Treasury yields fall despite stimulus progress as virus concerns persist

U.S. government debt prices were higher Monday morning as Congress prepares to vote on a $900 billion coronavirus aid package, but concerns emerge over a new Covid-19 strain in the U.K.

At around 2 a.m. ET, the yield on the benchmark 10-year Treasury note was lower at 0.9263% while the yield on the 30-year Treasury bond fell to 1.6776%. Yields move inversely to prices.

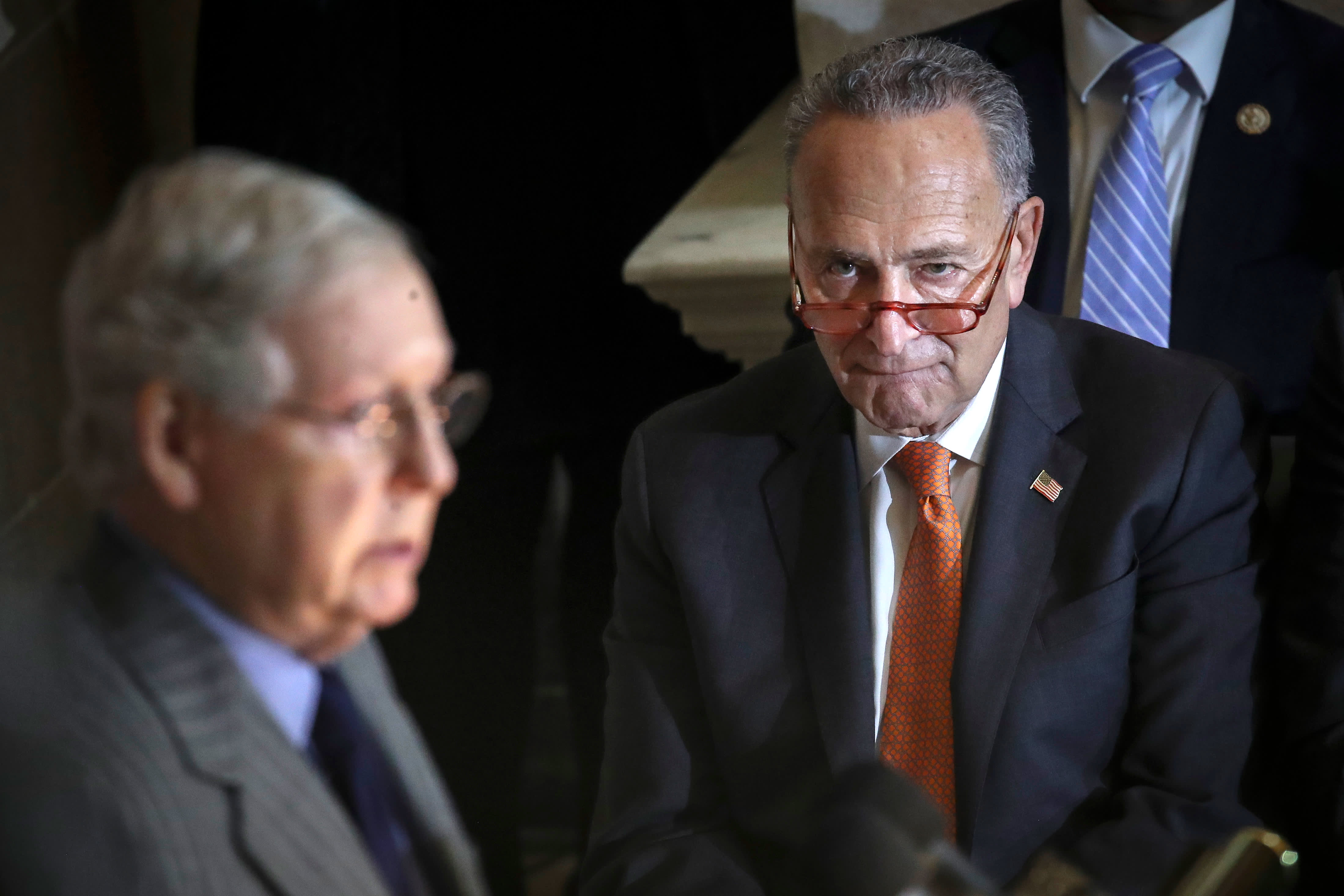

Senate Majority Leader Mitch McConnell and Minority Leader Chuck Schumer said Sunday that lawmakers had reached an agreement on a $900 billion relief package, which will be voted on Monday.

With the Pfizer and BioNTech vaccine already being rolled out across the country, shots of the Moderna inoculation began to be distributed on Sunday. An advisory panel recommended that essential workers and people over 75 should be first in line to receive the shot.

However, news of a new and more transmissible strain of Covid-19 in the U.K. has caused investor jitters over the containment of the virus to resurface. British Prime Minister Boris Johnson announced Saturday that much of the country would enter strict lockdown measures over the Christmas period, and a host of other countries have now closed their borders to the U.K.

Auctions will be held Monday for $54 billion of 13-week Treasury bills and $51 billion of 26-week bills, along with $24 billion of 20-year bonds.