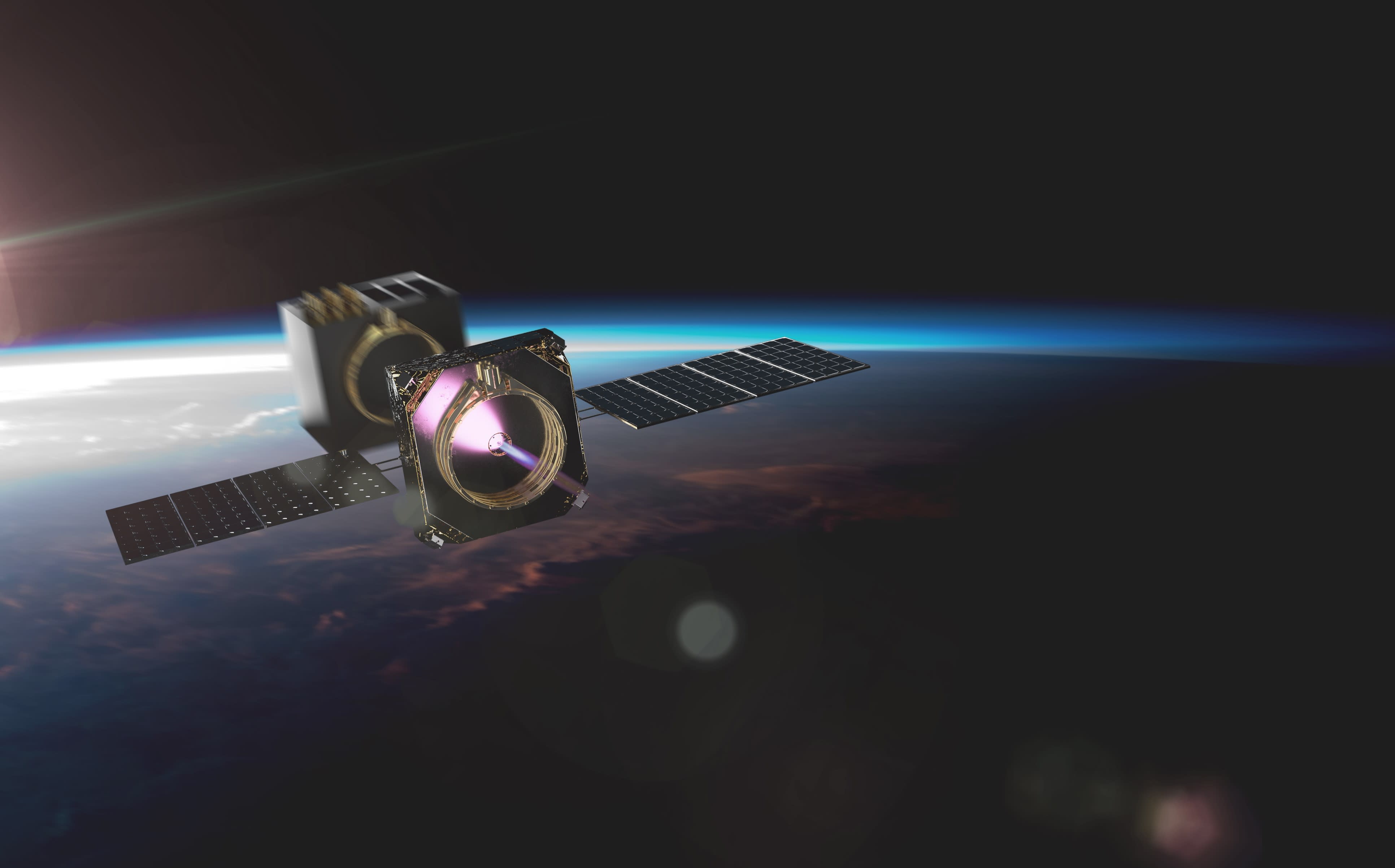

An artist’s rendering of a Momentus Vigoride transfer vehicle deploying satellites in orbit.

Momentus

Space transportation company Momentus is in final talks to go public through an acquisition by Stable Road Capital, a person familiar with the discussions told CNBC on Tuesday.

The company would go public through the special purpose acquisition company, or SPAC, which Stable Road raised $172.5 million for in November 2019. The deal values Momentus at near $1 billion, the person added.

Momentus is a Santa Clara, California-based company that offers a “last mile delivery” service for spacecraft. The core of Momentus’ business is Vigoride, which is a transfer vehicle that helps deliver satellites from a rocket to a specific orbit. Vigoride consists of a frame, an engine, solar panels, avionics and a set of satellite deployers and is especially designed for satellites that hitch a ride on large rockets, an increasingly popular industry practice called ridesharing.

The company launched its first demonstration mission last year, which proved that the key part of its transfer vehicle — the water plasma engines — worked. It has the first mission for Vigoride lined up this year, currently slated for launch on a SpaceX Falcon 9 rocket in December.

To date Momentus has raised almost $50 million from investors including Prime Movers Lab and Y Combinator. The company has more than 60 employees, growing quickly since its founding in 2017. The market for Momentus’ transfer vehicles comes into play due to the increasing popularity of small satellites, which still need a way to get from the orbit the rocket drops them off in to the spacecraft’s destination orbit. It has the first mission for its Vigoride spacecraft lined up this year, currently slated for launch on a SpaceX Falcon 9 rocket in December.

Stable Road Capital and Momentus did not immediately respond to CNBC’s requests for comment. Bloomberg first reported that Momentus is in talks to go public.

SPAC’s, known colloquially as blank check companies, have become an increasingly popular way method of going public. Rather than go through the traditional IPO market, an investor or firm uses a SPAC to raise funds to finance an acquisition within a certain time frame – and the company that is acquired is effectively taken public.

Stable Road’s SPAC is listed under the ticker symbol “SRAC.” Stable Road filings for the SPAC as recently as June note that it was “focusing its search on companies in the cannabis industry,” although the firm did not limit itself to acquiring a company in that particular sector.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.