“These holes represent the first of the RC (reverse circulation) holes from the 2020 drilling program at Gold Rock, with the results continuing to show strong, consistent mineralization and excellent opportunities to expand the current resource envelope going into the feasibility study (FS),” Tim Warman, Fiore Gold’s CEO, said in a release.

The 48.8-metre intercept above appears to be one of the best intercepts from Gold Rock to date and hit mineralization just below the base of the pit shell defined in the company’s preliminary economic assessment (PEA) from earlier this year.

Drilling between the PEA shells also hit mineralization, returning 10.7 metres of 0.73 g/t gold and has identified potential to connect the two separate pit shells.

Several holes completed around a historic heap leach pad hit gold east and below the PEA pit shells. The most recent drilling also suggests residual gold mineralization in the lead pad material, returning 15.2 metres of 0.32 g/t gold.

The Gold Rock holding is contiguous to the company’s operating Pan mine.

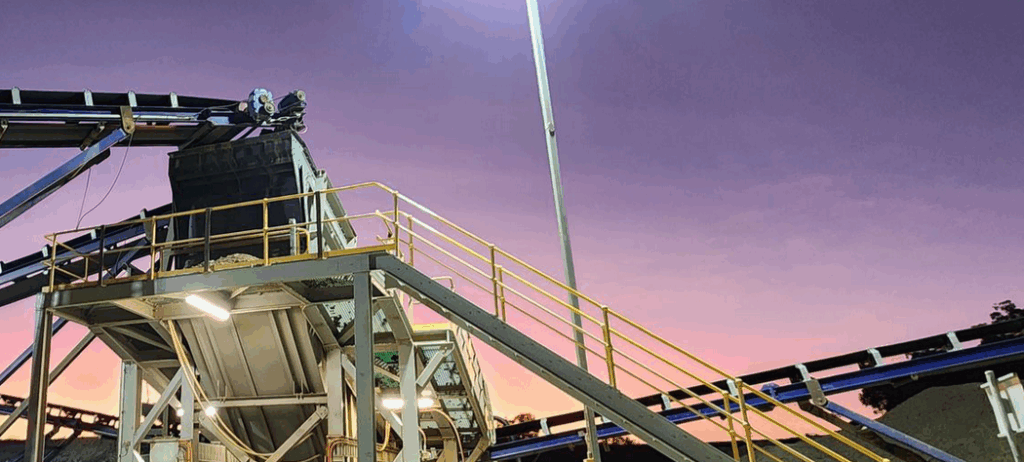

In April, Fiore announced the results of a PEA, which outlined an open pit operation sharing infrastructure and management with Pan.

As a 9,070-tonne-per-day heap leach operation, Gold Rock could generate an additional 55,800 oz. gold annually for the company over a 6.5-year mine life, at all-in sustaining costs (AISCs) of $1,008 per ounce. With a pre-production capital estimate of $64.6 million, the after-tax net present value estimate for the incremental development comes in at $32.8 million, at a 5% discount rate and based on $1,400 per oz. gold, with a 17.8% internal rate of return.

Fiore is working to complete a feasibility study for Gold Rock by the second half of 2021.

(This article first appeared in the Canadian Mining Journal)