Gold price clinging above $1,800 on stimulus hopes

Applications for US state unemployment benefits unexpectedly posted the first back-to-back weekly increase since July, while both incomes and savings fell last month. The data indicate the economic rebound is becoming more tenuous amid soaring coronavirus cases, fresh lockdowns and an extended deadlock in Congress over a new stimulus package.

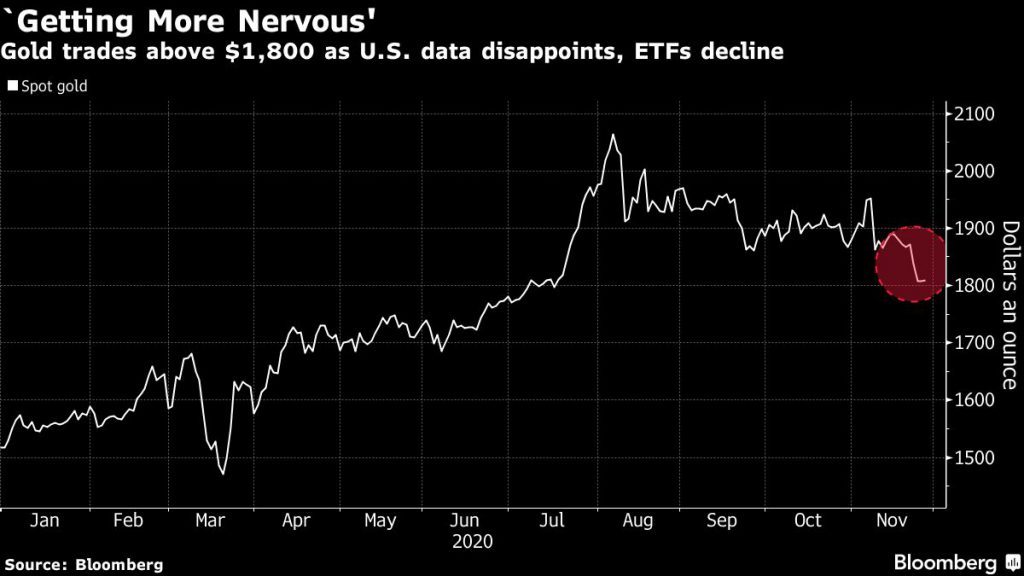

Still, bullion is heading for a fourth straight monthly decline as breakthroughs in covid-19 vaccine development lifted risk sentiment and damped demand for safe-haven assets.

“We’ve seen risk sentiment improve because of the optimism over vaccines and those were the headwinds for gold,” Harshal Barot, a senior research consultant for South Asia at Metals Focus, told Reuters. “But since the dollar continues to weaken, gold prices are finding a little bit of support.”

Barot believes gold would find support at $1,795 per ounce and likely trade sideways in the near-term, until a “convincing” break above $1,850.

Some investors appear to be abandoning bullion, with ETFs poised to post the first month of outflows this year after holdings surged to a record in October.

“We are cautious as many investors have bought gold and they are getting more nervous,” Georgette Boele, senior precious metals strategist at ABN Amro Bank NV, said in a note.

“They start to fear that we may have seen the peak. If that is the case, it could take a long time before we see the level of $2,000 again,” she added.

Gold is traditionally seen as a hedge against inflation that is likely to result from large stimulus, which many banks and analysts believe will eventually materialize and benefit gold.

“Continued accommodative central bank policy, given the widespread unavailability of a vaccine until the second half of 2021 and dollar weakness means gold is well supported,” ANZ said in a note, adding it maintains its 12-month price target of $2,100 per ounce.

Earlier this month, analysts at Goldman Sachs said they expect bullion to break out of the current narrow trading range and soar through 2021 as the coronavirus recession gives way to higher inflation, with a price target of $2,300 per ounce.

(With files from Bloomberg and Reuters)