Copper price rallies as Chinese scrap shipments sink by 50%

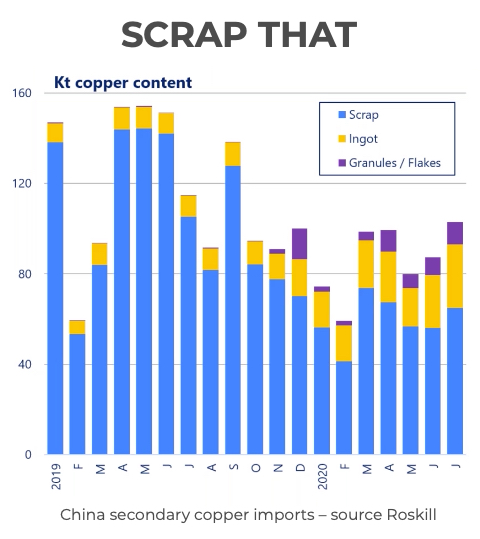

China consumes more copper than the rest of the world combined and Reuters reports the China Nonferrous Metals Industry Association told a conference on Friday imports of secondary copper could halve in 2020, from just under 1.5 million tonnes last year.

The country wants to eliminate imports of what it deems “foreign waste” and has implemented a strict quota system.

In a recent research report Roskill called scrap the most vulnerable link in the global supply chain and said Chinese importers’ attempts at diversification by buying more ingot and copper granules have only had limited success, forcing importers to buy cathode from the rest of the world, where metal demand has slumped.

Jonathan Barnes, associate consultant for copper at the London-based metal and minerals researcher, noted regulations set for June that would have classified copper scrap as a “renewable resource” to enable refiners to skirt regulations has been delayed indefinitely.

Barnes says on top of that several major shipping lines are refusing to transport scrap fearing a liability for return shipment if containerized cargoes are rejected by Chinese customs.

Concentrate hard to come by

Barnes says while the effects of covid-19 could decrease world consumption of the metal by 3%–4% this year, the drop in mine output and scrap flows have been greater.

Customs data shows China’s unwrought copper imports (anodes and cathodes) in August declined to 668,486 tonnes from July’s record haul of 762,211 tonnes, but still up 65% from August last year.

Year to date imports now total 4.27m tonnes, up 38% from 2019 and on track to easily beat 2018’s annual record of 5.3m tonnes.

At the same time concentrate supplies from South America, where China source the bulk of its mined copper, has been disrupted due to covid.

August imports of copper concentrate fell by more than 12% from the same month last year to 1.59m tonnes, on lingering supply disruptions from Peru and Chile.