It’s not time to buy tech … yet.

That’s what two traders said Tuesday as technology stocks continued their sell-off from the prior week, with the Nasdaq Composite index falling more than 4%. Though the S&P 500 technology sector is still up almost 23% year to date, last Thursday’s trading session was its worst in over five months.

“I already own some of the big ones — Apple, AMD, Salesforce, Nvidia — but we were trimming them on the way up and I’m not dying to buy any of these names just yet,” Mark Tepper, the president and CEO of Strategic Wealth Partners, told CNBC’s “Trading Nation” on Tuesday. “I don’t want to put any more new cash into any of them right now because I do think this correction has further to go.”

The S&P tech sector has fallen nearly 11% since Sept. 2. Corrections are typically defined as declines of 10% or greater in a given asset or index.

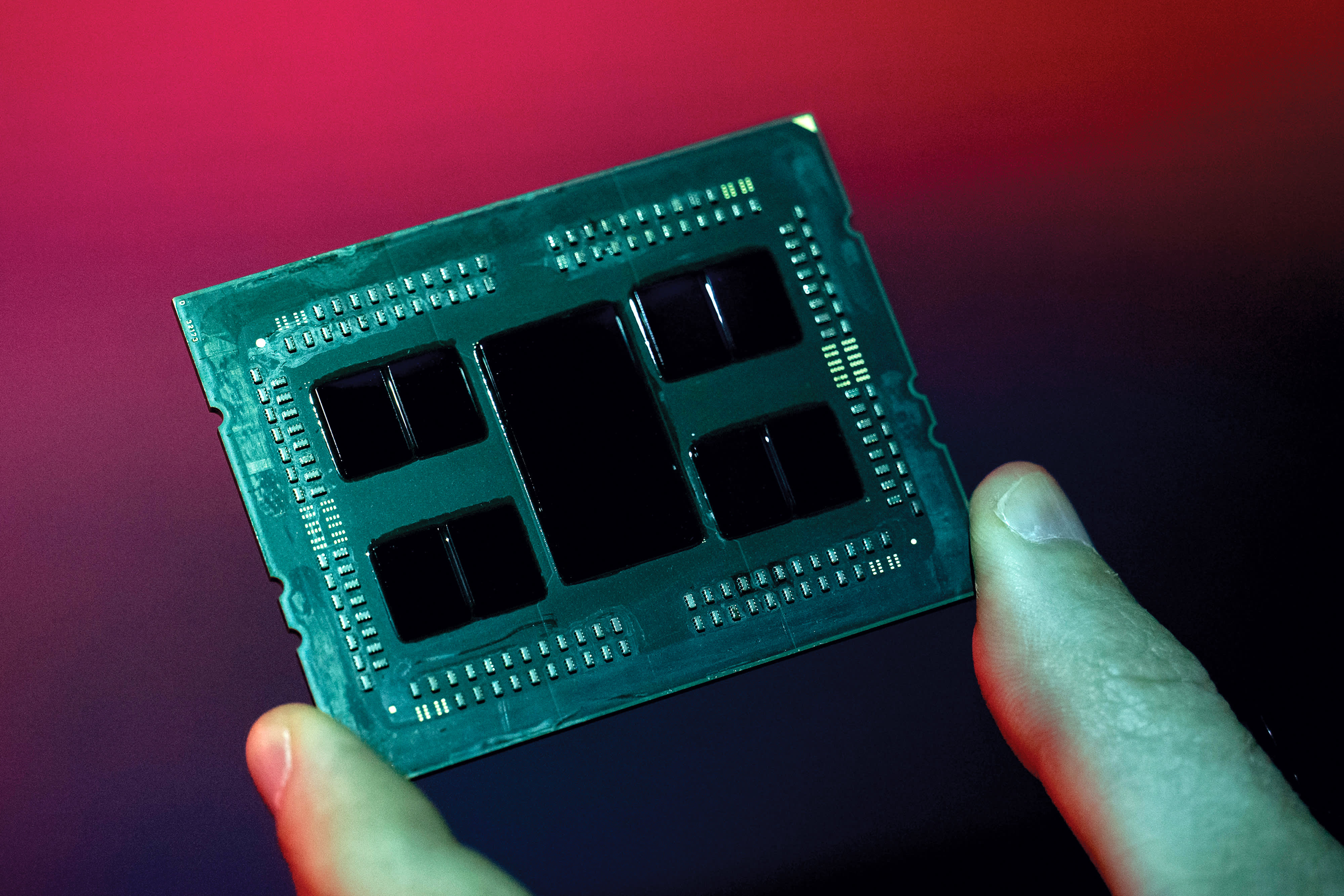

Out of the larger-cap stocks Tepper owns, his favorite was AMD, “but at 80 bucks, it’s just way too expensive,” he said. “If that thing were to drop down to [$]60 or [$]70, I’d be buying it, because we weren’t able to get a full position in it, as it kind of took off from us on the way up.”

One smaller name presented an even better opportunity, Tepper said.

“The smaller names, they never broke out like the larger-cap tech names did,” he said. “The one name that we already own that I like right here is Cloudera. I’d be buying more right now. This thing was [at] 14 bucks a week ago, just had a great quarter, and it’s down to 11 bucks, but nothing changed fundamentally. So, I would call that a buyable pullback. I love the business. I love the price.”

Todd Gordon, managing director at Ascent Wealth Partners, agreed with Tepper about AMD’s potential, calling tech’s recent weakness “nothing more than profit-taking after five straight months of the market moving up … without any pullback.”

“I think there’s still a very bullish backdrop. Fundamental valuations have become a bit more reasonable — still extended, but we’re in a new sort of normal,” Gordon said in the same “Trading Nation” interview. “Some names that we would look to add for the first time would be Nvidia and AMD.”

Looking at AMD’s chart, he said the stock remained in a “nice uptrend channel.”

“Keep in mind we just broke about a 25-year upper range in AMD,” Gordon said. “We broke up around $40-50. Any pullback is still supported above 60 in a nice parallel uptrend channel.”

With Nvidia also pulling back to its 50-day moving average, there does appear to be opportunity on the horizon in the chip stocks, especially with the long-term trends of artificial intelligence and self-driving car development still at play, he said.

“We’re remaining constructive,” Gordon said. He added that his firm would look to add to existing positions in Adobe, Activision Blizzard and Salesforce “in the future.”

As for Apple, shares of which are down nearly 16% in the past week, Tepper’s message was to proceed with caution, calling the stock’s valuation “stretched” even as he praised the company and its products.

“If you go back to January of 2019, the stock was trading at a forward multiple of 11 or 12. I mean, it’s more than tripled over the last 20 months and they haven’t grown earnings one bit and nothing fundamentally within that company changed,” he said. “I’m not saying it should’ve been trading at a 12 forward PE back January of 2019. It was probably too cheap at that point. But I think it just got a little too expensive.”

Gordon pushed back, saying Apple’s lofty valuation wasn’t exactly unprecedented.

“The last time Apple traded at 25 or 30 times earnings, forward earnings, like we are now, I think it was 2007, just ahead of the first iPhone launch,” he said. “We’re starting to get … echoes from that as we head into the new 5G phone. This is maybe the new supercycle they’re talking about [for] 2021 and 2022 in terms of this 5G phone. So, there is precedent for this high valuation in the past.”

Disclosure: Strategic Wealth Partners and Tepper own shares of Apple, AMD, Salesforce, Nvidia and Cloudflare. Ascent Wealth Partners owns shares of Apple, Adobe, Activision Blizzard and Salesforce. Gordon owns shares of Apple.