Pfizer and BioNTech SE plan to file for emergency use, allowing for the vaccine, which they say is 95% effective, to be used in the US in the next month.

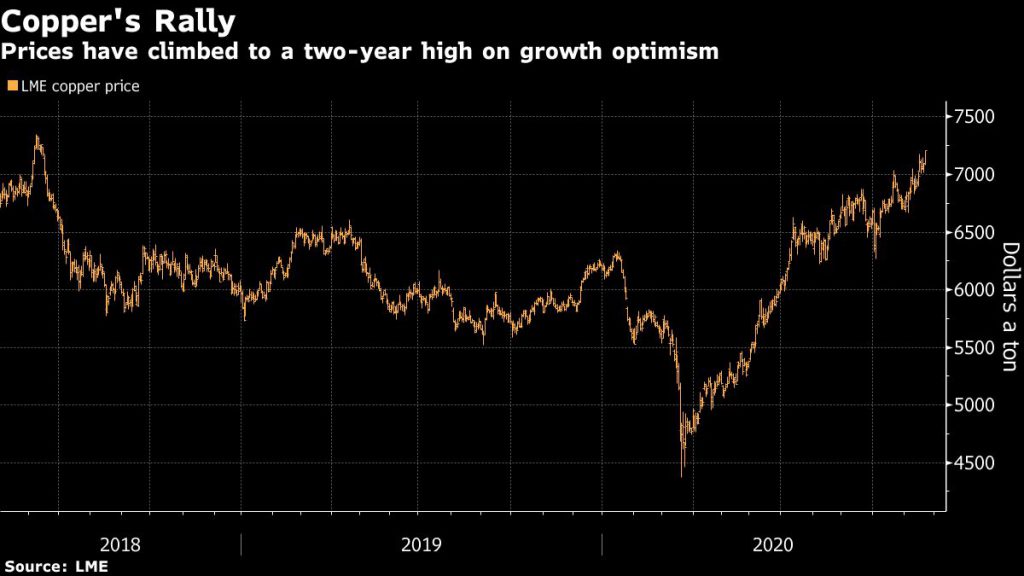

Copper is heading for an eighth straight monthly gain, the longest run in almost a decade, as rebounding growth in China and signs of progress in developing a covid-19 vaccine buoy demand prospects.

Copper is heading for an eighth straight monthly gain, the longest run in almost a decade

Investors are also betting on a boost from spending on green infrastructure following the five-year plan hammered out by China, as well as alternative-energy initiatives outlined by US President-elect Joe Biden.

“Generally a strong week for industrial metals with vaccine news driving recovery hopes outside China where demand is already robust,” Ole Hansen, head of commodity strategy at Saxo Bank A/S, told Reuters.

“Positive news for the metals is compounding and copper is gaining momentum,” RJO Futures senior market strategist Peter Mooses told Bloomberg.

“Base metals have been driven by bullish news all around, and a vaccine is just what the market is looking for: a long-term solution to fears for further disruptions to a global recovery.”

Fear of supply disruptions

As coronavirus infections surge worldwide, fears of further near-term disruptions to supply are also fueling gains.

Peru’s currency fell to a record low over the last weekend amid political chaos and the largest protests in the capital Lima in decades. Experts have also warned that further upheavals threaten the fight against the coronavirus in the country, which, with a population of 32 million, has one of the world’s highest per-capita death rates from covid-19.

In a note, BMO Capital Markets said the unrest in Peru, the world’s number two copper producer behind Chile, while focused on the capital, could cause issues for copper concentrate logistics (plus other metals), should the situation escalate.

Workers at Lundin’s Candelaria in Chile pushed a strike into a second month, as operations remained at a standstill.

A worker´s union at Antofagasta Minerals’ Centinela copper mine in Chile is preparing to vote next week on a contract offer but says it will likely reject it, paving the way for a strike.

“As we see cases increase, we have to expect that further restrictions are not far behind,” ED&F Man Capital analyst Edward Meir told Bloomberg.

“The spreading virus could be raising fears that mining operations will again be halted, fueling this supply premium.”

(With files from Reuters and Bloomberg)