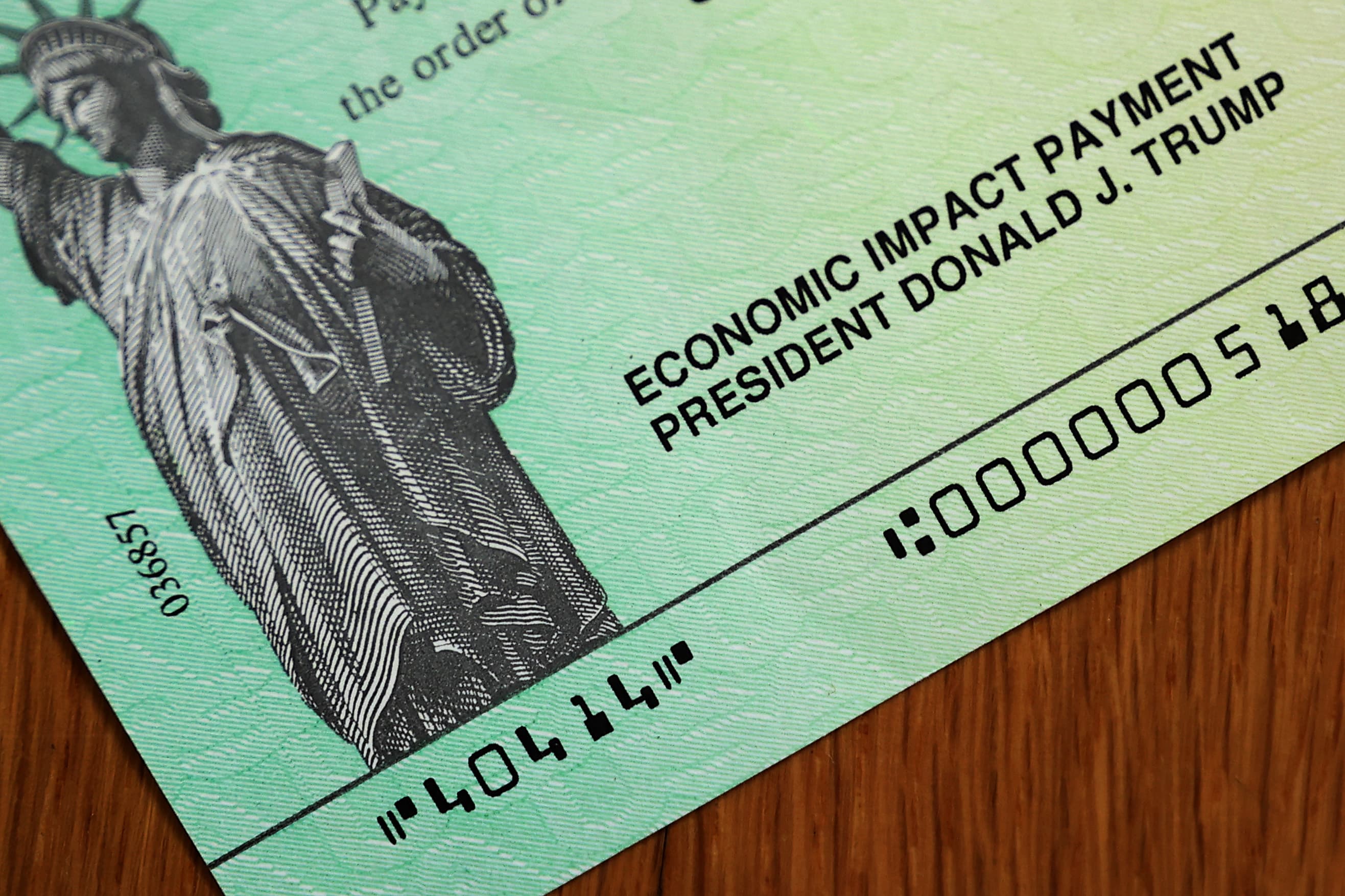

The federal budget deficit is on track to hit a record $3.3 trillion this year, and Democrats and Republicans are trying to work out the details on a second stimulus bill that could drive that number even higher.

Historically, large deficits can lead to increased inflation, according to Sahil Bloom, a financial educator and vice president at Altamont Capital Partners.

With greater inflation, the purchasing power of your dollar goes down, and that can happen when a government “prints” too much money, Bloom said.

The biggest risk now is that the buying power of the dollar is too high, according to Bloom. Such “deflation” would lead to less spending and more saving, which would actually be bad for the economy, he said.

Check out this video to learn why the value of your currency fluctuates, what it means for you and to see how the Fed plans to keep the dollar steady.

More from Invest in You:

‘Predictably Irrational’ author says this is what investors should be doing during the pandemic

Coronavirus forced this couple into a 27-day quarantine amid their honeymoon cruise

How to prepare for a family member with COVID-19

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: Why January is a particularly great time to invest your money via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.