On Tuesday, however, Shandong said it was prepared to increase its offer by five Australian cents to A$1.05 if a higher offer emerged, leaving Nordgold on the ropes.

The Moscow-based gold miner, which spun out of Russian steelmaker Severstal in 2012, has responded with an off-market takeover offer for all of Cardinal’s outstanding shares. It has also vowed to provide accelerated payment terms, as long as there are no higher competing offers.

If a higher bid comes along, Nordgold said that it would increase its offer to a price that could defeat the higher competing submission, and any other rival offer from Shandong.

The Russian miner is also proposing to make an offer to certain of Cardinal option holders for their options, at the same terms as those offered by Shandong.

A source familiar with the matter told MINING.COM there is “enough evidence” of Shandong’s “misleading” and “coercive activities” to try swaying Cardinal shareholders.

“After nearly a year of protracted takeover processes, it’s very clear there will not be a third party bidder, unless it is a fabricated Chinese party, in which case the regulator would step in,” the insider, who wishes to remain anonymous, said.

Eyes on Ghana

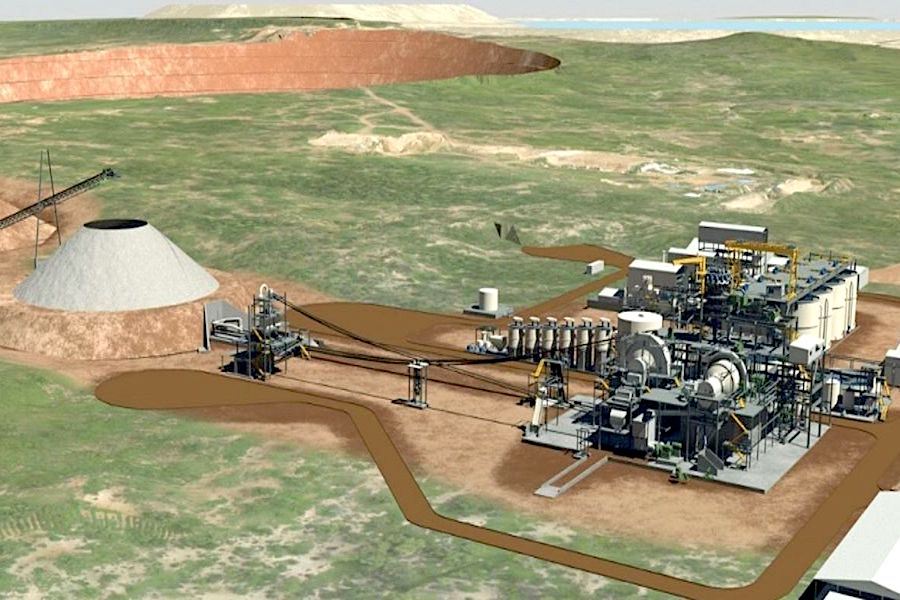

The main reason behind the two bidders back-and-forth contest for Cardinal is the Australian miner’s 5.1 million-ounce Namdini gold asset in Ghana.

A feasibility study into the project estimates that it will produce about 4.2-million ounces of gold over a mine life of 15 years. Nearly 1.1 million ounces would be generated in the first three years of operation.

Initial capital costs for Namindi were forecast to range from $275 million and $426 million, depending on the project’s scale.

Nordgold, which acquired many of its major assets during the 2008-2009 financial crisis, claims it is not only offering better terms for Cardinal’s shareholders, but that it also has a track record of best practice operations in West Africa.

The company owns several gold mines in Africa, including Bissa in Burkina Faso and Lefa in Guinea. It also operates in Russia and Kazakhstan.