A ‘flood of money’ should keep this bull market alive, even with the U.S. at a ‘tipping point,’ billionaire investor says

“ ‘Assets will not decline when measured in the depreciating value of money. I believe that with the enormous amount of debt and money that has been created and will be created in the future, the most important thing to pay attention to is the value of debt and money relative to the value of assets and other currencies.’ ”

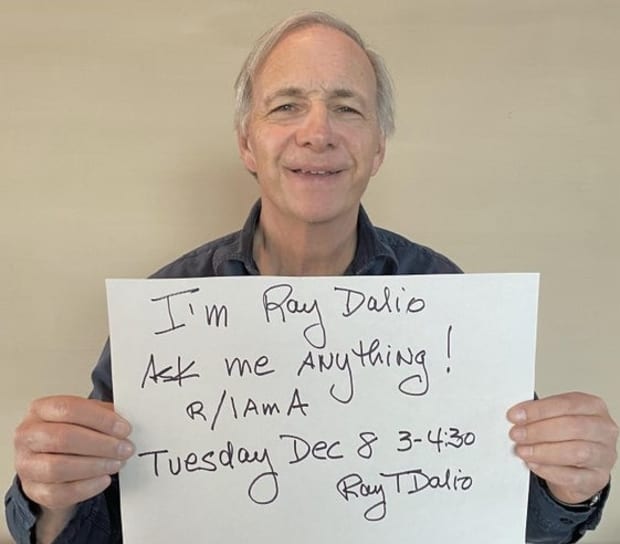

That’s Ray Dalio, the billionaire hedge-fund manager behind Bridgewater Associates, sharing his outlook for financial markets this week in a Reddit “Ask Me Anything” session this week.

Dalio explained that a “flood of money and credit” is keeping most assets afloat and further exacerbating the wealth divide.

He said that he believes stocks could trade at 50 times earnings in this environment, and he recommended “smart diversification” spread across asset classes, currencies and countries.

Part of that diversification should perhaps include bitcoin, which Dalio has been hesitant to embrace in the past. He wrote on Reddit that cryptocurrencies have “established themselves” over the last 10 years and were interesting “gold-like asset alternatives.”

Bitcoin BTCUSD,

Dalio, however, isn’t nearly as bullish on the U.S., in general.

“This is taking place in a politically and socially threatening environment, which will affect taxes, spending, and how we are with each other,” he wrote. “I think that between now and the mid-term elections in 2022, and between then and the next presidential election in 2024, we will face critical choices both domestically and internationally that will define the likelihood of having an internal and/or external existential conflict.”

Check out the whole post:

Last week, in a LinkedIn post, Dalio with a net worth of $15.5 billion, according to the Bloomberg Billionaires Index, put it even more bluntly. He wrote that “the United States is at a tipping point in which it could go from manageable internal tension to revolution and/or civil war.”

Meanwhile, the competition is heating up and Dalio opened up on Reddit about what he believes people are underestimating with China.

“The Chinese leadership is extremely knowledgeable in the lessons of its history and how things work,” he said. “It is a very civilized society that is doing extraordinarily well and is not consistent with the stereotypes that one might believe are true. It is by no means perfect (nor is any other country) and should be open-mindedly assessed based on evidence, rather than emotionally reacted against based on derogatory characterizations.”

As for the stock market, the bull was a bit wobbly on Thursday, with the Dow Jones Industrial Average DJIA,