Millions poised to lose unemployment benefits in ‘enormous cliff’ at year’s end

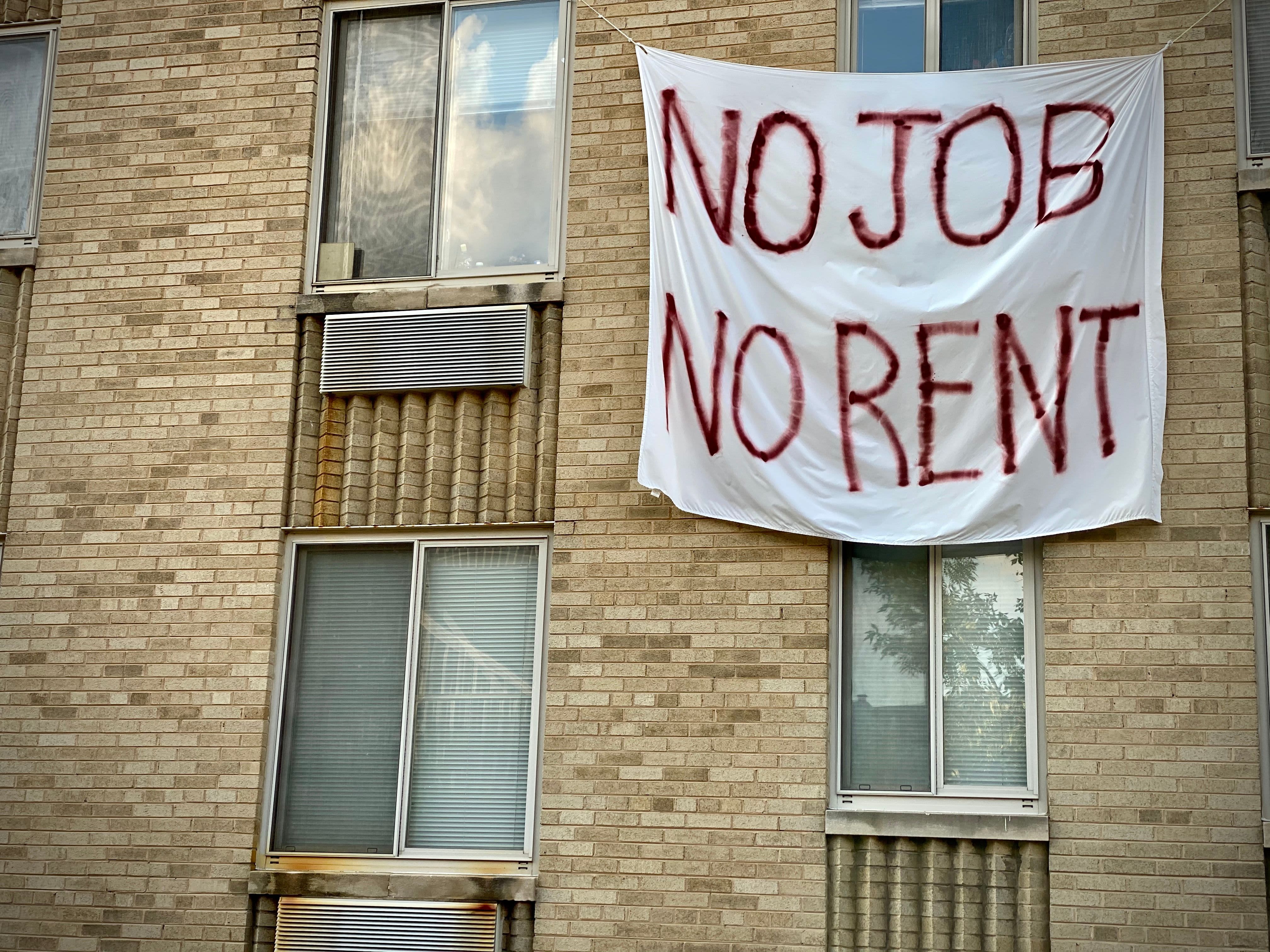

A banner on a controlled rent building in Washington, D.C., on Aug. 9, 2020.

ERIC BARADAT | AFP | Getty Images

Millions of jobless Americans are poised to lose their unemployment benefits at the end of the year without action from Congress to extend temporary aid programs.

A federal program paying benefits to gig workers and others (such as the self-employed, freelancers, contractors and part-timers) is poised to lapse after December, as is one paying extra relief to workers who’ve exhausted their standard state benefit.

More from Personal Finance:

Will there be a second round of $1,200 stimulus checks?

Who Biden would likely pick as top financial watchdog for consumers

3 worst money mistakes from a personal finance reporter

In all, there are about 13.5 million people in these two programs — more than half of the roughly 23 million people receiving unemployment benefits, according to Labor Department data.

“There’s going to be an enormous cliff at the end of the year,” Stephen Wandner, a labor economist and senior fellow at the National Academy of Social Insurance, said of the expiring benefits.

Scars for a generation

That aid would be ending at a precarious time and cripple household spending among these workers, according to economists.

Meanwhile, the U.S. is experiencing a third wave of new coronavirus cases. Rising infections could lead to renewed business closures, and associated layoffs, especially as the country heads into the colder winter months that limit outdoor activity, economists said.

The lack of a coherent and sustained federal response to this crisis will leave scars that will last a generation, at least.

Jean Kimmel

economics professor at Western Michigan University

Further, layoffs once thought temporary have become permanent and jobless durations are rising. There are about two unemployed workers for every job opening, according to the Bureau of Labor Statistics, making it difficult to find work at the same time the economic recovery that started in May has lost steam.

A federal ban on evictions also ends after December, meaning workers who have a tough time paying rent could get kicked out.

“The lack of a coherent and sustained federal response to this crisis will leave scars that will last a generation, at least,” said Jean Kimmel, an economics professor at Western Michigan University.

Stefani Reynolds/Bloomberg via Getty Images

Odds look slim that federal lawmakers will pass a relief bill before next week’s presidential election. Workers may have to wait until January and beyond, depending on the election outcome.

Benefits for gig workers

The federal government mobilized in the early days of the pandemic to pass an unprecedented amount of financial relief.

The $2.2 trillion CARES Act, the largest relief law in history, enacted several temporary measures to beef up unemployment benefits.

The Pandemic Unemployment Assistance program, for example, offers federal benefits to groups like the self-employed, gig workers (like Uber and Lyft drivers) and others who were previously ineligible for unemployment insurance from their state.

ROBYN BECK | AFP | Getty Images

More than 10 million people were collecting PUA benefits as of early October, according to most recent Labor Department data. Another 345,000 filed new applications for PUA benefits last week.

These workers will be left without any access to unemployment benefits after year’s end.

Extra 13 weeks

Another new federal measure, Pandemic Emergency Unemployment Compensation, offers up to 13 weeks of extra benefits. That’s on top of the 26 weeks of unemployment insurance states generally pay (though some pay much less).

And, as the economic crisis persists and workers are unemployed for longer periods, the ranks of this program have grown. There are about 3.3 million workers getting PEUC benefits, according to the Labor Department.

The program ends after Dec. 31.

A prior measure paying workers an extra $600 a week in unemployment benefits lapsed at the end of July. Absent that boost, state benefits generally replace about half of workers’ prior wages.

Inequality

Failure to extend these benefit programs would hit low-wage earners hardest, Kimmel said.

Job loss was concentrated among such workers in March and April, and their jobs have been slower than higher earners to bounce back.

“A society that already was becoming increasingly unequal will just become even more unequal [without benefit extensions],” Kimmel said.

Extended benefits

Many people who exhaust their state’s allotment of unemployment insurance would be eligible to continue getting benefits after the end of the year via state Extended Benefits programs.

These benefits become available in states with high levels of unemployment and typically pay up to 13 to 20 extra weeks, according to the Center on Budget and Policy Priorities.

Workers can collect these benefits after exhausting the 13 extra weeks of PEUC, for example.

However, more than a half dozen states that were paying Extended Benefits earlier in the crisis have stopped doing so (or signaled they will do so in coming weeks) as their unemployment rate has improved.

So, workers in these states — which include Alabama, Arkansas, Idaho, Iowa, Missouri, Nebraska, North Dakota and Wyoming — could lose benefits entirely after year-end, depending on when they lost their jobs.

And while the disappearance of these extended benefits coincides with a general improvement in unemployment levels, that won’t help individuals in hard-hit industries like hotels and restaurants that remain out of work, Wandner said.