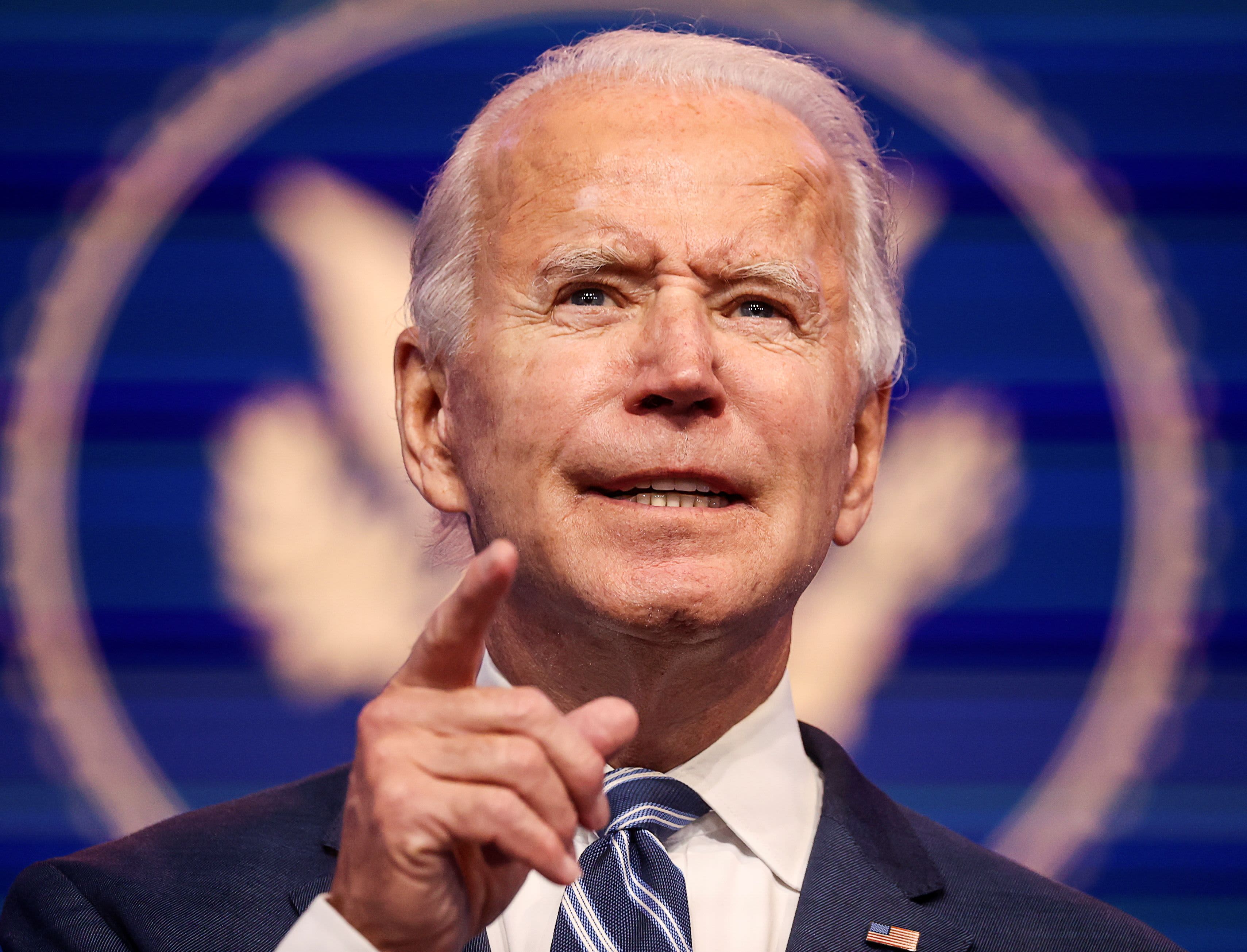

A Joe Biden presidency could give international equities a long-awaited boost.

Exchange-traded funds tracking overseas stocks including the SPDR Euro Stoxx 50 ETF (FEZ) and the SPDR S&P China ETF (GXC) have been on the rise since Election Day, fueled by hopes that the Biden administration could forge friendlier ties with foreign powers than its tariff-happy predecessor.

Three market analysts say that’s likely the case, based on the former vice president’s track record.

“Under a Biden-Harris administration, foreign stocks will likely be more beneficial to have in your portfolio than, say, U.S. on a relative basis just because Biden is more of a globalist,” said Matthew Bartolini, head of SPDR Americas Research at State Street Global Advisors.

In an interview on CNBC’s “ETF Edge,” Bartolini said the president-elect could roll back some of the tariffs levied by the Trump administration in favor of “more formal” trading pacts with other countries.

The result “would be overall net positive growth for international markets like Europe as well as China, and that’s why we saw some really strong action last week,” he said in Monday’s interview.

Brendan Ahern, chief investment officer of China-based ETF issuer KraneShares, agreed that a Biden presidency will likely mean less international tension and fewer tariffs.

“I do believe that it is a net positive for non-U.S. equities and I think the markets are proving that out,” Ahern said in the same interview.

“China was a little bit of a distraction technique for Trump,” said Ahern, whose company is majority-owned by a Chinese investment bank. “I think Biden was elected to focus on domestic issues, and I think that takes some of the scrutiny [and] at least dials it down a notch.”

Ahern added that his KraneShares Bosera MSCI China A ETF (KBA)’s recent outperformance has been driven by some of the telecommunications stocks under scrutiny from U.S. regulators on optimism around “a more pragmatic approach from the Biden administration.”

DataTrek co-founder Nick Colas said he also will be watching the Chinese companies embroiled in controversies with U.S. officials.

“What I’m looking for is to see what happens with all the blacklisting of Chinese companies that we saw under the Trump administration and if we begin to see an unwind of that, particularly with Huawei, going into 2021,” Colas said in the same interview.

“Because what’s so important for Chinese equity investors … is where is technology going in the Chinese stock market over the next couple of years?” he said. “That’s really been a key driver of why that market’s done well, particularly this year, and can that continue with an easier overall trade policy and IP policy from the U.S. towards China?”