Tesla “battery day” a possible blow to cobalt miners

Tesla currently uses the nickel rich nickel-cobalt-aluminum cathode chemistry, which has a low cobalt content of about 5%, for their cars produced outside China.

The company also embraces the Responsible Minerals Initiative (RMI) to identify red flags such as child labour in their cobalt sourcing.

A reportedly signed deal between Tesla and Glencore (LON: GLEN) in June has cast doubts on the company’s statement that it’s close to eliminating cobalt from its batteries altogether.

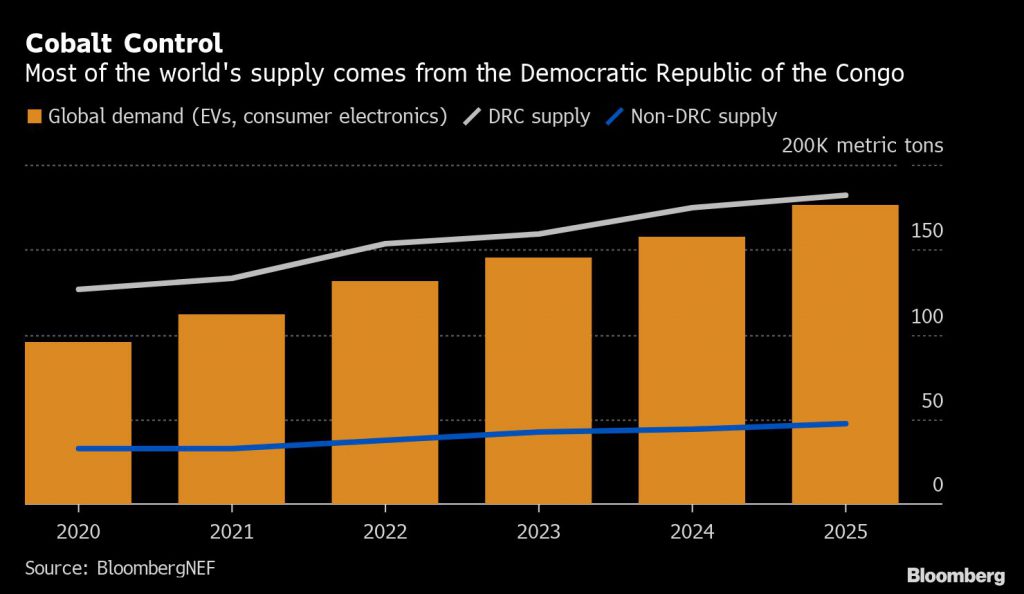

The contract would involve supplies of 6,000 tonnes of cobalt from the Democratic Republic of Congo for Tesla’s new Shanghai factory.

There also are rumours about a wider cell design, which would bring down the cost of making batteries. That would be a critical development given that they are the main cause of EVs hefty price tag.

Musk, 49, said earlier this year that the event would “blow your mind” and has been adding to the hype over the weekend by tweeting the upcoming announcement “it’s big” and “insane”, with “many exciting things to be unveiled.”

Patrick Hummel, analyst at investment bank UBS, has put his money on batteries containing so-called dry electrodes, which would not require energy-intensive processes. They would also remove some of the obstacles to breaking the stranglehold of fossil fuels.

Analysts at Citigroup said with Tesla having roughly 30% of the pure battery electric vehicle (BEV) market this year, its innovations in battery performance and chemistry have “significant implications for EV metal demand” and so Battery Day “could impact sentiment towards battery metals demand”.

Goldman Sachs believes the focus on Tuesday will be on “production capacity expansion, battery cost and new technology trends”.

Even if Tesla is not ready to transition to an entirely new type of battery, updates in the chemistry of its existing cells could also offer extra longevity, with high hopes the coveted “million-mile battery” will be unveiled.

Volkswagen’s own battery day earlier this month predicted 300 gigawatt-hours of batteries will be needed in 2025

In the last three years, Tesla has mass-manufactured batteries for its cars and energy storage products at its Gigafactory in Nevada, US, with its partner Panasonic.

It has also begun sourcing cells from Contemporary Amperex Technology Co Ltd (CATL) and LG, and making battery packs for the made-in-China (MIC) version of its Model 3 sedans.

No so near-future news

Most of Tesla’s announcements have related to finding ways drive down production costs, increase the lifetime and charging speed of their batteries, and make sure the metals used in the making of its EVs are ethically sourced.

The carmaker events often cause short-term stock volatility, but what Musk shows at these presentations doesn’t always result in a working product within the announced timeline.

In October 2016, the South African-born billionaire showed off different styles of roof tiles with solar cells that weren’t actually functional. The event helped Tesla score shareholder approval for a $2.6 billion acquisition of debt-saddled SolarCity.

So far, the carmaker has not produced or install solar glass roof tiles in a significant volume.

A year later, Tesla unveiled its new Roadster vehicle prototype, “the fastest production car ever made”, which should have been available this year. Last May, however, Musk listed several other tasks Tesla would need to achieve first, suggesting it may not arrive until after next year.

Tesla’s “Autonomy Day”, held in April 2019, was all about self-driving cars or “robotaxis” being available in the second quarter of 2020. They have yet to pass all safety tests needed before beginning mass production. “All the things I said we would do them, we did it,” Musk said at the event. “Only criticism— and it’s a fair one — is sometimes I’m not on time. But I get it done and the Tesla team gets it done.”