Roku target lifted to a Street-high $410 after HBO Max deal

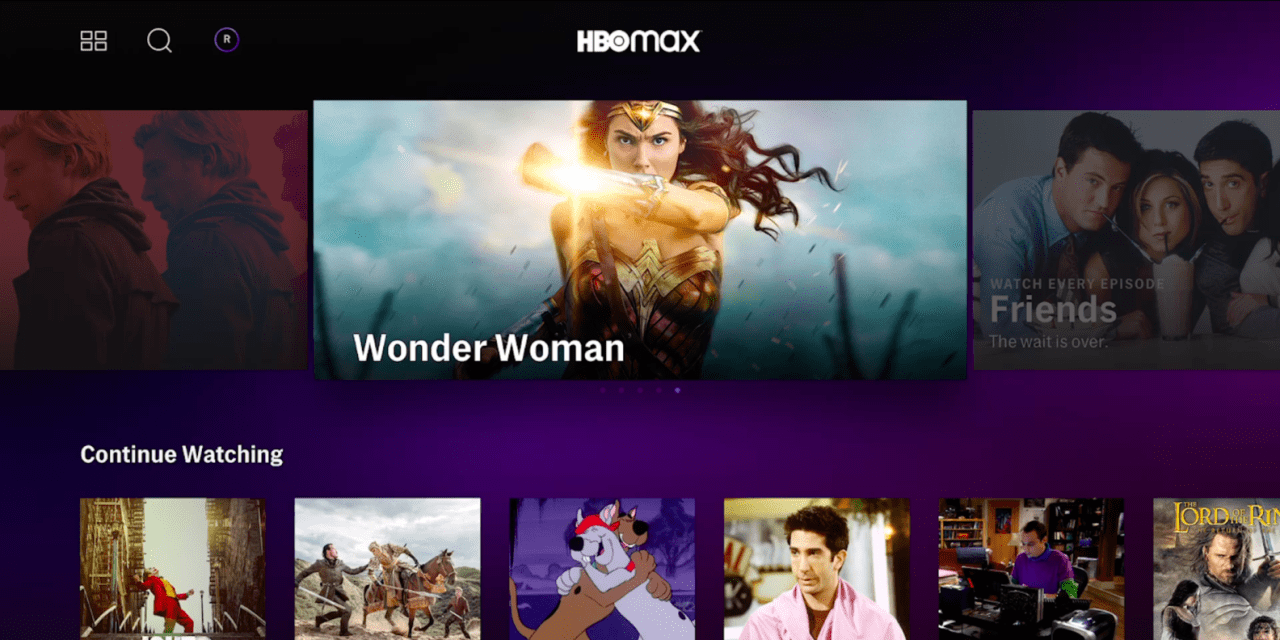

Roku Inc. finally struck an agreement to bring AT&T Inc.’s HBO Max service to its platform, and that’s one more reason to believe in the company’s streaming “leadership,” according to one analyst.

Benchmark Company’s Daniel Kurnos upped his price target on Roku’s stock ROKU,

Roku shares are up 4% in Thursday trading.

“While largely the expected outcome, the order of operations, including the addition of Peacock first, was somewhat perplexing, with Roku clearly unwilling to budge especially in light of what we believe was a much stronger negotiating position,” Kurnos wrote. “While we acknowledge that a lot of the good news already appears to be priced into the stock, we still anticipate a significant upside surprise in 4Q, driven by advertising strength bolstered by material CPM [ad-pricing] improvement, which should flow through into 2021.”

Kurnos argued that Roku’s deals to carry AT&T’s T,

Don’t miss: Here’s everything coming to Netflix in January 2021 — and what’s leaving

Roku shares have added more than 150% so far this year as the S&P 500 SPX,