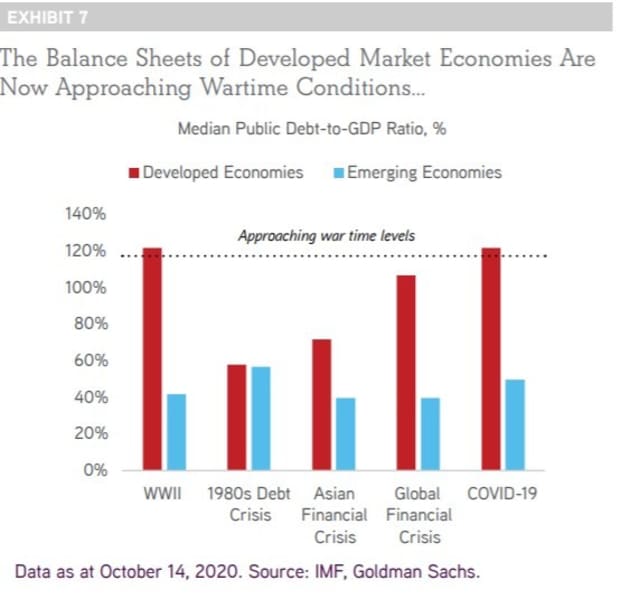

But even with a flood of global monetary and fiscal support running near wartime levels, see the below chart, the pandemic’s shocks could still get worse before the crisis is over.

Public debt-to-GDP near WWII levels

IMF, Goldman Sachs

And at some point in the coming years, the near $30 trillion added to central bank balance sheets to help counter the pandemic’s economic toll likely will need to be addressed, either through economic growth that outpaces the cost of servicing the debt or through less politically palatable measures, such as austerity or higher taxes.

Alessio de Longis, senior portfolio manager at Invesco, said one potential way to address high debts levels by the U.S., while spurring economic growth, would be to revive infrastructure and job-creation projects like those enacted in World War II and its aftermath, albeit with a green energy bent.

“In my mind, that’s one way to solve the problem,” he said.

On deck next week will be a shortened Christmas holiday week for both trading and U.S. economic data.

Monday will see the release of the Chicago Fed national activity index, while Tuesday will see an update on revised GDP for the third quarter, and a December reading of the Conference Board’s consumer confidence index and existing home sales for November.

On Wednesday, December’s consumer sentiment index from the University of Michigan, and a reading for November on consumer spending will be released, which will be followed on Thursday by weekly jobless benefit claims, before the stock market closes early at 1 p.m. ET for the holiday.