Big mining stocks make spectacular covid comeback

Unlike gold, where the price is increasingly hostage to the whims of ETF investors large and small, if you want to have a flutter on copper and iron your only real entry point is mining stocks.

Iron ore trading remains a specialist affair, unless you enjoy the frenzy of an exchange like Dalian, which this week had to caution its members to deal in “a rational and compliant manner.”

Copper ETFs are not really a viable option either (not liquid at any temperature) and futures markets may be better left to managed money (they were still short at the beginning of June) or producers/merchants who’d built up the biggest short in at least a decade as of last week – 2.7 billion pounds worth.

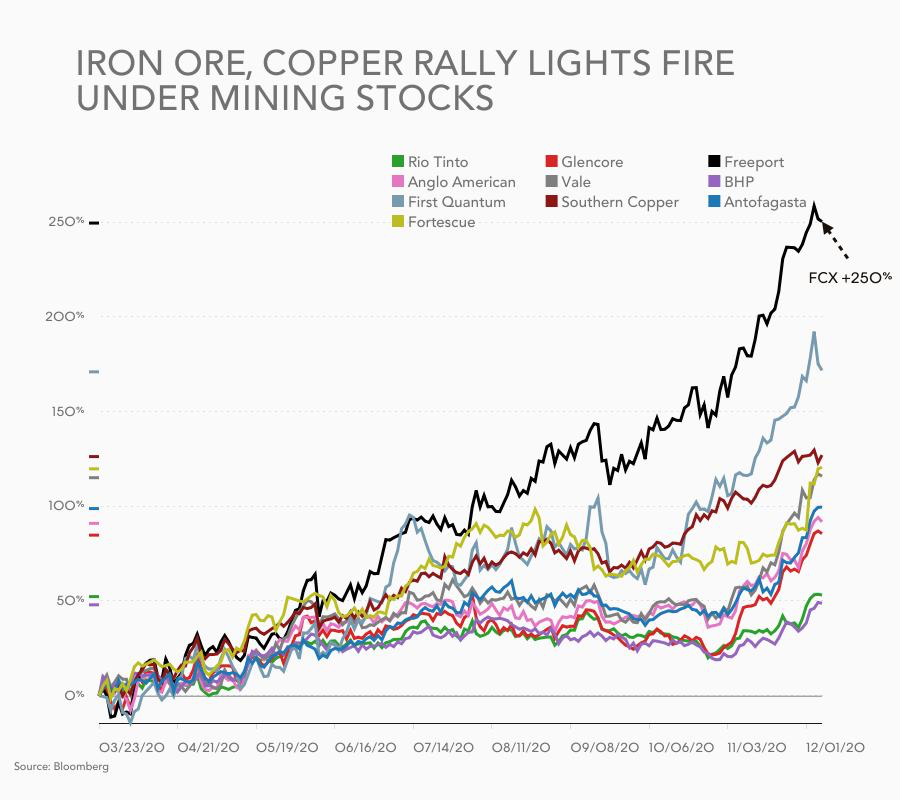

If you picked up copper specialists Freeport (NYSE:FCX), Southern Copper (NYSE:SCCO), Antofagasta (LON:ANTO) and First Quantum (TSE:FM) in March, you’ve at least doubled your money.

Thanks to its outback ore farm, Rio Tinto (LON:RIO) is up 50% – hitting a twelve year high Tuesday – despite a set of scandals, a leadership vacuum and troubles in Mongolia, where the company’s future in copper is supposed to be.

Iron ore pure play Fortescue (ASX:FMG) has been setting records with regularity and BHP (LON:BHP) is up 50% to its highest since 2011.

Vale (NYSE:VALE) has overcome skepticism about its response to ongoing operational and reputational problems thanks to an iron ore price just shy of $150 a tonne Tuesday and Glencore’s (LON:GLEN) share price is finally out of the doldrums.

It may not be over yet – iron ore is 27% below its peak set in February 2011 and copper still has 30% to go before it equals the all-time high set one month after iron ore.