U.S. Curbs on Huawei May Impact South Korea’s Recovery

(Bloomberg) — New U.S. restrictions against Huawei Technologies Co. threaten to weigh on South Korea’s economy, which is counting on chip exports to China to drive its rebound from the coronavirus pandemic.

The U.S. Commerce Department said this week it would further restrict the Chinese company from access to commercially available chips, adding that even foreign firms will be affected if they use U.S.-made design software and gear.

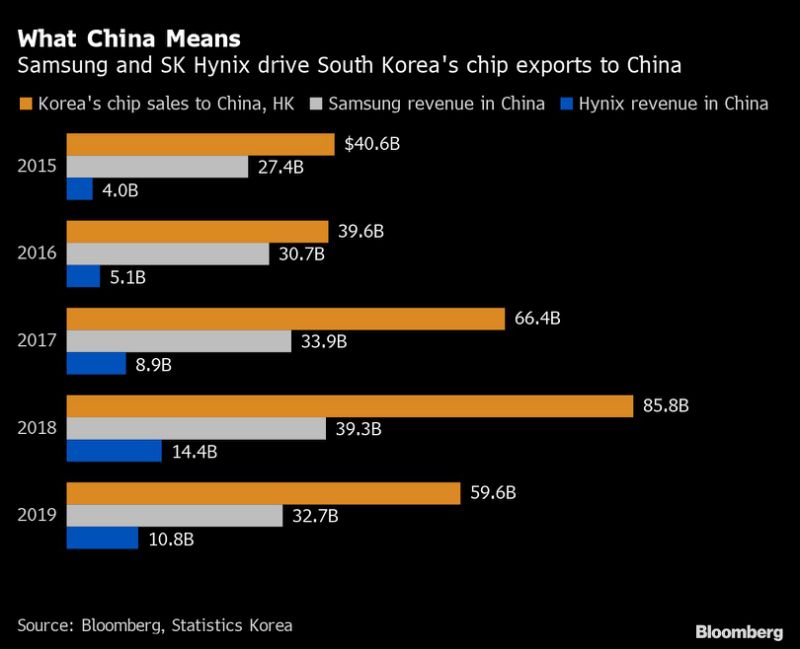

Both Samsung Electronics Co. and SK Hynix Inc., South Korea’s two biggest exporters, use U.S.-made equipment while generating a large share of their earnings by trading with Huawei and other Chinese firms. Samsung earned almost 20% of its revenue from China in the latest quarter, while Hynix generated almost 40%.

“U.S. curbs on Huawei can lead to smaller Chinese tech exports that contain South Korean semiconductors,” said Kim Yang-paeng, an analyst at the Korea Institute for Industrial Economics & Trade in Sejong, South Korea. “South Korea’s exports may never be the same with chip demand slackening from China.”

China is South Korea’s biggest trading partner, and chips are the country’s largest single export category — worth $94 billion last year, or 17% of total exports, according to the Korea International Trade Association.

Huawei has risen as a major buyer of South Korean chips in recent years as it expands its lineup of devices from smartphones to wireless networks. The company expected to buy more than $10 billion from South Korea in 2019, ZDNet Korea reported last year, citing a Huawei official.

Huawei’s decline may still prove a boon for some South Korean sectors such as smartphones, an industry where Samsung competes with the Chinese company for the top spot globally. But other Chinese rivals may take Huawei’s place, potentially limiting the benefits for South Korea from the U.S. move.

“Huawei is going to be in bad shape,” said Dan Wang, technology analyst at Gavekal Dragonomics. “But even if it mostly has to stop operations, there are other Chinese phonemakers that can erode the competitive position of Korean firms.”

bloomberg.com” data-reactid=”40″>For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”41″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.