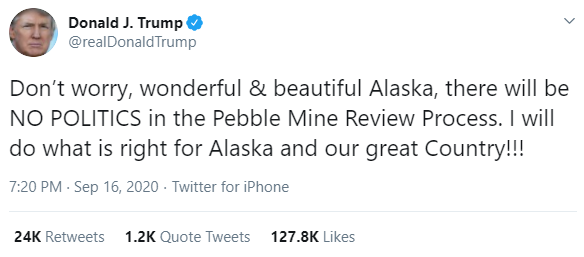

Trump says ‘no politics’ in Pebble mine review – Northern Dynasty stock surges

Trump’s announcement comes as doubts about the project have steadily risen over recent months.

Last week, short seller J Capital Research accused Northern Dynasty management of “gaslighting investors” and said the mine plan “is on its face absurd.”

“We believe Northern Dynasty has crafted a money-losing mining plan to achieve government approvals. Since management is bonused on lobbying success instead of for producing minerals, NAK has no reason to care that the new plan is irrational: we think it will lose money, leave investors with a stranded asset, and be canceled anyway if Joe Biden is elected,” JCap’s report read.

Midday Thursday, Northern Dynasty’s stock was up 17% on the TSE

Northern Dynasty responded to the report, calling it “fatuous, flimsy and fundamentally self-serving,” as well as “typical of such efforts to profit by destroying the value of honest shareholders’ investments.”

The Trump administration in July proposed approving a permit for the mine, which would be located near the world’s largest commercial sockeye salmon-producing region.

Opponents of the project have long feared its discharges could contaminate local waters, causing irreparable damage to the aquatic habitat.

US President’s son Donald Jr. took to Twitter to oppose the project, saying “the headwaters of Bristol Bay and the surrounding fishery are too unique and fragile to take any chances with.”

If permitted, Pebble would become North America’s largest mine, with an estimated measured and indicated resource of 6.5 billion tonnes containing 57 billion lb copper, 71 million oz gold, 3.4 billion lb molybdenum and 345 million oz silver.

Midday Thursday, Northern Dynasty’s stock was up 17% on the TSE. Shares had been traded over 37.6 million times, over double the average daily volume. The company has a C$759 million market capitalization.