Treasury yields climb on renewed stimulus optimism

U.S. government debt prices were lower Wednesday morning as hope returned for a fresh round of fiscal stimulus before the election.

At around 2:25 a.m. ET, the yield on the benchmark 10-year Treasury note had jumped to 0.8293% while the yield on the 30-year Treasury bond climbed to 1.6430%. Yields move inversely to prices.

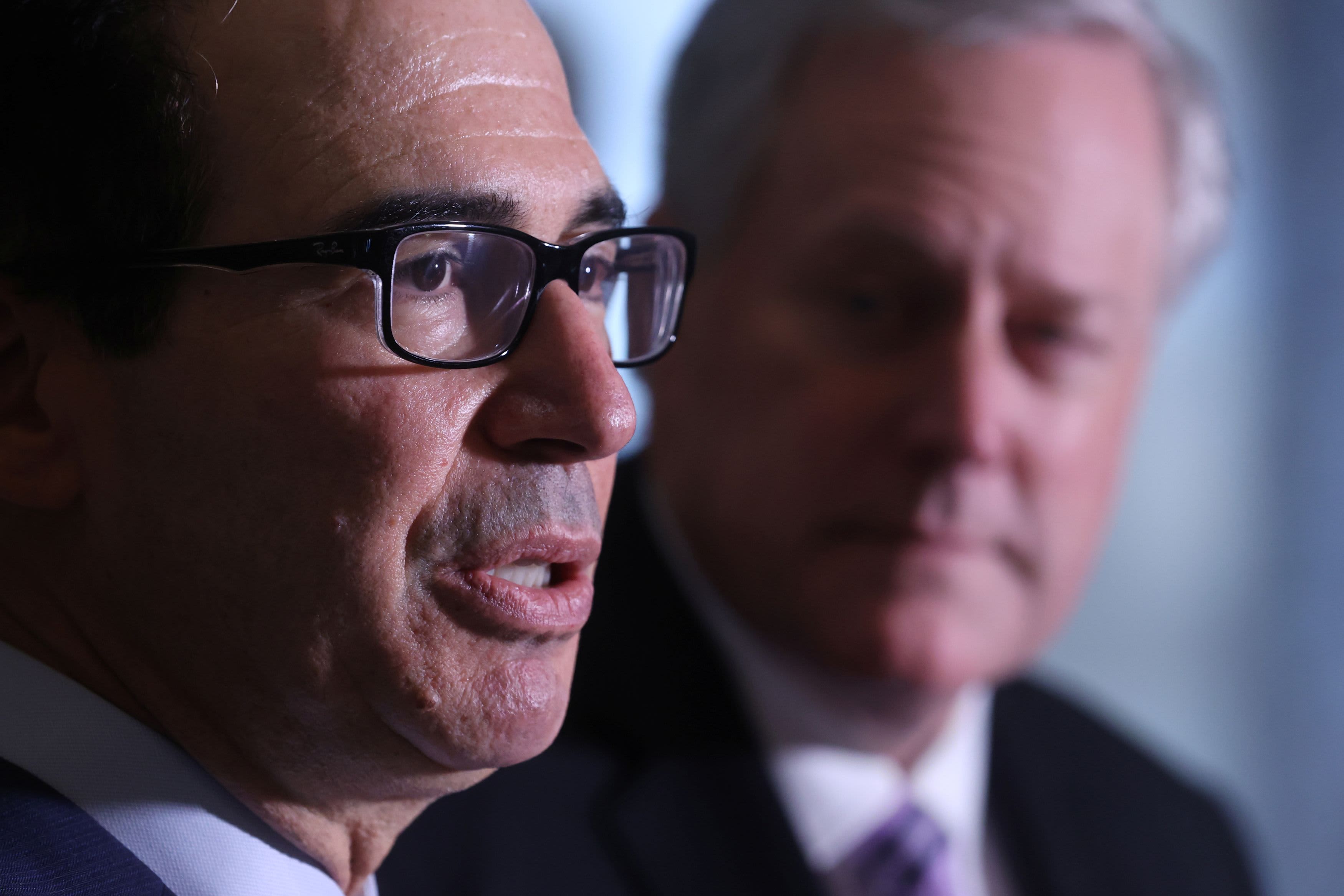

Yields ascended to four-month highs on Tuesday night after White House Chief of Staff Mark Meadows said Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi had made “good progress” toward a deal on a new coronavirus aid bill, although Meadows warned the two sides “still have a ways to go.”

Following Pelosi and Mnuchin’s meeting on Tuesday, Meadows told CNBC’s “Closing Bell” that the two will talk again on Wednesday, and that he hopes to see “some kind of agreement before the weekend.”

President Donald Trump has said he is willing to accept a large relief package despite opposition from within his own Republican party, while Pelosi told Bloomberg TV on Tuesday that she is “optimistic” about a potential accord.

There are no major economic data releases scheduled for Wednesday, though Federal Reserve Board Member Lael Brainard is set to speak at 8:50 a.m. ET before Cleveland Fed Governor Loretta Mester at 10 a.m.

Auctions will be held Wednesday for $25 billion of 105-day Treasury bills and $30 billion of 154-day bills, along with $22 billion of 20-year bonds.