In April, the company released an initial pit-constrained resource estimate for TLC. Measured and indicated resources at the site total 1.1 billion tonnes grading 912 parts per million (ppm) lithium, which contain 5.4 million tonnes of lithium carbonate with additional inferred resources of 362 million tonnes also at 912 ppm lithium, for a further 1.8 million tonnes of lithium carbonate. The resource remains open to the north and west. In July, the company added 52 claims, or 4 sq. km, to the property.

According to American Lithium, all of the resources on the TLC property appear to be “mineable with a favourable stripping ratio.” The zone of lithium mineralization at TLC extends for “kilometers” laterally and is up to 80 metres thick. Since the TLC deposit is an alluvial formation, the lithium is “weakly” bound with the surrounding clays, which would allow it to be converted to battery-grade lithium carbonate within hours.

The junior is now working on a preliminary economic assessment for the project, which is expected in the first half of 2021.

In November, American Lithium started a third-phase drill campaign to expand current resources and obtain material for hydrometallurgical and thermal process testing and validation.

In September, the company announced that it had produced lithium carbonate from TLC in a lab setting. This marked the start of a testing program, to generate the information required to design and build a continuously operating pilot plant.

American Lithium has a $128.8 million market capitalization.

Conic Metals

Conic Metals’ (TSXV: NKL) principal asset is an 8.56% joint venture interest in the Ramu nickel-cobalt operation in Papua New Guinea. The company also holds a portfolio of investments with exposure to nickel and cobalt through various royalties – Conic’s royalty portfolio includes 11 pre-production projects in Canada and Australia.

The Ramu open pit nickel-cobalt mine and high pressure acid leach plant have been operating since 2012.

Conic acquired a stake in the large-scale mine through a US$68 million 2019 acquisition of Highlands Pacific, an Australian company. With a current mine life of 14 years, Conic expects to start receiving 35% of its share of cash flows from the asset starting in 2022. Once its share of Ramu construction and development loans are repaid, Conic’s share in the Ramu joint venture will increase to 11.3% and the company will receive 100% of its attributable cash flows from the mine. Metallurgical Corp. of China is Ramu’s majority owner and is also the project operator.

The Canadian royalties include a 1.75% net smelter return (NSR) royalty on the construction-ready Dumont nickel-cobalt project, held by Waterton Global Resource Management and a 2% NSR on Giga Metals’ (TSXV: GIGA) Turnagain nickel-cobalt project in B.C. The junior holds two additional NSR royalties in B.C. and the Yukon, as well as four additional NSR holdings in Ontario.

In Australia, Conic has royalties on two pre-production nickel-cobalt assets. The construction-ready Nyngan nickel-cobalt-scandium project, where Conic holds a 1.7% gross revenue royalty, is fully permitted and held by U.S.-based Scandium International Mining (TSX: SCY).

The company also has a 2.2% interest in Minerva Intelligence (TSXV: MVAI), an artificial intelligence software company.

Conic Metals has a C$33.4 million market capitalization.

Denison Mines

Denison Mines (TSX: DML; NYSE-AM: DNN) is a uranium explorer and developer with assets in Canada’s Athabasca Basin.

In November, Denison announced plans to restart a formal Environmental Assessment (EA) process for its flagship, 90%-owned Wheeler River project, 35 km northeast of its 22.5%-owned McClean Lake mill, in January 2021.

The company decided to temporarily suspend the EA process in March 2020 due to the Covid-19 pandemic. According to David Cates, Denison’s president and CEO, Wheeler River would be “Canada’s first in-situ recovery (ISR) uranium mine.”

Wheeler River includes two high-grade uranium deposits: Phoenix and Gryphon. Probable reserves across the two total 109.4 million lb. uranium oxide. Phoenix features 141,000 tonnes, at 19.1% uranium oxide, for a total of 59.7 million lb. uranium oxide.

The Phoenix development would deliver a pre-tax net present value estimated at $930.4 million, at an 8% discount rate, with a 43.3% internal rate of return, based on uranium spot prices between US$29 and US$45 per lb.

Also in November, the company released the results of a preliminary economic assessment for the 66.71%-held Waterbury Lake property in northern Saskatchewan. The study examined a potential “small-scale” in-situ recovery uranium project at the Heldeth Túé deposit, with processing at the McClean Lake mill.

With an estimated six-year mine life, this operation would generate an average of 1.6 million lb. of uranium oxide annually, at average cash operating costs of $12.23 per lb. at an initial capital cost of C$112 million. This proposed development has an after-tax net present value estimated at C$72 million, at an 8% discount rate, with a 30.4% internal rate of return.

In October, Denison closed a $19 million public offering of common shares. The proceeds are intended for evaluation and environmental assessment work at Wheeler River, and for corporate purposes.

The company’s 22.5%-held McClean Lake uranium project includes a plant licensed for production of 24 million lb. U3O8 annually. The McClean Lake mill processes ore from the Cameco-operated Cigar Lake mine under a toll milling agreement.

Denison Mines has a C$508.3 million market capitalization.

Generation Mining

Generation Mining (TSX: GENM; US-OTC: GENMF) holds an 80% interest in the 220-sq.-km Marathon platinum group metal (PGM)-copper deposit in northwestern Ontario, within 10 km of the town of Marathon.

A January 2020 preliminary economic assessment of the project defined a 14-year open pit operation, producing an average of 194,000 oz. palladium-equivalent annually at all-in sustaining costs of $586 per oz. palladium, net of by-product credits. With a pre-production capital cost estimate of C$431 million, the after-tax net present value estimate for the development comes in at C$871 million, at a 5% discount rate.

This operation would ultimately produce a PGM-copper concentrate, shipped off-site.

By July 2020, the company contracted engineering companies for a feasibility study on the Marathon project. The study is expected to be completed in the first quarter of 2021.

In November, Generation Mining announced that the Canadian government, together with the Ontario government, appointed a Joint Review Panel (JRP) for an environmental assessment of the Marathon project.

This past fall, the company also started a second-phase metallurgical test program, which includes a pilot plant testing three bulk sample composites from the site to optimize the process design, estimate life-of-mine metal recoveries and provide details for concentrate marketing.

After starting a 5,000-metre exploration program along the western margin of the Marathon project in August, Generation Mining announced in December that it had validated its feeder-zone model for higher-grade mineralization at the site. Drill highlights included 92 metres of 0.08 gram gold, 0.23 gram platinum, 0.66 gram palladium and 0.32% copper (1.41 grams palladium-equivalent) from 338 metres and 32 metres of 0.07 gram gold, 0.27 gram platinum, 0.71 gram palladium and 0.22% copper (1.33 grams palladium-equivalent) starting at 282 metres.

In September 2019, the company released an updated pit-constrained resource estimate for the Marathon deposit, with 179.2 million measured and indicated tonnes, at 1.24 grams per tonne palladium-equivalent (with contained palladium, platinum, copper, gold and silver), for a total of 7.1 million palladium-equivalent ounces. Additional inferred resources stand at 668,000 tonnes, grading 0.95 gram palladium-equivalent, for a further 21,000 oz. palladium-equivalent. There are additional mineral resources within the Geordie and Sally deposits at the property.

Generation Mining has a C$83.6 million market capitalization.

Global Atomic

Global Atomic (TSX: GLO; US-OTC: GLATF) is working to advance its Dasa uranium project in Niger while also harnessing cash flow from its 49% stake in the Befesa zinc concentrate facility in Turkey.

The 750-sq.-km Dasa project, 105 km south of Arlit, features the high-grade Dasa deposit.

In April 2020, Global Atomic released the results of a preliminary economic assessment for the high-grade Flank zone of the Dasa deposit, which outlined the first phase of a larger underground mine at the site — with a 12-year life.

With a capital cost pegged at $203 million, mining the Flank zone would produce an average of 4.4 million lb. of U3O8 per year at all-in sustaining costs of $18.38 per lb., with an after-tax net present value estimate of C$211 million, at an 8% discount rate and based on $35 per lb. uranium prices.

The company submitted an application for a mining permit for the Flank zone and received the permit on Dec. 23.

Global Atomic is looking to complete final engineering and design studies on Dasa’s Flank zone in 2021 ahead of mine construction in 2022.

Based on a 1,200 part per million U3O8 cut-off, indicated resources at Dasa stand at 7.9 million tonnes grading 4,483 ppm U3O8 for a total of 78 million contained lb., with additional inferred resources of 8.4 million tonnes grading 3,783 ppm U3O8 for a further 69.9 million lb. of uranium. During the first 12 years of mining, given the $35 per uranium lb. base-case price used in the PEA over this period, the cut-off grade would be 2,300 ppm U3O8 within the high-grade Flank zone, resulting in an average mineable grade of 5,400 ppm.

In 2017, Global Atomic signed a memorandum of understanding (MOU) with uranium miner Orano, and continues to work under the terms of the MOU.

In Turkey, Global Atomic holds a 49% interest in the Befesa Silvermet joint venture, which includes a 110,000-tonne-per-year electric air furnace dust kiln capable of producing 50 to 60 million payable lb. of zinc concentrate annually from metallurgical waste for sale to smelters.

Global Atomic has a C$165.4 million market capitalization.

Group Ten Metals

Group Ten Metals (TSXV: PGE) is an explorer focused on advancing its Stillwater West platinum group element-nickel-copper project, next to three of Sibanye-Stillwater’s palladium-platinum mines in Montana.

The wholly owned, 54-sq.-km Stillwater West property covers 25 km of strike and is next to Sibanye’s producing J-M reef PGE deposit.

Group Ten suggests similarities between the Stillwater and Bushveld complexes (the latter is a platinum group element-bearing layered intrusion in South Africa). The comparison is based on comparable stratigraphy (both are layered magmatic intrusions) and similar emplacement patterns of platinum group elements.

There are a total of 14 exploration target areas at Stillwater West: eight large-scale, bulk tonnage PGE-nickel-copper-cobalt zones with ‘platreef-style’ mineralization and six higher-grade PGE ‘reef-type’ areas. Both types of targets have the potential to host multiple deposits.

Stillwater West also features 21 km of anomalous precious and base metal values, based on soil geochemistry, over the lower Stillwater stratigraphy with good correlation to geophysical conductors.

The three most advanced targets at the site are the Discovery (Chrome Mountain) area, and the HGR (Iron Mountain) and Camp targets. According to Group Ten, 2019 drilling confirmed ‘platreef-style’ mineralization in these areas, and the 2020 program was aimed at defining initial resources within the zones. Drill highlights included 272 meters of 1.9 grams total platinum-equivalent from HGR, drilled in 2019, and 118 metres of 2.15 grams total platinum-equivalent from Discovery, drilled in 2007.

In 2020, Group Ten completed a 77 line-km geophysical survey over the site to expand out from areas of known mineralization. In November, Group Ten announced that it had completed its “biggest field program to date at Stillwater West.” Resource modelling is now underway for the Discovery, Camp and HGR target areas.

The company also holds the 137-sq.-km Black Lake–Drayton gold project in Ontario’s Rainy River district, as well as the Kluane PGE-nickel-copper property in the Yukon.

Group Ten Metals has a C$55.1 million market capitalization.

Millennial Lithium

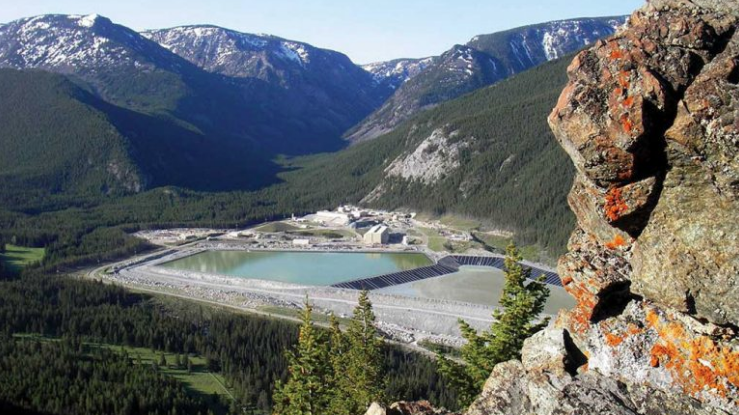

The pilot plant under construction at Pastos Grandes, with evaporation ponds in the background. Credit: Millennial Lithium.

Millennial Lithium (TSXV: ML) is working to fast-track its 100%-owned 126-sq.-km Pastos Grandes lithium brine project in Argentina’s Salta province to the production stage. The property is 231 km from the city of Salta with year-round road access.

In July 2019, Millennial announced the results of a feasibility study on the project, which suggested a 40-year operation producing battery-grade lithium carbonate, extracting lithium-rich brine using up to 30 wells, which would then be directed to evaporation ponds. The brine would then be directed to a lithium carbonate plant, for the removal of impurities. A carbonation stage would follow, to precipitate lithium carbonate, which would then be transported to a port for shipment.

The suggested operation has two stages: a six-year start-up portion and a 34-year main mining stage. In the start-up stage, Pastos Grandes would produce approximately 21,000 tonnes a year of battery-grade lithium carbonate equivalent; in the main stage, the site would generate around 24,000 tonnes a year of battery-grade lithium carbonate.

With an initial capital cost of $448.2 million, and total operating costs pegged at between $3,377 and $3,388 per tonne of lithium carbonate, the after-tax net present value estimate for the project comes in at $1 billion, at an 8% discount rate, with a 24.2% internal rate of return.

According to Farhad Abasov, Millennial Lithium’s president and CEO, the feasibility results suggest a potential “robust lithium carbonate producer” that is “among the lower quartile of LCE (lithium carbonate equivalent) costs.”

In October 2020, the company started up a lithium carbonate pilot plant at Pastos Grandes. The flowsheet allows the test facility to produce up to three tonnes a month of battery-grade lithium carbonate. The initial output from this plant will be used to test and optimize the individual processes. By December, Millennial Lithium announced that a number of its concentration ponds had reached a lithium content of 3% with the brine now directed to the pilot plant for processing — battery-grade lithium carbonate is expected in the first quarter of next year.

In June, Millennial Lithium’s Environmental Impact Assessment for Pastos Grandes, for the construction and operation of a 24,000-tonne-per-year lithium carbonate facility, received approval from the provincial environmental and mining authority.

The company also holds the Cauchari East project, which covers 110 sq. km in the Cauchari Salar and is contiguous with Orocobre’s (TSX: ORL) Olaroz lithium mine.

Millennial Lithium has a C$233.1 million market capitalization.

NexGen Energy

The core processing facility at Rook 1. Photo Credit: NexGen Energy.

NexGen Energy (TSX: NXE) wholly owns the Rook I project in the southwest Athabasca Basin in Saskatchewan. Rook I includes the high-grade, basement-hosted Arrow deposit, which, according to NexGen, is the “largest development-stage uranium deposit in Canada.”

Arrow includes an indicated resource of 1.2 million tonnes grading 6.88% U3O8, for a total of 179.5 million lb. U3O8, with a high-grade core of 400,000 tonnes at 18.84% U3O8. Additional inferred resources stand at 4.3 million tonnes at 1.3% U3O8, for a further 122.1 million lb. U3O8.

This resource is derived from 200 drillholes; Arrow currently covers an area of 875 metres by 280 metres, starts at a depth of 100 metres and extends down to a depth of 980 metres and remains open.

In November 2018, NexGen released the results of a prefeasibility study on Arrow, which suggests an underground long-hole stoping mine, with the ore fed to a conventional uranium processing plant. This nine-year mine would generate an average of 25.4 million lb. of U3O8 annually, at average life-of-mine operating costs of US$4.36 per lb. U3O8. Based on $50 per lb. uranium, the after-tax net present value estimate for the development comes in at $3.7 billion, at an 8% discount rate, with a 56.8% internal rate of return.

NexGen is now working to deliver a feasibility study for Arrow and anticipates starting early engineering in the second half of 2021.

The company has also made several discoveries around Arrow in the past few years – these include South Arrow, 400 metres northeast of Arrow; Harpoon, 4.7 km northeast of Arrow; and Bow, 3.7 km northeast of Arrow.

Within the southwest Athabasca Basin, NexGen’s land position totals 2,090 sq. kilometres.

NexGen also has a 52.5% stake in IsoEnergy (TSXV: ISO), with a portfolio of assets in the eastern Athabasca Basin.

NexGen Energy has a C$1.3 billion market capitalization.

(This article first appeared in The Northern Miner)